RCMC Registration

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

RCMC Registration Online - Process, Documents, Benefits, Cost

RCMC, also known as Registration Cum Membership Certificate, is a significant certificate for exporters in India. It is issued by Export Promotion Councils (EPCs), Commodity Boards or other authorized bodies under the supervision of the Directorate General of Foreign Trade (DGFT).

It certifies that an exporter is formally registered in the Indian Foreign Trade Policy (FTP) and is qualified to receive government-sponsored export promotion programs.

Benefits of RCMC Registration

RCMC Registration in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get RCMC

Documents Required for RCMC Registration

IEC (Import Export Code)

Permanent Account Number

GST Registration Certificate

Business Registration Certificate

Evidence of Export Trade

Bank Details

Address Proof

List of products and services

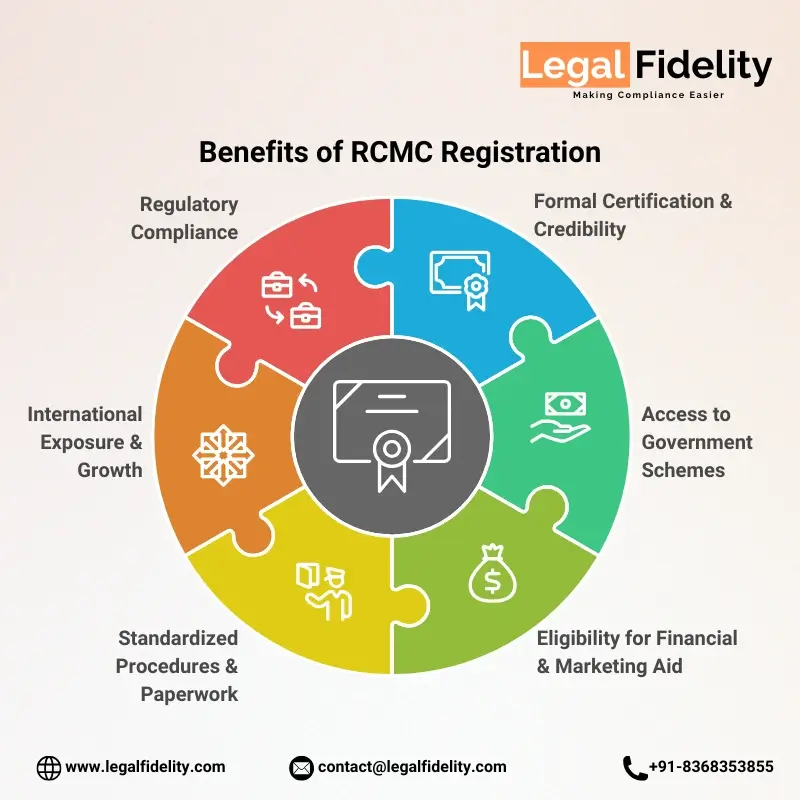

Benefits of RCMC Registration

Formal certification and credibility

Access to the government schemes

Eligibility of accessing financial and marketing aid

Standardized procedures and paper work

International exposure, and growth in incomes

Regulatory compliance

What You Get

RCMC Registration

What is RCMC Registration?

Table of Contents

Eligibility Criteria for RCMC Registration

- Exporter or Traders requirement: Find out which Export Promotion Council (EPC), Commodity Board or Development Authority supervise your product or service. When no specific council is listed you may also register with FIEO.

- Active IEC (Import-Export Code): You must possess a valid IEC approved by DGFT. You cannot apply to RCMC without this.

- Legal Business registration: Your business should be registered in the form of company, LLP, partnership, or proprietorship.

- Business Main Line Declaration: The company must specify its core activity which must be in line with the export business.

- Permission of the FIEO Board: For applications via Federation of Indian Export Organisations (FIEO), formal permission of its board is required.

- Digital Signature Requirements: Your IEC profile should be linked to Digital Signature Certificate or Aadhaar e-Signature.

- Sector specific eligibility requirement: In certain cases, councils can impose additional requirements, which are related to the product or sector such as textiles, agriculture, and engineering goods.

Types of Exporters and Importers Covered under RCMC

- Manufacturers: The companies that engaged in the production of goods to be exported including textile factories, spice processing companies, or engineering departments.

- Merchant exporters: They are traders who purchase commodities and sell them in foreign markets.

- Service exporters: Enterprises which export services like IT, consultancy, logistics, health services or education.

Practical examples:

- Kerala based spice manufacturer is dispatching consignments to Europe or any other nation.

- A farmer who sells fruit and vegetables to the Middle East.

- A software firm based in India that provides software solutions to international clients.

This broad scope makes sure that every Indian business, no matter whether it is product based or service based, is capable of registering legally, enjoying the benefits of the Foreign Trade Policy.

Benefits of RCMC Registration

- Formal certification and credibility: RCMC registered your business as an official exporter under Indian export laws, and you are a recognized and a certified exporter.

- Access to the government schemes: You have access to incentives, subsidies and other export promotion programs initiated by the government.

- Eligibility of accessing financial and marketing aid: Businesses registered under the RCMC are only eligible to seek the financial and marketing assistance, including trade fair participation, export financing and market development schemes.

- Standardized procedures and paper work: Having an RCMC certificate generally means quicker customs clearance and fewer legal or procedural difficulties.

- International exposure, and growth in incomes: Due to these opportunities, exporters are able to discover new markets, make more profits, and keep in pace with the competition on the international scale.

- Regulatory compliance: RCMC helps your exports to be compliant with the Foreign Trade Policy of India, which will minimize the risks of fines or legal conflicts.

