IEC (Import Export Code) Registration in Telangana

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

IEC (Import Export Code) Registration in Telangana Online - Process, Documents, Benefits, Cost

IEC Code Registration in Telangana or Import Export Code Registration in Telangana is the basic requirement to start importing or exporting goods and services from India whether you are a manufacturer, trader, or even a service provider.

For businesses in Telangana, having an IEC opens doors to global opportunities and helps them take advantage of the Proximity to Rajiv Gandhi International Airport; IT/export services hub. It gives businesses in this area the chance to connect with international buyers and suppliers more easily.

Some of the key industries in Telangana that often need an IEC include Pharmaceuticals, IT services, biotech, textiles. The sectors are very dependent on the inflow of raw materials to continue production and the export of finished products to expand in the foreign markets.

IEC Import Export Code Certificate Sample

IEC (Import Export Code) Registration in Telangana in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get IEC Code

Documents Required for IEC (Import Export Code) Registration in Telangana

PAN Card of the Individual, Firm, LLP or Company

Identity Proof of Individual, Partners or Directors

Proof of Business Location

Bank Proof

Proof of Business Registration

Board Resolution

Passport Size Photographs of Authorised Signatories

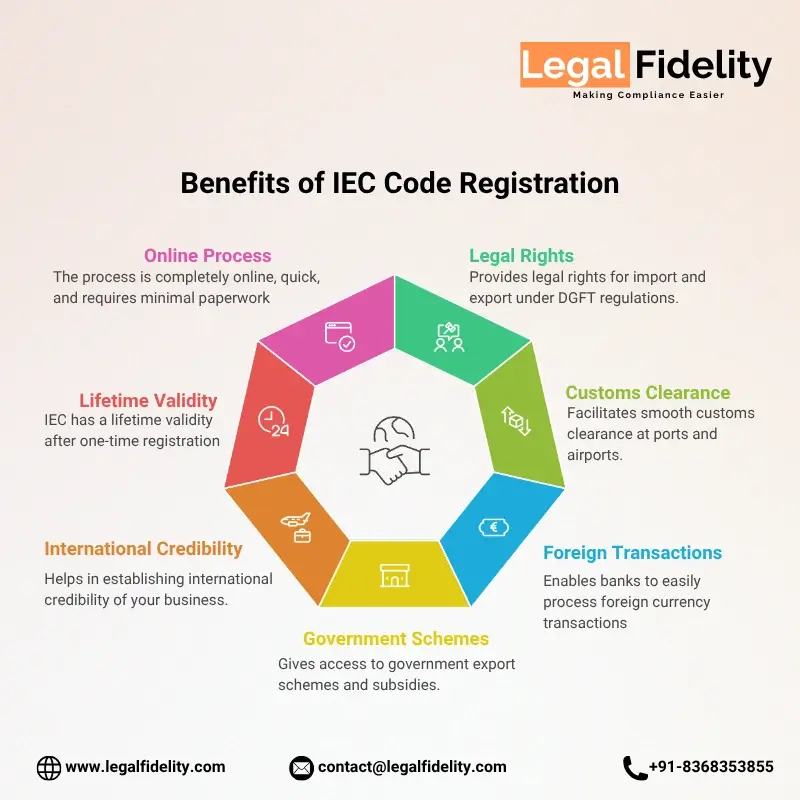

Benefits of IEC (Import Export Code) Registration in Telangana

Legal Rights to Import/Export

Smooth Custom Clearance

Easy Foreign Currency Transactions

Access to Export Schemes and Subsidies

International Business Credibility

Lifetime Validity

What You Get

IEC Certificate

IEC Acknowledgement

What is IEC (Import Export Code)?

Table of Contents

- Key Features of IEC Code Registration in Telangana

- Why is IEC Code Registration in Telangana important?

- Who Can Apply for IEC Code Registration in Telangana?

- Documents Required for IEC Code Registration in Telangana

- Step-by-Step Process of IEC Code Registration in Telangana

- Time Taken for IEC Code Registration in Telangana

- Cost of IEC Code Registration in Telangana

- Validity & Renewal of IEC

- Benefits of IEC Code Registration in Telangana

- Common Mistakes to Avoid During IEC Code Registration in Telangana

- Why Choose LegalFidelity for IEC Code Registration in Telangana?

- Conclusion

Import Export Code IEC Code Registration in Telangana is a 10-digit number that is given by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce, Government of India. It represents the legal identity of any person or business engaged in international trade. In the absence of IEC, companies are unable to import commodities or export products, or carry out other foreign trade transactions.

Key Features of IEC Code Registration in Telangana

- Mandatory by law: IEC is required for anyone involved in import or export activities.

- Lifetime validity: IEC has lifetime validity, although it must be renewed annually as per DGFT guidelines.

- Customs clearance and benefits: IEC is essential for customs clearance, export incentives, and international fund remittances.

Why is IEC Code Registration in Telangana important?

- Legal Requirement: IEC is a mandatory legal requirement for any individual or business involved in import and export. International trade activities are not possible without it.

