Income Tax Return (ITR) e-Filing

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Income Tax Return (ITR) e-Filing in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get ITR Filed

filed

Documents Required For Income Tax Return (ITR) e-Filing Online

ID Proof

Address Proof

Photo

Registered Office Proof

What You Get

Acknowledgement

Income Tax Return (ITR) e-Filing

Table of Contents

Who Should File Income Tax Return (ITR) in India?

Income Tax Return Filing is required to be done by the following entities:

- Salaried Individuals

People who earn Salaried income above the basic exemption limit set by the Income Tax Department must file an ITR. Taxpayers can also claim deductions under different sections such as 80C, 80D, as well as HRA exemptions to lower their taxable income. - Self-Employed and Business Owners

All freelancers along with professionals such as doctors, lawyers and consultants along with business owners must file their ITR irrespective of their revenue amounts. Taxpayers who opt to submit ITR-4 a presumptive income scheme under Section 44AD, Section 44ADA and Section 44AE of the Income-tax Act,1961 can benefit from a simplified tax filing process. - NRIs and Foreign Income Earners

Non-Resident Indians (NRIs) who earn income in India through rental income, interest, dividends, or capital gains, are need to file an ITR when their income exceeds the exemption limit. - Partnership Firms, LLPs, and Companies

All registered partnership firms, Limited Liability Partnerships (LLPs), and companies, irrespective of profit or loss, must submit their yearly income tax declarations. - Directors and Partners

Individuals serving as directors in a company or as partners in an LLP or partnership firm must file an ITR, even if they do not have taxable income. - Dividend Earners

Individuals earning dividends from stocks or mutual funds are required to report their dividend income in their ITR, even though it is now taxable in the hands of the recipient. - High-Value Transaction Taxpayers

Individuals involved in high-value transactions such as purchasing property above a certain limit, large credit card payments, or making huge investment in Mutual funds are required to file an ITR, even if their taxable income is below the exemption limit. - Charity and Religious Trusts

Trusts, NGOs, and religious institutions that seek tax exemptions are required to file their ITR under ITR-7. This ITR contains all the details of their income and expenses for regulatory purposes.

Step by Step Income Tax e-Filing Process in India

Online Filing of income tax return is a simple process Here’s a step-by-step complete guide to help you with e-filing on the official Income Tax Portal:

1. Log in to the Income Tax e-Filing Portal

Visit the official Income Tax Department and log in using your registered User ID, password, and the captcha code to access your e-filing account.

2. Access E-Filing Services

Begin the online e-filing process, Go to the “e-File” section followed by selecting “Income Tax Return” within that section.

3. Choose the Assessment Year and Filing Mode

Select AY 2025-26 for filing returns for the FY 2024-25. You can choose either online filing or offline utility-based filing.

4. Select Taxpayer Category

Choose your category individual, HUF, company, partnership firm, etc. depending on the taxpayer’s income sources.

5. Choose the Right ITR Form

Based on your source of income and taxpayer’s category, select the correct ITR form such as ITR-1, ITR-2, ITR-3 etc.

6. Provide Income and Deduction Details

Enter your income details from Form 16 for salaried employees, bank statements, rental income, and deductions such as 80C, 80D, and home loan interest

7. Review and Confirm ITR Return Details

The tax will be calculated automatically, Verify all pre-filled details and tax calculation, and confirm that your data is correct before submission.

8. Make Tax Payment (if applicable)

If there is tax liability you can make the payment via net banking, UPI, or debit card before final submission.

9. e-Verify Your Return

After review, submit the return by verifying your return using Aadhaar OTP, net banking, or digital signature.

10. Download Acknowledgement

After submission of ITR, you will receive an acknowledgement receipt. Download it for your records.

Income Tax Return (ITR) Forms in India

There are different types of ITR, taxpayers must use one of the ITR forms depending on their income sources to file their I-T returns. Below is an overview of ITR forms applicable for FY 2024-25:

1. ITR-1 (SAHAJ) – For Salaried Individuals with Simple Income

This return form is applicable to individuals with income from salary, one house property or other income, or agricultural income with total income up to Rs. 50 lakh.

2. ITR-2 – For Individuals with Multiple Income Sources

ITR-2 is used to file Income tax return by individuals and HUFs who have income from capital gains, income from House property, income from other sources and foreign income but do not have business income.

3. ITR-3 – For Professionals and Proprietorships

Form ITR-3 is applicable individual or a Hindu Undivided Family who have income from business or profession, Income of a person as a partner in firm including consultants, freelancers, and proprietors.

