Private Limited Company Registration

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Private Limited Company Registration in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Incorporation

incorporated

Documents Required For Private Limited Company Registration Online

ID Proof

Address Proof

Photo

Registered Office Proof

What You Get

Incorporation Certificate

Memorandum of Association

Articles of Association

Company PAN

Company TAN

Name Approval Letter

DIN for 2 Directors

DSC for 2 Directors

EPF Registration

ESI Registration

What is a Private Limited Company?

A Private Limited Company ( Pvt. Ltd.) represents a recognized business entity in India. It provides its partners protection from Legal obligation through Limited Liability provisions. A Private limited company provides assets protection to its owners for personal property in case of Financial losses. Private limited company regarded as separate legal entity from its owners which increases its professional reputation and credibility.

Table of Contents

Key Characteristics of a Private Limited Company

- Limited Liability — Shareholders enjoys limited liability up to the funds they invest into the business.

- Separate Legal Identity — Company has a separate legal identity, it exists as its own independent entity, separate from the people who own it.

- Restricted Share Transfers — Shares of Private Limited company cannot be freely traded on the Stock Exchange.

- Minimum Two Directors and Shareholders — A Private Limited company must have minimum two directors and two Shareholders to get registered.

- Mandatory Compliance and Regulations —It is compulsory for the companies to comply with MCA (Ministry of Corporate Affairs) regulations.

Types of Private Limited Companies in India

In India, Private Limited Companies are divided into three types based on the extent of liability:

1. Limited by Shares

This structure is the widely chosen for Private Limited company. Liability of the shareholder is limited up to the value remains unpaid on the shares they have subscribed. Financial losses of the company only affect shareholder investment and are not personally liable for the debt.

2. Limited by Guarantee

In this shareholders gives guarantee to pay pre- determined amount in the event on company shuts down . This type of structure is preferred by non-profit organizations and charitable trusts.

3. Unlimited Liability Private Company

This structure is the widely chosen for Private Limited company. Liability of the shareholder is limited up to the value remains unpaid on the shares they have subscribed. Financial losses of the company only affect shareholder investment and are not personally liable for the debt.

Benefits of Private Limited Company Registration in India

Limited Liability Protection

In a Private Limited Company, shareholders enjoy limited liability. Shareholders are only financially responsible for the amount they have invested in the company. This Feature gives protection to their personal assets, which remain secure in the event of financial difficulties faced by the company.

Enhanced Credibility and Professionalism

A Private Limited Company is considered more reliable and professional than unregistered or sole proprietorships and partnerships might lack. Having a Pvt Ltd status can increase the trust among customers, investors, and financial institutions

Access to Funding and Investment Opportunities

Private Limited Companies can raise capital through various ways which is necessary of growth and expansion:

- Company can raise funds through Equity financing such as Angel investors, Venture capital firms and Private equity investments

- Debt Financing like Bank loans, Debentures and Bonds

- Funds can be raised through other Options like Government Grants and Subsidies

Perpetual Succession and Continuity

A Pvt Ltd company keeps running smoothly even if the owners or directors change. It maintains stability in the business and supports its long term growth.

Tax Benefits and Planning

Private limited enjoys various Tax Advantages inculding:

- Companies are taxed Lower at lower rates compared to individual income tax rates.

- Deduction on expenses like salaries, rent, operational costs, and more, reducing taxable income can be claimed by the companies.

- Companies that satisfies the criteria of startups may be eligible for tax exemptions and other incentives under the Startup India scheme.

Ownership and Control Flexibility

- Transfer of ownership can be done easily by mere transfer or sale of shares from shareholders to investors.

- The company’s directors are responsible for making decisions and day-to-day operations.

Disadvantages of Private Limited Company in India

Private Limited Company has multiple benefits, but it also comes with some disadvantages:

Compliance and Regulatory Burden

Private limited company has to comply with various legal and regulatory requirements such as annual filings and other reporting obligations. If company fails to comply with these legal requirement can result in fines and penalties.

Limited Share Transferability

Shareholders of Private limited company cannot be freely bought or sold their shares. It makes it difficult for shareholders to exit the business or for new investors, general public, to join.

