IEC (Import Export Code) Registration

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

IEC (Import Export Code) Registration Online - Process, Documents, Benefits, Cost

The Import Export Code (IEC) Registration is a 10 digit unique number that is granted by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce and Industry, Government of India . It is the basic license necessary for any business or individual to start importing or exporting goods and services from India.

You cannot legally conduct a cross border trade without the IEC. Therefore, whether you are an exporter of products, a trader importing raw materials, or even a service provider in the international market providing consultancy services, the IEC is your official entry point into international business.

The DGFT (Directorate General of Foreign Trade) is the body that grants and controls the Indian IEC registrations. It operates under the ministry of commerce and facilitates smooth foreign trade as well as compliance with international trade laws.

The process is now fully online. This online system has enabled IEC registration to be quicker, easier, and paperless, saving businesses time and efforts.

IEC Import Export Code Certificate Sample

IEC (Import Export Code) Registration in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get IEC Code

Documents Required for IEC (Import Export Code) Registration

PAN Card

Aadhaar Card

Business Registration Proof

Address Proof of Business

Bank Details

Digital Signature Certificate (DSC)

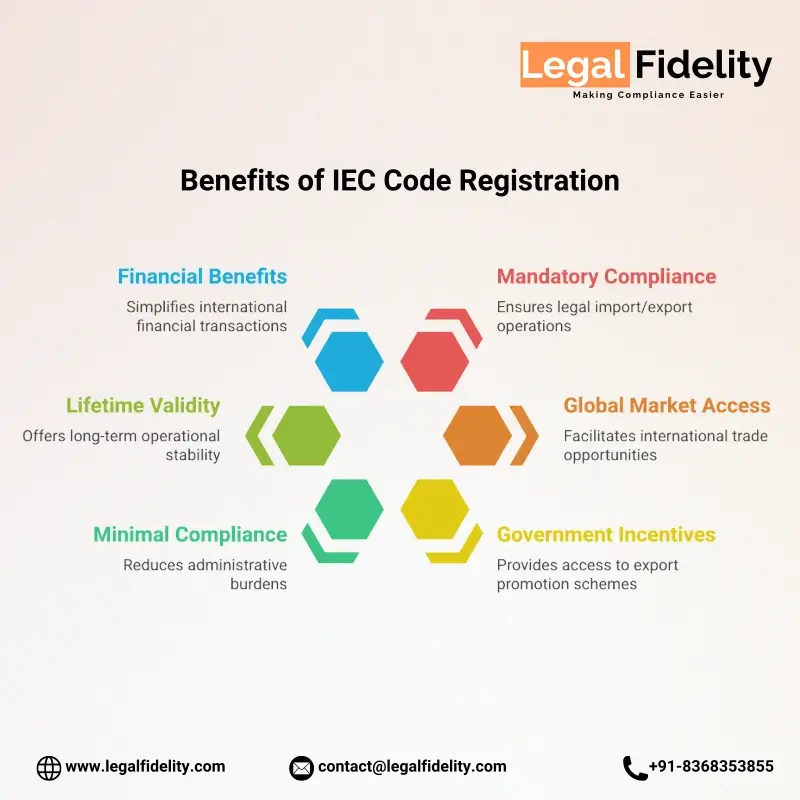

Benefits of IEC (Import Export Code) Registration

Mandatory for Import/Export

Global Market Expansion

Availability of Government Incentives

No Regular Compliance Burden

Lifetime Validity

Financial and Banking Benefits

What You Get

IEC Certificate

IEC Acknowledgement

IEC (Import Export Code) Registration

Table of Contents

Why IEC Code Registration is Required for Businesses

Any business or individual dealing with international trade must have the Import Export Code (IEC) issued by the DGFT. It is important in facilitating legal and smooth cross border transactions.

- Customs Clearance: Goods cannot be transited through customs without IEC whether importing or exporting.

- Bank Transactions: Banks require IEC to make foreign currency payments regarding imports and exports.

- Government Benefits: The government provides export promotion schemes, tax benefits, and subsidies to businesses with IEC.

- Global Credibility: The presence of an IEC provides businesses with credibility in international markets, making it easier to build trust among buyers and suppliers.

Eligibility for IEC (Import Export Code) Registration

- Individuals: Anyone who owns a business as a sole proprietor is eligible to receive an IEC.

- Partnership Firms: Firms registered under the Partnership Act are qualified.

- Limited Liability Partnerships (LLPs): Registered LLPs are eligible to apply for IEC.

- Private Limited Companies: This is the most common type of exporters and importers.

- Public Limited Companies: Large companies involved in international trade.

- Societies, Trusts, and NGOs: Non-profit organisations that engage in exports or imports.

- Government Entities and PSUs: Some departments or units of the government involved in procurement or trade.

Why IEC (Import Export Code) Registration is Important and Its Benefits

Mandatory for Import/Export

The initial compliance requirement that businesses wishing to import raw materials or export finished goods must comply with is IEC Code Registration. Without it, shipments are halted at the customs clearance point.

Global Market Expansion

IEC Code Registration serves as an access point to global trade. Through a valid IEC, businesses can reach foreign buyers and suppliers, assisting them to expand their business beyond domestic boundaries.