Authorities for RCMC Registration

Export Promotion Councils (EPCs):

These are the main authorities which grant RCMC to different sectors. Every EPC deals with a particular set of products or services. Some key examples are:

- APEDA : For agricultural products and processed food products.

- Spices Board of India : For spices.

- ESC (Electronics and Computer Software EPC) : Electronics, IT, and software exports.

- FIEO : For goods not covered under any council.

Commodity Boards:

These are special boards designed to specific product lines like coffee, tea or rubber. In such industries, exporters are required to receive their RCMC from the concerned commodity board.

Development Authorities:

There are also some regional or sector-specific authorities that are given the power to encourage exports in their sector and provide RCMC certificates.

Legal Criteria for EPCs and Other Authorities:

RCMC cannot be issued by every council or board. The registering authority must be officially recognized by DGFT. They also have some legal obligations that include keeping current records of the members, checking the eligibility of the exporters and also making certain that each RCMC is issued without breach of Foreign Trade Policy.

Documents Required for RCMC Registration

- IEC (Import Export Code): Compulsory code given to all exporters by DGFT.

- Permanent Account Number: PAN Number of the business.

- GST Registration Certificate: Certificate confirming that the business has been registered under the GST.

- Business Registration Certificate: Company Incorporation, Partnership Deed, LLP Agreement and Proprietorship proof.

- Evidence of Export Trade: Business legal document such as Company Incorporation, Partnership Deed, LLP Agreement and Proof of Proprietorship.

- Bank Details: A cancelled cheque or bank certificate that confirms the account of the exporter with the bank in which trade transactions are done.

- Address Proof: Registered business address proof such as Electricity bill or ownership documents.

- List of products and services: A list with clear description of the products or services to export.

- Sector Specific Document: Certain EPCs might require some extra license or certifications based on the product like organic certification in case of agri-exports, quality certificates in case of engineering goods.

- Additional Documents (optional): That includes Commercial Invoice, Packing List, Bill of Lading, Certificate of Origin, Shipping Bill or Letter of Credit.

RCMC Registration Procedure Step by Step Guide

- Identify the relevant authority: Identify the Export Promotion Council (EPC), Commodity Board or Development Authority that handles your product or service. When no specific council is stated you can register with FIEO.

- Get your papers ready: Prepare all documents including IEC, PAN, GST, business registration, bank details, and product list and any other industry-specific certificates.

- Fill the application form: Fill application form with relevant business and product specifications.

- Pay the prescribed fee: Every EPC or Board has a fee that must be paid when applying.

- Application via DGFT common portal (e-RCMC): The application is made online through DGFT platform, under which registration takes place centrally.

- Verification and approval: Your application will be verified by the relevant authority to make sure that they are in line with the Foreign Trade Policy.

- Status of application: You can track the status of application online, and can also respond quicker in scenarios where further information is needed.

- Upon approval: The RCMC is published and valid for a time span of five years with your business officially known as a registered exporter.

Time Taken for RCMC Registration

Your RCMC application usually takes an average of 7-15 working days to be approved after you have submitted your application on the DGFT portal.

Validity, Renewal &De-registration of RCMC

Under the Foreign Trade Policy, an RCMC remains valid within a period of five financial years. The validity is computed as on 1st April of the year of issue and continues up until 31st March of the fifth year unless otherwise stated in the issuing EPC or authority.

To continue as an exporter and continue enjoying government benefits, your RCMC must be renewed as soon as possible.

You can use voluntary de-registration through your EPC or authority in case you wish to stop exporting.

Conclusion

RCMC Registration is an important requirement for getting recognized under the Foreign Trade Policy and getting government backed benefits. Through RCMC, businesses are able to trade internationally without difficulties, avail schemes on export promotion, and gain credibility in foreign markets.

Faqs about RCMC Registration

Is RCMC mandatory for export?

Yes, Exporters with goods or services that are handled by Export Promotion Councils are required to possess an RCMC. It provides legal status, entry to the export benefits and government schemes.

What is the cost/fee of RCMC?

The fee is not fixed and is determined by the Export Promotion Council and product line.

How many years is the RCMC valid for?

RCMC has a normal term of 5 years since the date of issue. It must be renewed to enjoy export related benefits.

Can I export goods without GST registration?

No. GST registration is mandatory for RCMC and export.

Which license/certificate is required for export?

You require RCMC and a valid Import Export Code (IEC). There are some products that might have to be licensed further within the sector.

How many types of RCMC are there?

There are multiple types of RCMCs issued by various Export Promotion Councils and Commodity Boards, based on the sector or product.

Are RCMC and APEDA the same?

No. APEDA is an Export Promotion Council who issues RCMCs of agriculture and processed food items. The certificate is called RCMC.

Can we export without an AD Code?

No, Banking and Export related foreign exchange transactions require an Authorized Dealer (AD) Code.

How to become an exporter in India?

The first step is to register your business, IEC, RCMC, GST registration, and other product-specific licenses. Our experts at LegalFidelity will assist you in every step.

What is the purpose of RCMC?

The purpose is to recognize exporters, provide access to export schemes, ease customs and enforce adherence to government trade regulations.

What is the difference between FIEO and RCMC?

FIEO is an Export Promotion Council through which the certificates of RCMC are issued. The certificate is called RCMC and the issuing authority is called FIEO.

Get In Touch

Customer Reviews For RCMC Registration

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Nidhi V

Extremely reliable and trustworthy service provider.

Riya R

Seamless experience! Would recommend to everyone.

SAMEER I

Customer support was always available when I needed help.

NEHA R

Excellent service, very professional and responsive.

Riya S

Their attention to detail sets them apart.

Anjali K

Highly skilled team delivering quality service.