Higher Registration and Maintenance Costs

- Cost of Incorporating the private limited company is higher as compared to partnership or sole proprietorship firms.

- The expense incurred on fulfilling the ongoing legal compliance, audits, and regulatory submissions increase the financial burden on a Private Limited Company.

Eligibility Criteria for Private Limited Company Registration

Private Limited Company businesses must fulfill the following eligibility criteria:

- Minimum two directors, at least one of whom must be an Indian resident (i.e., stayed in India for at least 182 days in a financial year).

- Minimum of two shareholders, who can also be directors.

- Maximum limit of 200 shareholders.

- Unique company name that follows MCA naming guidelines.

- Registered office must situated in India

Minimum Requirements for Pvt Ltd Registration

By following below listed criteria Businesses can make an informed decision about registering a Private Limited Company in India.

Number of Directors & Shareholder

- A Private Limited Company must have minimum two directors and two shareholders for incorporation.

- The maximum number of shareholders allowed is 200.

- Directors can also be shareholders in the company.

Company Name Guidelines

- The name of the company must be unique and not similar to any existing company or trademark.

- It of the company must end with “Private Limited” (Pvt Ltd)

- The name should follow to the naming guidelines issued by MCA (Ministry of Corporate Affairs)

Registered Office Address Requirement

- The company must have its registered office in India.

- The Proof of address can be the following:

- Utility bills (Electricity, Gas, or Water bill, Telephone Bill ).

- Rent agreement (if office is rented).

- No Objection Certificate from the property owner

Company Registration Process – How to Register a Private Limited Company in India?

It is essential to understand the registration process before starting the registration process. Below is a step-by-step guide on how to register a Private Limited Company in India.

Step 1: Acquire a Digital Signature Certificate (DSC)

Registration process of Private limited is online, each director and shareholder needs to get a Digital Signature Certificate (DSC). This is used to sign electronic application form. You can obtain DSC Certificate from trusted companies like eMudhra, NSDL, or Sify.

Step 2: Obtain Director Identification Number (DIN)

Each director must get a Director Identification Number (DIN) whio wish to become director in company. Ministry of Corporate Affairs (MCA) issues by and is required for anyone who wants to become a company director.

Step 3: Name Reservation for the Company (SPICe+ Part A)

The most crucial step is to reserve a name for the company. You can do this by filling out the SPICe+ Part A form on the MCA website. The name of the company must be unique and comply with the guidelines set by the MCA. If your company name is available and comply with the rules, it will get approved.

Step 4: Prepare Memorandum and Articles of Association (MOA & AOA)

These are important legal document of the company. The Memorandum of Association (MOA) outlines the scope of the company while the Articles of Association (AOA) contain the rules and regulations that the company will follow. Both documents must be signed by the directors and shareholders.

Step 5: Submission of Incorporation Forms (SPICe+ Part B)

Once all the necessary documents are complied. For registration SPICe+ Part B form must be filled out and submitted on the MCA portal. This form contains all the details like company, directors’ information, and registered office address details.

Step 6: Pay Registration Fees

Registration fee charged by government depends on the authorized share capital of the company.

The payment can be made online through the MCA portal while submitting of incorporation forms.

Step 7: Receive Certificate of Incorporation

After submission of Registration form, Registrar of Companies (ROC) verifies all your documents, you’ll receive the Certificate of Incorporation. Certificate of Incorporation is the official document that proves your company is legally registered, and it will also contain your company’s Corporate Identification Number (CIN).

Company Registration Fees in India

Generally, the total registration fee for a Private Limited Company in India falls within the range of ₹7,000 to ₹15,000. Fee range depends on various factors like authorized capital, professional fees, and government charges. This includes all the required charges for documents, filings, and the initial government fee.

Time Required to Register a Private Limited Company in India

The company registration process usually takes 7 to 10 working days, assuming all required are in order and there are no delays in approval from MCA.

Checklist for Private Limited Company Registration in India

To ensure a smooth company registration process, here’s a handy checklist to follow:

- Obtain DSC (Digital Signature Certificate) for directors which is required to sign documents electronically.

- Every directors must obtain DIN (Director Identification Number) from MCA website.

- Choose and Reserve a unique company name for the company.