Availability of Government Incentives

Various export promotion schemes are provided by the Government of India including MEIS, SEIS, EPCG, and duty drawback benefits. In order to claim these incentives, an IEC Code Registration number is required.

No Regular Compliance Burden

Compared to GST or company filings, there are no monthly or annual compliance requirements with IEC. The only requirement is to verify/renew information each year on the DGFT portal.

Lifetime Validity

IEC Code Registration is valid as long as the business is running. No renewal is necessary unless business details such as Name, Address, or ownership change.

Financial and Banking Benefits

Banks require IEC Code Registration when transferring payment internationally, opening letters of credit, or during any other foreign currency transaction. This facilitates easy and safe trade.

Documents Required for IEC (Import Export Code) Registration

- PAN Card: PAN of the business entity or the proprietor is compulsory since IEC Code Registration is issued on the basis of the PAN.

- Aadhaar Card: Identity proof of the owner, partners, or directors, based on the nature of the business.

- Business Registration Proof: Partnership Deed, Incorporation Certificate, or GST Registration Certificate, where applicable, to determine the legal status of the business.

- Address Proof of Business: This may be an electricity bill, rent agreement, or property ownership of the registered business address.

- Bank Details: Cancelled cheque or bank certificate is required to confirm the bank account of the business when conducting international trades.

- Digital Signature Certificate (DSC): In the case of companies and LLPs, a DSC might be necessary to complete online authentication when applying.

Step by Step Process for IEC (Import Export Code) Registration

Step 1: Free Consultation and Eligibility Check

Our first step is a free consultation to determine whether your business can be registered for IEC. We not only explain what documents you would need in this call but also make recommendations on whether additional licences are needed when handling restricted products.

Step 2: Document Collection and Verification

Once you submit the required documents such as PAN, Aadhaar, bank information, address proof, and business registration certificate, our team carefully checks for mistakes or discrepancies and assists you in correcting them before filing.

Step 3: DSC or E-Sign Assistance

We help in obtaining or verifying a Digital Signature Certificate (DSC) or e-sign in case your entity (company or LLP) needs it. Before signing on the DGFT Portal, we ensure that the DSC functions correctly.

Step 4: Application Drafting and Filing in Form ANF 2A

We fill and process your application Form ANF 2A IEC with verified details. Each field is completed precisely according to your legal documents to prevent rejection.

Step 5: Submission and DGFT Coordination

After your application is submitted, our team monitors it within the DGFT portal. In case any questions or document rejections arise, we act immediately by re-uploading or fixing the issue. We also handle portal errors like file format errors or upload errors.

Step 6: IEC Issue and Certificates Delivery

On approval, you receive an official IEC Code Registration certificate which is downloaded immediately from the DGFT portal and mailed to you as a secure soft copy.

IEC (Import Export Code) Registration Fees and Validity

The fee for professional assistance for IEC Code Registration usually includes the preparation of documents, application submission on the DGFT portal, and complete support until your IEC is issued.

Validity (Lifetime with Annual Update)

Your IEC number is a lifetime number; no renewal is required after it has been issued. Nonetheless, according to the DGFT notification dated 2021, all IEC holders are required to verify or update their information once per year during the period between April and June. Otherwise, your IEC can be deactivated until the update is completed.

Post Registration Compliance for IEC Code Holders

1. Annual Update Requirement (Since 2021)

The DGFT requires all IEC holders to update or verify their information at least once a year, even if nothing has changed. This must be done between April and June. Failure to do so will result in the deactivation of your IEC, and it cannot be used for trade until re-updated.

2. Customs and GST Linkage

Your IEC is directly linked with Customs and GST systems, allowing the government to monitor international trade efficiently. Any mismatch in PAN or GSTIN details can cause delays in shipment clearance. Therefore, companies should maintain their GST and IEC information properly.

3. Record Keeping for Trade

IEC holders must maintain proper records of all import and export transactions, including:

- Invoices

- Shipping bills

- Customs documents

These records are necessary not only for your own business but also for audits, DGFT verification, or claiming export incentives.

Modification, Renewal and Cancellation of IEC Code

Businesses may need to update, renew, or surrender their Import Export Code (IEC) over time. These processes are simplified and completely online via the DGFT portal.

1. Updating IEC Details

In case of changes in your business, you need to revise your IEC. Common updates include:

- Change of business address

- Addition or removal of directors or partners

- Change in bank account details

- Change of ownership or company structure

2. Renewal Process

Although IEC has lifetime validity, yearly updates are mandatory from 2021. Every year, during April and June, IEC holders must verify or renew their information. Failure to update will result in deactivation of the IEC. A deactivated IEC can delay customs clearance and prevent finalizing import/export deals until reactivated.

3. Surrender or Cancellation of IEC

If you are closing your business or no longer performing import/export transactions, you can surrender your IEC:

- The surrender application can be submitted online on the DGFT portal.

- After surrender, the IEC is permanently cancelled and cannot be used in international trade.