- Customs Clearance: To pass shipments through ports, IEC is required.

- Banking Transactions: Banks need IEC to make foreign outward payments and enable businesses to receive foreign inward payments.

- Export Incentives: IEC holders in Telangana can enjoy government benefits like MEIS, SEIS, and RoDTEP.

- Global Expansion: IEC enables businesses to gain international credibility and connect with foreign buyers with confidence.

Exporters and importers in Telangana get a big advantage due to proximity to Visakhapatnam (nearest). These hubs make international shipping quicker, customs clearance smoother, and overall logistics far more convenient.

In addition to that, Telangana businesses also benefit from Pharma SEZs, IT parks, Pharma export promotion. These come with tax breaks, subsidies, and faster clearance facilities.

Who Can Apply for IEC Code Registration in Telangana?

The Import Export Code (IEC) can be applied for by any person or business entity that wants to take part in international trade. According to DGFT rules, the following are eligible:

- Proprietorship firms

- Partnership firms

- Private Limited companies

- Public Limited companies

- Limited Liability Partnerships (LLP)

- HUFs, Trusts, NGOs, and Societies

- Exporters and importers of goods and services

The DGFT Hyderabad Office deals with IEC applications in Telangana. Businesses and individuals in the surrounding districts may apply here to obtain new IEC, make corrections or modifications, or check the status of their IEC.

Practical Insights

Fast document and bank processing is possible for IT and pharma exporters through Hyderabad DGFT.

Documents Required for IEC Code Registration in Telangana

In order to apply for an Import Export Code (IEC), certain documents are required. Depending on whether you are an individual or a business entity, the list varies:

In case of Individuals or Proprietorship Firms

- PAN Card of the individual (compulsory).

- Identity proof such as Aadhaar, Passport, or Voter ID.

- Proof of business location, such as electricity bill, rent agreement, or ownership documents.

- Bank proof — a cancelled cheque or bank certificate containing name and account number with IFSC code.

- Passport-size photograph of the applicant.

In case of Partnership Firms, LLPs, or Companies

- PAN card of the firm, LLP, or company.

- PAN and identity proof of all partners or directors.

- Proof of business registration, such as Certificate of Incorporation, Partnership Deed, or LLP Agreement.

- Proof of registered office or place of business, such as ownership proof or NOC from owner in case of rented premises.

- Bank proof — a cancelled cheque or bank certificate containing name, account details, and IFSC code.

- Board Resolution in case of companies.

- Passport-size photographs of authorised signatories.

Exporters and importers in Telangana can also take support from trade associations and export promotion councils such as FICCI Telangana, APIIC, local Chambers. These organisations frequently conduct training sessions, networking programs, and provide policy updates, helping businesses grow faster in international markets.

Step-by-Step Process of IEC Code Registration in Telangana

Step 1: Consultation

We assess the type of your business and provide a checklist of required documents.

Step 2: Document Verification

You have to submit the documents to us, and we verify them to prevent errors.

Step 3: Bank Proof Help

We assist you in obtaining the necessary bank certificate or cancelled cheque.

Step 4: Application Filing

The online submission of your IEC application is done by our professionals. Our experts ensure that all details are accurate and consistent with the documents to avoid rejection.

Step 5: Follow-up & Resolution

We follow up on the application and address any queries raised by DGFT.

Step 6: IEC Issuance

Your Import Export Code is issued in just a few working days. We share the approved IEC code PDF so you can use it for future purposes.

Time Taken for IEC Code Registration in Telangana

| Stage | Estimated Time |

|---|---|

| Application Filing | Once your documents are ready, the application can be filed on the same day. |

| Processing Time | IEC is issued within 1–3 working days in most cases. It may take longer during high application volume or technical issues at DGFT. |

| Corrections | If any query is raised or if there is a mismatch in PAN, GST, or bank details, the process may take longer until corrections are made. |

Cost of IEC Code Registration in Telangana

The process of applying for IEC includes certain compulsory government fees that must be paid online during submission. In addition, there may be professional or consultancy fees if you choose expert assistance like LegalFidelity to avoid errors and speed up the process.

Sometimes there are also additional expenses such as obtaining a Digital Signature Certificate (DSC) for the authorised signatory, a bank certificate, or notarisation of documents, depending on your business type and requirements.

Validity & Renewal of IEC

- Lifetime Validity: The Import Export Code (IEC) has a lifetime validity.

- Annual Update: According to the DGFT regulations, all IEC holders must confirm or update their information online between April and June every year. This helps maintain the code’s validity and compliance with regulations.

- Non-Compliance: Not renewing or updating the IEC within the prescribed period can result in deactivation or suspension of the IEC, halting import and export activities until reactivation.

Benefits of IEC Code Registration in Telangana

- Provides legal rights to your business for import and export under DGFT regulations.

- Facilitates smooth customs clearance at ports and airports.

- Enables banks to easily process foreign currency transactions.

- Gives access to government export schemes and subsidies.

- Helps in establishing international credibility of your business.