4. ITR-4 (SUGAM) – For Businesses Under Presumptive Taxation

ITR-4 can be used by individuals and HUFs, Partnership firms other than LLPs, who opt for the presumptive taxation scheme under sections 44AD, 44ADA, or 44AE inculding Income from salary or pension, one house property, other sources up to Rs 50 lakh.

5. ITR-5 – For LLPs and Partnerships

ITR-5 is used by partnership firms, LLPs, Association of persons (AOPs) and Body of Individuals (BOIs), Artificial Juridical Person (AJP), Estate of deceased, Estate of insolvent, Business trust and investment fund. that need to file their income tax return.

6. ITR-6 – For Companies

This ITR-6 form is filled by companies other than companies who do not claim tax exemptions under Section 11 i.e Income from property held for charitable or religious purposes

7. ITR-7 – For Special Entities (Trusts, NGOs, Political Parties)

Form ITR-7 is used by Business entities such as trusts, political parties, and institutions claiming exemptions under Section 139(4A) or 139(4D).

Important Due Dates for ITR e-Filing in India

Filing of ITR within the due dates specified by the Income Tax Department is important, to avoid penalties. Below are the key deadlines:

1. For Individuals and Salaried Taxpayers:

- ITR filing begins on 1st April and last date is July 31, 2025

2. For Businesses and Companies who required to conduct Audit:

- Required to file ITR before October 31, 2025

3. For Revised and Belated Returns

- Revised or belated return must filled before December 31, 2025

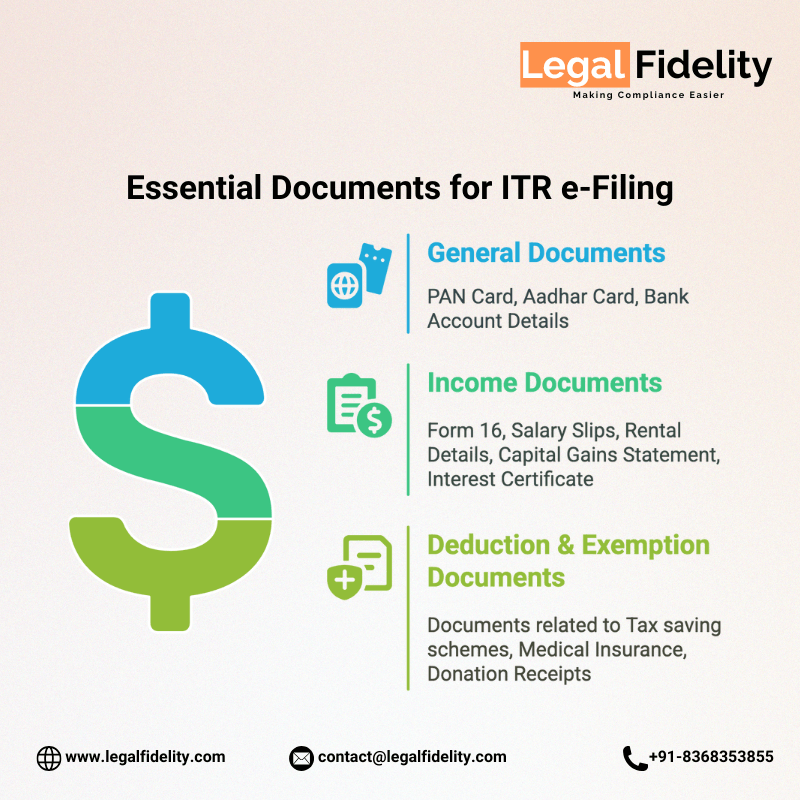

Documents Required for ITR e-Filing

Before starting online filing your Income Tax Return, make sure you have these documents ready:

1. General Documents

- PAN Card

- Aadhaar Card

- Bank Account Details

2. Documents related to Income

- Form 16 in case of salaried employees)

- Salary slips

- Details of Rental income

- Capital gains statements for stocks, mutual funds, property etc.

- Interest Certificate for Interest received from saving account in bank and post office, Fixed Deposits.

3. Documents related to Deductions & Exemptions

- Proof of documents required If you have invested in any tax-saving schemes to claim deduction under Section 80C

- Proof of Medical Insurance to claim deduction under section 80D

- Donation Receipts for section 80G, and other deduction proofs

- Home loan interest certificate

- Details of any other Investment proofs

Tax-Saving Opportunities for ITR e-Filing

1. Deductions Under Section 80C

Under the Income Tax Act through section 80C, Taxpayer is allowed to deduct Rs. 1.5 lakh from their taxable income through select investments and expenses. Here are some key deductions under this section:

- Life Insurance premium paid on insurance policies of self, spouse, or child can be minor or major

- Contributions made to Employees’ Provident Fund (EPF), Public Provident Fund (PPF), National Savings Certificate (NSC)

- Payment of Tuition Fees to any college, school, or any other educational institution for maximum two children.