Special Cases of IEC Code Registration

IEC is not limited to large trading firms. It is also mandatory in various other cases involving international transactions. Special cases include:

1. IEC for Service Exporters, IT and Freelancers

IT professionals, consultants, or freelancers providing services to foreign clients require an IEC to receive foreign payments. DGFT regulations also apply to service exports.

2. IEC for Manufacturers

Importers of raw materials and exporters of finished products must possess an IEC. It is essential for customs clearance and to obtain government export benefits and subsidies.

3. IEC for Non-Governmental Organizations and Charity Organizations

NGOs, societies, or charitable trusts that contribute in kind (e.g., medical supplies, equipment, or relief material) must register under IEC.

4. IEC for E-Commerce Exporters

Individuals or businesses selling goods online through platforms like Amazon Global, eBay, or Etsy require an IEC to accept payments across international borders.

In short, IEC is not limited to traditional importers and exporters. It also applies to service providers, manufacturers, NGOs, and e-commerce sellers involved in cross-border trade.

Why Choose LegalFidelity for IEC (Importer Exporter Code) Registration

- Problem-free Documentation and Filing: All of your documents are properly checked and filled in by our professional experts, minimizing the risk of rejection.

- Handling DGFT Portal Issues: The DGFT portal may contain technical faults. We handle troubleshooting, uploading, and resubmission to save your time.

- Compliance and Modifications in Future: We not only help with registration but also with annual updates, modifications, or cancellations of IEC details when needed.

- Save Time and Effort: You need not worry about paperwork and technicalities. You can focus on your business while we assist with the entire registration process.

Conclusion

IEC Code Registration is an essential requirement to legally import raw materials or export goods and services to international markets. IEC allows businesses to gain international credibility and confidently enter global markets. It offers lifetime validity, easy compliance, and access to government export incentives and subsidies.

Faqs about IEC (Import Export Code) Registration

How do I get IEC registration?

You can get hassle-free IEC Code Registration using LegalFidelity. You just have to submit the required documents and pay the required fees.

What is the cost/fees for IEC registration?

Registration of IEC may attract fees. However, when you pay a professional service such as LegalFidelity, charges may be based on assistance provided.

What is the validity of IEC and does it need renewal?

IEC comes with lifetime validity, but from 2021, according to DGFT regulations, all IEC holders are required to sign in at least once a year from April to June and validate or revise their information.

Is GST compulsory for IEC registration?

No, GST is not mandatory to use IEC. Nevertheless, you can link your GSTIN to IEC to easily transact in customs and banking.

What documents are required for IEC registration?

You need the basic identity and business documentations like PAN, Aadhaar, Business registration document where applicable, address document, and bank details such as a cancelled cheque.

Is IEC registration mandatory for export/import?

Yes, IEC is compulsory for all importers and exporters in India. Government departments are the only exemptions, including personal imports or cases individually exempted by notifications.

What is DGFT and how is it related to IEC?

Directorate General of Foreign Trade (DGFT) is the government body under the Ministry of Commerce. The agency issues, manages, and controls IEC registrations in India.

How to import without IEC?

In most cases, imports are subject to IEC. Importation of goods without IEC is only permitted in limited situations such as government imports, personal imports by individuals, or exemptions.

How to apply for an import license?

You will have to get an import license separately besides a valid IEC if you want to trade in restricted items.

What are the benefits of IEC registration?

IEC allows you to legally carry out importing and exporting business, build international business, enjoy benefits and incentives of exporting, clear goods at customs without issues, receive foreign payments in banks, and much more.

How much money is needed to start an import export business in India?

Minimum investment is not fixed. Depending on their product, suppliers, and target markets, startups, freelancers, and small businesses can begin international trade.

Do we need to update IEC every year?

Yes. As of 2021, you are required to validate or update your IEC details once every year between April to June, even when nothing has changed.

Are IEC and PAN number the same?

No. PAN is the tax code whereas IEC is a 10-digit import/export code. IEC and PAN are linked but not identical.

What is the full form of IEC?

IEC stands for Import Export Code.

What are the requirements for IEC registration?

A valid PAN, Aadhaar of the applicant/authorized signatory, business registration documents, address proofs, and a bank account in the name of the business or proprietor.

What is the minimum investment for import export business?

There is no legal minimum investment required. Even small-scale exporters or freelancers can obtain IEC and start international trade.

Is IEC the same as an export license?

No. IEC covers all imports and exports. Only an export license is required for restricted or prohibited goods.

How to check if IEC is valid or not?

Your IEC validity can be verified on the DGFT portal by entering your IEC number in the status check section.

What is IEC approval?

IEC approval means that your application has been completed successfully by the DGFT and you have been given a legal 10-digit IEC code.

How to activate or check IEC status?

Log in to the DGFT portal, enter your IEC number, and check its status. If it is not active, simply update your details to activate it.

Get In Touch

Customer Reviews For IEC (Import Export Code) Registration

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Vikram A

Amazing service! Quick and hassle-free process.

ANJALI N

I would definitely use their services again!

Sandeep M

The team is very knowledgeable and helpful.

Riya S

Trustworthy and dependable. I’m really happy with them!

KAVITA D

Highly professional and efficient. I am very satisfied.

POOJA G

Great customer support! They handled everything smoothly.