- IEC has a lifetime validity after one-time registration.

- The process is completely online, quick, and requires minimal paperwork.

The significant exports of Telangana include Pharma, IT services, biotech, with USA, Europe being its major destinations. These trade patterns highlight the strong export potential of Telangana and the importance of IEC in helping local businesses thrive internationally.

Common Mistakes to Avoid During IEC Code Registration in Telangana

- Mismatch in details: Ensure PAN, Aadhaar, and bank account details exactly match. Even minor discrepancies can lead to rejection.

- Poor quality of documents: Upload clear and legible copies. Blurred or unclear files can delay processing.

- Incorrect address proof: The address on your documents must match your registered business address. Mismatched addresses often cause rejections.

- Missing Board Resolution (for companies): Always include a board resolution authorizing the IEC application. Missing it can cause delays.

- Failure to update IEC annually: IEC must be updated between April and June each year. Neglecting this step leads to suspension or deactivation.

Why Choose LegalFidelity for IEC Code Registration in Telangana?

- Fast and accurate application: We ensure your IEC application is filled correctly, minimizing chances of delay or rejection.

- Guidance on documents: Our experts review your documents carefully and guide you through exactly what is needed.

- Assistance with updates & changes: If you need to modify your IEC later, we help you handle the process smoothly.

- Handling DGFT queries: Our team manages all clarifications and queries raised by DGFT authorities on your behalf.

At LegalFidelity, getting your IEC in Telangana is easy, secure, and hassle-free, allowing you to focus on growing your business globally.

Conclusion

Obtaining an Import Export Code (IEC) in Telangana is a vital yet simple step in starting your international trade journey. It enables your business to reach global markets with minimal documentation, low government fees, and lifetime validity.

Once registered, remember to renew or update your IEC annually between April and June to ensure that it remains active and compliant.

Faqs about IEC (Import Export Code) Registration in Telangana

What is IEC registration and why is it required?

IEC is a 10-digit number issued by DGFT which is needed by law to import or export goods or services in India. International trade is not allowed without valid IEC code.

How much does IEC registration cost in Telangana?

There are government fees and professional fees in case you use the help of the expert in IEC registration. This may be a fixed sum based on the service provider.

How long does it take to get IEC?

The IEC is normally issued in a period of 1 to 3 working days in case all the documents are right and verified. Delays may take place in case of a discrepancy in the details or errors in documentation.

Is GST mandatory for IEC registration?

No, GST registration is not necessary to acquire IEC. Those Businesses not registered under GST can apply to it as well.

What documents are required for IEC registration in Telangana?

In the case of Individual or Proprietorship: PAN, Aadhaar, Passport, Voter ID, address evidence, bank certificate or cancelled cheque, and passport size photograph is necessary.

In the case of companies or LLPs: PAN of the business, PAN and identity document of partners or directors, incorporation certificate or partnership deed, address proof of business, bank certificate or cancelled cheque, board resolution, and passport size photographs of authorised signatories.

Does IEC need renewal?

IEC has lifetime validity. Nevertheless, the code must be updated at least once a year between April to June to remain effective.

Can individuals apply for IEC?

Yes, any person who is involved in importing or exporting goods and services can apply to IEC.

What happens if I don’t update IEC annually?

Failure to update the IEC within the fixed timeframe can make it deactivate, and you cannot proceed with importing or exporting goods and services until it is updated.

Can I use one IEC for multiple businesses?

No, IEC is specific to each business entity. A separate IEC is required in each company, firm or proprietorship.

Can service exporters apply for IEC?

Yes, even exporters of service such as IT, software or consultancy services need IEC.

Which authority issues IEC in Telangana?

In Telangana, IECs are issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce, Government of India.. It handles all services that are related to IEC in Telangana which includes new applications, amendments, revising, and status checks.

Can IEC be modified after issuance?

Yes, the IEC information can be updated or changed online on the DGFT portal in case business information is changed.

Is IEC required for import/export through courier/post?

Yes, IEC is compulsory in all forms of shipment, courier, post or cargo.

Is there any penalty for operating without IEC?

Yes, it is unlawful to import or export without the IEC and can enter penalties or fines according to Foreign Trade Development and Regulation Act.

Can I apply IEC offline in Telangana?

No, registration under IEC is fully online on the DGFT portal. Offline applications are not entertained.

Do exporters of software/IT services need IEC?

Yes, every service exporter such as IT and software companies included needs to possess IEC to legally export their services.

Can an IEC be surrendered?

Yes, in case of closure or termination of international trade by a business, the IEC may be surrendered online via DGFT portal.

Get In Touch

Customer Reviews For IEC (Import Export Code) Registration in Telangana

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Rahul N

Seamless experience! Would recommend to everyone.

NEHA P

The team is very knowledgeable and helpful.

Vikram A

Highly skilled team delivering quality service.

NEHA R

They took care of everything so I didn’t have to worry.

POOJA M

Super responsive and dedicated to customer satisfaction.

SAMEER I

I was impressed by the speed and accuracy of their work.