- Any Investment made in a five-year fixed deposit of a Scheduled Bank or Post Office

2. Health Insurance Deduction (80D)

Section 80D is the most popular tax-saving options. You can claim deduction for premiums paid for health insurance on following :

- Maximum deduction is allowed for self, spouse, and children below age of 60 years up to Rs. 25,000 while for senior citizens, the limit can exceed Rs 50,000 per year

- Maximum deduction is allowed for Up to Rs. 50,000 for senior citizen parents.

- Preventive health check-ups up to Rs.5,000 within the overall limit of Rs. 25,000 or Rs. 50,000 specified above.

3. Home Loan Benefits ( Section 80EE)

- Deduction under section 24 is allowed for Interest Paid on Home Loan of up to Rs. 2 lakh per year if the owner or his family reside in the house property.

- Deduction under the Rs 1.5 lakh limit under section 80C can be claim for Principal Repayment of home loan.

- Additional deduction under section 80EEA up to Rs 1.5 lakh is available for First-Time Home Buyers. If you satisfy for both Section 24 and Section 80EEA, you can claim benefits under both sections.

4. Capital Gains Exemptions

- Section 54 – Exemption on capital gains from the sale of a residential property if reinvested in another house.

- Section 54EC – Exemption if capital gains are invested in government bonds within six months.

- Section 54F– Tax exemption on the sale of any long-term asset if proceeds are used to buy a new house.

5. HRA & Rent Deductions

Deduction under this section is available only to those individuals who do not receive benefits via HRA(House Rent Allowance) or RFA(Rent Free Accommodation). Under Section 80GG, Deduction is allowed up to ₹60,000 per year for self-employed or those without HRA benefits.

Common Mistakes to Avoid While e-Filing ITR Online

1. Incorrect Personal Details

Sometimes tax processing system may face problem due to incorrect details PAN, Aadhaar, bank details, or email ID. You must double check the details before submitting the ITR.

2. Choosing the Wrong ITR Form

Choosing the incorrect ITR form can lead to rejection or re-filing. You must choose IT Form depending on your income sources.

3. Not Reporting All Income Sources

- You have to provide complete details of income earned during the year from Salary, business, or professional income or from other sources accurately.

- Interest income earned from savings bank accounts or post office, Fixed deposits or bonds etc

- Capital gains details of stock trading, selling of property , or mutual funds.

4. Missing Deductions and Exemptions

Sometimes due to lack of detailed knowledge of IT rules leads to failure in claiming eligible deductions under Sections 80C, 80D, 80E, 80G, etc. that may result in higher tax liability.

Things to do after ITR Filing

1. e-Verify ITR After Submission

You must e- verify the IT return otherwise your E-filing will remain incomplete without verification

Options to verify the return include:

- Otp on registered mobile through Aadhaar authentication

- Net banking or EVC through ATM

- Sending a signed physical copy of ITR to CPC, Bengaluru

- Digital Signature Certificate (DSC)

2. Check ITR Filing Status – Track Processing Updates

Once the filing of Income tax return is completed, you track your ITR status and processing updates. So that you will remain updated whether your return is processed, pending, or needs action.

3. Correct Mistakes in ITR – File a Revised Return if Needed

If errors are found post-filing, Do not worry you can file a revised return under Section 139(5) before the due date.

Missed ITR Filing Deadline? Here’s What to Do

1. File a Belated Return – Eligibility & Process

You can still file your income tax return If you missed the deadline:

- Belated return cab be filed before December 31 of the assessment year with a late fee depending upon income.

- Loss of carried forward business losses or capital losses: if you file late return you can not take benefit of carry forward of losses.

2. File an Updated Return (ITR-U) – Correcting Past Errors

ITR-U is used by taxpayers to correct mistakes or omission or incorrect income details filed in previous returns within two years with additional tax payments.

3. Impact on Refunds & Penalties – Consequences of Late Filing

- Late Fees – Rs. 1,000 if income below Rs. 5 lakh or Rs. 5,000 if income above Rs. 5 lakh.

- Interest on Taxes – Interest at 1% per month or part thereof will be charged under Section 234A on tax due until the payment of taxes.

- Loss of Carry Forward Benefits –You are not allowed to be carried forward business losses or capital losses to subsequent years.