- Prepare MOA (Memorandum of Association) and AOA (Articles of Association). These documents must be signed by all shareholders and directors.

- After completing the requisite documents, Fill and submit forms SPICe+ Part B with details about your company, directors, and office address.

- Last step is to make the necessary payment for government registration fees depending on the company’s authorized capital.

- Once the submitted application is verified and approved, you’ll receive your official Certificate of Incorporation, marking the legal establishment of your company.

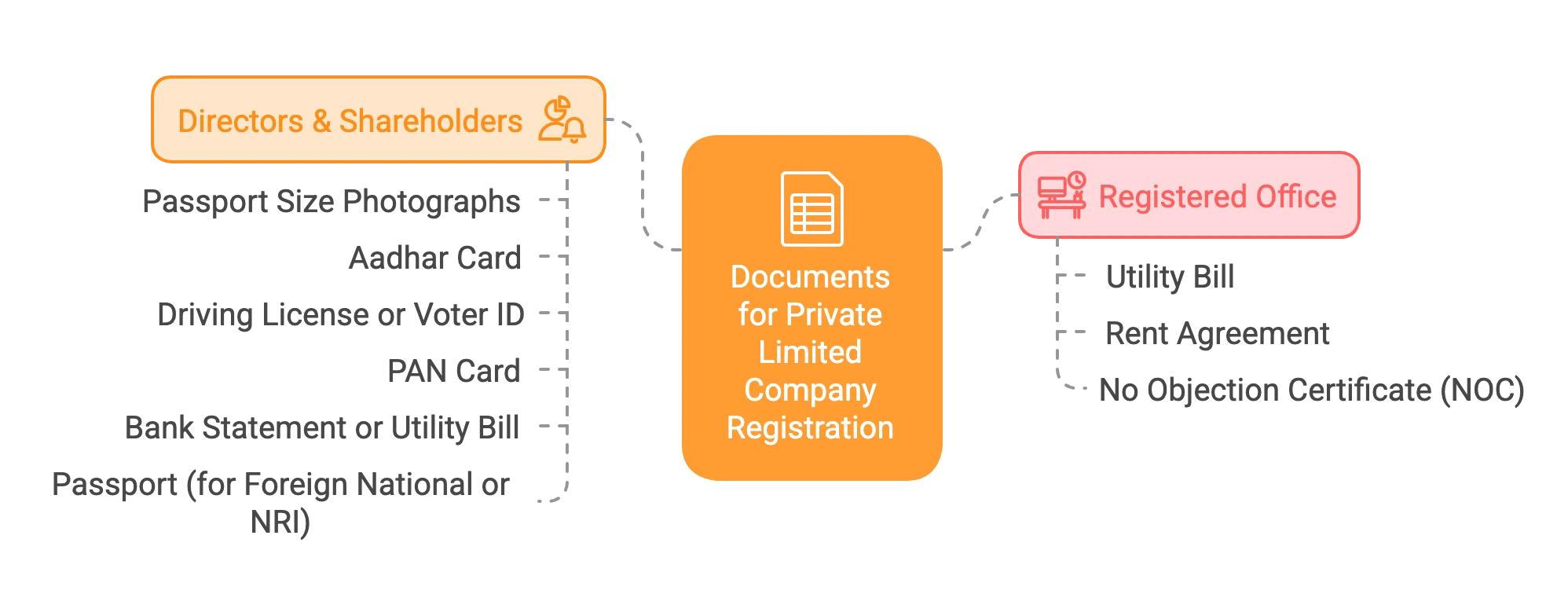

Documents Required for Private Limited Company Registration

Below mentioned is list of the important documents required for registering a Private Limited Company in India:

- PAN Card of Directors: PAN Card copy of all the directors is mandatory for registering a company.

- Aadhaar Card of Directors: Aadhar card copy of all directors must be submitted as proof of identity during the registration process.

- Identity Proof (Voter ID, Passport, or Driving License) : Directors must submitted any of these documents as their identity proof.

- Address Proof (Bank Statement, Utility Bill, or Rent Agreement): A recent bank statement, electricity bill, or rent agreement can be submitted as Address proof .