Income Tax Slabs & Tax Rates for FY 2024-25

New vs Old Tax Regime Comparison

There are different tax slabs in old and new regime:

- New Tax Regime offers lower tax rates but fewer deductions and exemptions are allowed

- Old Tax Regime: Higher tax rates with various deductions and exemption are allowed such as 80C, 80D, HRA, etc.

Tax Rates for Individuals, Senior Citizens & Businesses

New Tax Regime

| Income Slab | Tax Rate |

|---|---|

| Up to ₹3,00,000 | NIL |

| ₹3,00,001 – ₹6,00,000 | 5% |

| ₹6,00,001 – ₹9,00,000 | 10% |

| ₹9,00,001 – ₹12,00,000 | 15% |

| ₹12,00,001 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

Old Tax Regime

| Income Slab | Tax Rate |

|---|---|

| Up to ₹2,50,000 | NIL |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Capital Gains Tax Rules for Income Tax Return Filing

Long-Term vs Short-Term Capital Gains

- The tax rate for Short-Term Capital Gains (STCG) is 15% for listed shares and mutual funds and assets that meet the less than 12 month holding requirement.

- Long-Term Capital Gains (LTCG) tax applies to assets held beyond 12 months at a rate of 10% after the first Rs. 1 lakh in equity-related assets.

Exemptions and Deductions

- Section 54 –This section enables deduction of profits on sale of house when you purchase another residential property.

- Section 54EC – The tax provision Section 54EC allows individuals to reinvest their capital gains through government bonds.

- Section 54F – Section 54F provides tax relief to individuals who re-invest their sale proceeds of any asset other than a House Property into purchasing a new house.

Special Cases for ITR Filing

1. Income Tax for NRIs

Non-Resident Indians are liable to pay tax in India on the income they earn within the country. If total income of NRI from Indian sources exceeds the basic exemption threshold of Rs. 2.5 lakh in a financial year, then NRI is required to file an Income Tax Return

General types of taxable income for NRIs include:

- Rental income earned from property located in India

- Capital Gain

- occurring from the sale of property, shares, or mutual fund investments

- Interest earned on NRO (Non-Resident Ordinary) bank accounts

- Income earned from any business or professional or freelance services provided in India

NRIs are not eligible for tax benefits under Section 80C for investments such as Public Provident Fund (PPF) or National Savings Certificates (NSC) etc .

NRI can benefit from deduction by investing in specific financial instruments, including Non-Resident External fixed deposits and select government-issued bonds.

2. Income Tax for Self-Employed Professionals

Self employed professional means Individuals who work as Freelancers, consultants, and independent business. They are required to file an Income Tax Return if their annual income exceeds the basic taxable limit.

Important points to consider:

- Their income earned must be reported under the category “Profits and Gains from Business or Profession.”

- The business need to undertake tax audit if the business turnover exceeds Rs. 1 crore or if professional income exceeds beyond Rs. 50 lakh in a financial year.

- Professionals taxpayers to ease compliance can choose the presumptive taxation scheme under Section 44ADA, which simplifies income calculation and tax filing.

- Self-employed individuals can deduct costs related to their business acitivites including office rents and wages for employees together with utility bills and professional fees.

3. Income Tax Filing for Salaried Employees

Salaried employees need to file their Income Tax Returns (ITR) using information provided in Form 16, which is issued by their employer.

Key points to note:

- Salaried taxpayers have the two option to choose first is old tax regime which allows for multiple deductions and second is new tax regime, which provides reduced tax rates but fewer deductions and exemptions

- Under the old regime,Employees can benefit from Section 80C tax deductions by investing in Employees’ Provident Fund (EPF), Public Provident Fund (PPF), and Equity-Linked Savings Schemes (ELSS).

- Individual earing salary income can claim standard deduction of Rs. 50,000, along with exemptions like House Rent Allowance (HRA), subject to specific requirements.

- Individuals required to file Schedule AL (Assets and Liabilities) when their total salary income exceeds Rs. 50 lakh in one financial year.

Online Tax Filing through LegalFidelity

Assisted e-Filing Services

Generally many taxpayers take assistance from professionals or experts in e-filing to ensure accurate and hassle-free tax return submissions. These services generally includes Complete guidance and consultations from Expert, Checking of document and validation, Providing Hassle free preparation and filing of returns

Here, Legalfidelity ensures that taxpayers get access to affordable affordable and budget friendly tax preparation services and other services

Professional and Expert Assistance in ITR Filing

For complex tax cases such as business filings, capital gains taxation, or high-income earners,it is recommended to take help from LegalFidelity Tax Experts like CA, CS in ITR filing . Our Tax Experts through their expertise can help in:

- Income tax planning and optimization

- Ensuring compliance with the latest tax laws

- Handling notices and tax audits

Latest Updates & Notices in Income Tax

Mandatory Linking Aadhaar with PAN

It is mandatory Aadhaar linking with PAN as per the guidelines issued by the government. If you fails to link your PAN to Aadhaar it may become inoperative which could impact both your financial deals and tax return procedures. Since deadlines can shift it is essential to stay informed about the changes.

Understanding Form 26AS & AIS

The two essential related to verification of taxes paid and reported income sources depends on documents namely Form 26AS together with Annual Information Statement (AIS). Key points include:

- Form 26AS provide information related to all tax at source deductions together with advance tax payments and high-value transaction records.

- The Annual Information Statement provides a comprehensive summary of all the income, investments, and transactions that the income tax department records.

Notice Management & Compliance Requirements

It is must for Taxpayers to respond immediately whenever they get income tax notices to prevent receiving fines as penalties. Common notices include:

- Notice under Section 143(1) of the income tax rules requires tax payers to notify computation differences through the Notice system.

- Notice under Section 139(9): If any defects pointed out by the Income Tax Department within 15 days. Taxpayers must respond to defective return errors before doing amendments.

- Notice under Section 148 under income tax law issued by Assessing officer whose income has not been properly assessed

Taxpayers should access the e-Filing portal to reply to notices while taking help from professional experts like Legalfidelity is recommended.

Faqs about Income Tax Return (ITR) e-Filing

What is the ITR or the Income Tax Return?

ITR stands for the Income Tax Return. It is a prescribed form using which the particulars of income earned by a person in any financial year as well as the taxes paid on that income are communicated to the Income-tax Department. Additionally, It allows carry -forward of losses and claim refund from income tax department. Different forms of returns of income are prescribed for filing of returns for different Status and Nature of income.What is ITR filing?

Income Tax Return (ITR) filing means the process of declaring details of your income, deductions, and tax liabilities to the Income Tax Department of India. Individuals and businesses are required to report their earnings and pay taxes as per the applicable tax laws.Which is the best website for filing ITR?

One of the best websites for filing your Income Tax Return (ITR) is Legalfidelity. We are customer friendly platform that makes the whole process of filing ITR smooth, simple, and stress-free even if you are doing it for the first time.What is the last date for ITR?

div>Last date of filing Income tax returns for FY 2024-25 and AY 2025-26 is as follows:

- Salaried individuals & businesses (not requiring audit): July 31, 2025

- Businesses requiring audit: October 31, 2025

- Belated returns: December 31, 2025

How can I get my ITR?

What is the penalty for filing an income tax return late?

- Rs. 1,000 penalty if total income is below Rs. 5 lakh.

- Rs. 5,000 penalty if total income is above Rs 5 lakh.

- Additional interest under Section 234F & 234A may apply depending on the date of filing of the return.

Can I file my ITR offline?

How to file ITR for previous years?

- You can file Belated return before December 31 of the assessment year with a late fee depending upon income.

- If more than 1 year has passed, ITR-U can be filed by taxpayers to correct mistakes or omission or incorrect income deatils filed in previous returns within two years with additional tax payments.

Can I claim myself when filing taxes?

How do I know my ITR type?

Your ITR form type depends on your income:

- ITR-1: This return is used by Salaried individuals with income up to Rs 50 lakh.

- ITR-2: Return is used by Individuals with capital gains, multiple income sources.

- ITR-3: Return is filed by Business owners & professionals to report their yearly income.

- ITR-4: Presumptive taxation scheme filers.

What is the best way to file income tax?

Which ITR to choose?

- Salaried individuals: ITR-1 or ITR-2

- Self-employed/professionals: ITR-3 or ITR-4

- Companies/LLPs: ITR-5, ITR-6

How do I get an ITR filed?

Who is not required to file an income tax return in India?

- Individuals earning below the basic exemption limit ( Rs. 2.5Lac for individuals whose age is below 60 years, Rs. 3Lac for individuals whose age is 60-80 years, Rs. 5Lac for senior citizens whose age is more 80 years).

- People whose income is only from agricultural sources and income is below Rs. 5,00,000

Can we file ITR now?

What is the fastest way to file a tax return?

Who can help me fill in my tax return?

Which is the best tool to file ITR?

When you are looking for reliable, efficient, and user-friendly ITR filing process. LegalFidelity stands out as one of the best in India.

- Expert guided filing process designed to help in your income tax filing

- Continously checks for accuracy and detailed study

- Affordable pricing with zero hidden charges

- Real time expert assistance when needed

Which online tax filing is the best?

Get In Touch