- Photograph of Directors: All directors must provide their passport sized photograph for getting registered as company.

- Office Address Proof: The proof of registered office address must be submitted during registration process. It can be utility bill or rental agreement along with a No Objection Certificate (NOC) from the property owner.

Post-Registration Compliance for Private Limited Companies in India

After getting certificate of incorporation, company must comply with various legal and regulatory requirements to ensure smooth operations:

Annual Compliance

Every Private limited must file annual returns and financial statements with the Ministry of Corporate Affairs (MCA) within the stipulated deadlines to avoid penalties.

Accounting & Bookkeeping

The company must keep proper accounting records and prepare financial statements in accordance with the accounting principals.

Corporate Secretarial Compliance

Regular board meetings must be held, and minutes must be documented. Annual General Meeting (AGM) should be conducted every year, where annual accounts and other crucial matters are discussed and approved.

Other Registrations

Company must obtain other important registration such as GST registration, PAN, TAN, and other applicable licenses.

By following these post-registration compliance steps, Business owners can ensure their company works within the legal framework, avoiding penalties and maintaining a smooth business flow.

How to Secure a Unique Company Name?

Choosing a non similar and legally compliant name is a essential step in company registration. Here’s how to do it:

1. Conduct a Name Search

- Use the Ministry of Corporate Affairs (MCA) website to search for name availability.

- Choose a company name differs and not match from all an existing company or trademark.

2. Follow Naming Guidelines

- The company name must contain a special component and a descriptive term that reflects your business activity. (e.g., “Tech Solutions Pvt Ltd”).

- Company name should not break intellectual property rights or any registered trademarks.

- You should avoid using in name any restricted words like “Government,” “Bank,” or “National.”

3. Reserve the Name via SPICe+ Part A

- Once the application Submitted on the MCA portal to reserve the name through SPICe+ Part A.

- You can propose two options of names in the form, if one gets rejected. You will have to resubmit with new options.

4. Trademark the Name

To protect your Brand from used by others. You should secure name of the company by getting register it as a trademark with the Intellectual Property India portal.

Company Registration Number – How to Get One?

A Private Limited Company Registration Number is also known as the Corporate Identification Number (CIN). The Ministry of Corporate Affairs (MCA) will issue unique identification number once your company is successfully registered. Here’s complete process through which you can obtain your CIN.

Steps to Obtain a Company Registration Number (CIN)

- Apply for Digital Signature Certificate (DSC) and Director Identification Number (DIN) for Directors who wish to register the company.

- Apply to Reserve the Company Name which should not be undesirable and resembles to existing company or trademark via SPICe+ (Part A)

- After reserving name of the company submit Incorporation Forms via SPICe+ (Part B) with necessary documents and details like register office address, directors details.

- Once the form verified and reviewed by the Registrar of company. You will get the Certificate of Incorporation, a legal document confirms your company’s legal existence.

- The CIN is mentioned in this certificate. You can search the company details using this CIN through MCA website.

Private Limited Company Registration Through LegalFidelity

At LegalFidelity, we simplifies the registration process of Private Limited Company in India. We offers complete assistance from very start to end. Here’s why you should choose us:

Why Choose us?

- Expert Guidance: Our specialized team of Experts will lead you through every step so that your registration process is simple and efficient.

- Hassle-Free Process: The documentation part related to registration, filings, and compliance requirements are handles by us. So you don’t have to worry about.

- Affordable Pricing: We keep our prices clear and competitive pricing without any hidden cost ensuring you get value for your money.

- Post-Incorporation Support: After completion of registration process. We will provide continuous to support with services such as GST registration, income tax filing, and ongoing legal compliance.

Our Registration Process

- Consultation & Documentation work : Once you will provide the your details and requested documents with us, and we will help you every step of registration process from very beginning.

- Assistance in Obtaining DSC & DIN : Our team will assist you in getting DSC and obtaining DIN through which registration forms will get signed by the directors.

- Company Name Reservation: We ensure name of the company must be unique and not resemble to any other existing company name and it get approved easily.

- Filing & Submission: We will prepare all the paper work required and submit all the forms for incorporation. We will make complete process hassle free.

- Certificate of Incorporation Issuance: Once the Certificate of incorporation issued by MCA. Your company is officially registered and has legal existence.

Faqs about Private Limited Company Registration

How much time is taken for the incorporation of a Private Limited Company in India?

Generally it takes only 10-15 days to register a Private Limited Company.Who can be a Director in a Pvt. Ltd. Company?

Any individual, organisation or even a Non Resident Indian (NRI) can be a director in the company. The Director must possess the following characteristics:- He must be at least 18 years of age.

- He must have a Director’s Identification Number aka DIN.

What is the validity of Private Limited Company Registration in India?

As long as all the annual compliances are done, the company will remain active. However, if the annual compliances are not done, it will become dormant and can be struck off from the register of the Registrar of Companies (ROC).How many shareholders a Private Limited Company can have?

A Private Limited Company can have a minimum of 2 and a maximum of 200 shareholders.How many Directors a Pvt. Ltd. Company can have?

A Private Limited Company can have minimum 2 and maximum 15 Directors. In addition, at least one Director should be a resident of India.Does one have to be physically present during the incorporation of a company?

No, at LegalFidelity.com, the Company Registration process in completely online. You just need to send scanned copies of all the documents required for the incorporation.What are the compliances for Private Limited Company?

The mandatory compliances are as follows:- Auditor appointment

- Audit of accounts

- Annual Return Filing

- Filing of Financial Statements

- Holding of AGM aka Annual General Meeting

- Preparation of Directors Report

Can I register a company at my residence?

Yes, you can register a company at your residence. You only need to submit any utility bill along with the No Objection Certificate (NOC)Can I be a Director if I am already employed?

Yes, one can be a Director of a Private Limited Company, OPC or LLP even if he is already employed. There are no such restrictions according to the Companies Act. However, you must ensure that your employment agreement does not contain any restrictions for you to become a Director of any company.Is FDI allowed in a Pvt. Ltd. Company?

Yes, FDI or Foreign Direct Investment is allowed.Can a Pvt. Ltd. Company be converted to other legal entities?

Yes, the Pvt. Ltd. Company can be converted to other legal entities such as Public Limited Company, One Person Company (OPC) or the Limited Liability Partnership (LLP). But it cannot be converted to a Partnership or a Sole ProprietorshipHow do I register a private limited company?

These are the following steps, To register a private limited company in India:

- First of all obtain a Digital Signature Certificate (DSC) for the directors of the company.

- Make an application for a Director Identification Number (DIN) through the Ministry of Corporate Affairs (MCA) portal for each director.

- Fill the SPICe+ Part A form to Reserve name for your company, it must be unique and not similar to any existing company or Registered trademark.

- Next step is to Prepare the Memorandum of Association (MOA) and Articles of Association (AOA). These key documents defines the scope and rules and regulation of the company.

- In Final Step, Submit the necessary incorporation forms SPICe+ Part B along with the required documents.

- Pay the registration fees which depends on authorized capital of the company and wait for approval.

- Once your company will get approved, you'll receive a Certificate of Incorporation from the Registrar of Companies (ROC) shows its legal existences

Who is eligible for PVT Ltd?

Any individual above the age of 18 whether Indian or foreigner resident can register a Private Limited Company. For Company incorporation minimum two directors and two shareholders, with at least one director being a resident of India is mandatory.Can I register a Pvt Ltd company by myself?

Due to complex legal and procedural way of process incorporation, it's advisable to seek expert guidance from experts like LegalFidelity.How much does it cost to start a private limited company?

The cost varies and depends on the various factors like on state and professional fees but generally ranges between ₹7,000 to ₹15,000, including government charges, DSC, DIN, and professional assistance fees.Can a single person register a Pvt Ltd company?

No, It is mandatory to have at least two directors and two shareholders to incorporate a Private Limited Company . However, you are a single entrepreneur, you can opt for a One Person Company (OPC) instead of private limited.

What is the minimum turnover for a Pvt Ltd company?

There is no minimum turnover requirement for a Pvt Ltd company. However, as your turnover grows, legal compliance and regulatory filings will increase.Can I start a Pvt Ltd company from home?

Yes, you can register a Pvt Ltd company with your home address as the registered office. You will need to providing proof such as utility bills and a NOC from the owner.What are the rules for Pvt Ltd company?

Basic rules. of PVT Ltd registration include:

- A Minimum 2 directors & shareholders.

- Regulars Annual filing & tax compliance.

- Unique company name as per the naming guidelines issued by MCA .

- Regular ROC filings & financial audits for transparency.

How can I open a Pvt Ltd company bank account?

After registration it is necessary to open separate bank current account for your Pvt Ltd company, :

- Certificate of Incorporation of Private Limited

- Key documents of company, MOA & AOA

- PAN card of company

- KYC of directors, aadhar card, pan card etc.

- Board resolution authorizing account opening of the private limited

What are the benefits of a Pvt Ltd company?

- Limited liability protection for Shareholders

- Easy funding opportunities from investors through equity or Debt.

- Perpetual succession, even if business discontinues its business or ownership changes.

- Better credibility & Market Reputation

What is the minimum capital requirement for a private company?

There is no minimum capital requirement to start a Pvt Ltd company. You can register with as low as ₹1 lakh authorized capital.What is the difference between Ltd and Pvt Ltd?

- Private limited : Ownership is Privately held, limited numbers of shareholders and shares of private limited company are not publicly traded.

- Ltd (Public Limited Company): Company listed on Stock Exchange and can issue shares to the public.

What documents are required for company registration?

- PAN & Aadhaar card of directors

- Identity proof of Directors (Passport/Voter ID/Driving License)

- Address proof of Directors (Bank statement/Rent agreement/Utility bill)

- Register office address proof

- Passport-size photos of all directors

What is the difference between LLP and Pvt Ltd?

- Pvt Ltd has shareholders and directors, allowing easier fundraising.

- LLP (Limited Liability Partnership) has partners and control is shared among the partners. It is suitable for startup and professional service providers .

What documents are required for company registration?

- PAN & Aadhaar card of directors

- Identity proof of Directors (Passport/Voter ID/Driving License)

- Address proof of Directors (Bank statement/Rent agreement/Utility bill)

- Register office address proof

- Passport-size photos of all directors

What is the difference between LLP and Pvt Ltd?

- Pvt Ltd has shareholders and directors, allowing easier fundraising.

- LLP (Limited Liability Partnership) has partners and control is shared among the partners. It is suitable for startup and professional service providers .

What is a private company called?

A private company is called a company ending with “Pvt Ltd” and registered under Companies Act, 2013 in India.What is the minimum number of members in a Pvt Ltd company?

At least 2 members or shareholders and 2 directors are mandatory.What are the different types of Pvt Ltd companies?

- Company limited by shares

- Company limited by guarantee

- Unlimited company

What is the age limit for Pvt Ltd company registration?

There is no maximum age limit, but directors must be at least 18 years old.How to convert a proprietorship to a Pvt Ltd company?

You must:

- Firstly, Incorporate a new Pvt Ltd company

- Transfer assets & liabilities of proprietorship through an agreement

- Apply for GST, PAN & bank account in the company's name

Is it necessary to write Pvt Ltd?

Yes, Name of a Private Limited Company must end with word "Pvt Ltd.”.Can I buy a private limited company?

Yes, a Private Limited company can be acquired and taken over through transfer of share or by purchasing the assets of company.How much profit is taxed in a Pvt Ltd company?

Pvt Ltd companies are taxed at 22% (new regime) or 30% (old regime) + applicable surcharges & cess.Can I start a private limited company alone?

No, you can not start a Private Limited Alone, at least two directors and two shareholders. If you are a Single founder, you can get registered as One Person Company (OPC).What is the minimum revenue for a Pvt Ltd company?

There is no minimum revenue requirement, but tax compliance will apply based on the company’s income.

Get In Touch

Customer Reviews For Private Limited Company Registration

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Riya S

Great customer support! They handled everything smoothly.

NIDHI D

Fast, efficient, and affordable. Couldn’t ask for more!

NEHA P

Excellent service, very professional and responsive.

Shruti T

The team is very knowledgeable and helpful.

AMIT A

I was impressed by the speed and accuracy of their work.

Anjali K

Their attention to detail sets them apart.