Icegate Registration

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Icegate Registration Online - Process, Documents, Benefits, Cost

ICEGATE Registration provides importers, exporters, customs brokers, shipping lines, and airlines with legal access to online customs services.

ICEGATE is the official online platform of the Central Board of Indirect Taxes and Customs (CBIC), called the Indian Customs Electronic Gateway. It aims at facilitating import and export procedures which are easier, faster, and within the legal framework.

Using this one-window system, importers, exporters, customs brokers, and shipping agents can perform nearly all customs work online. This involves filing documents, clearing custom duties, filing shipping bills, and cargo clearance without the inconvenience of excessive paperwork and time wastage.

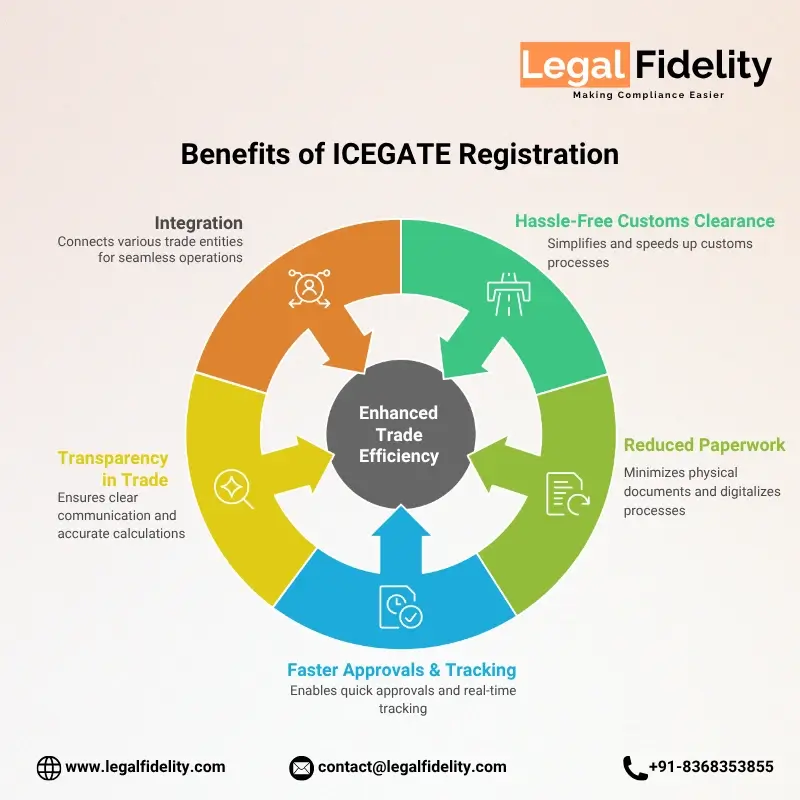

Benefits of ICEGATE Registration

Icegate Registration in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Icegate

Registration

Documents Required for Icegate Registration

IEC Certificate

PAN Card

Digital Signature Certificate (DSC)

GSTIN

ID proof and Address Proof of Authorized Signatory

Bank Details / AD Code Letter

Benefits of Icegate Registration

Hassle-Free Customs Clearance

Reduced Paperwork

Faster Approvals & Tracking

Transparency in Trade

Integration

What You Get

Icegate Registration

What is ICEGATE Registration?

Table of Contents

What is ICEGATE Registration?

ICEGATE Registration is the procedure of obtaining a valid account on the Indian Customs Electronic Gateway (ICEGATE), which is the official e-filing portal of CBIC. It provides importers, exporters, customs brokers, shipping lines, and airlines with legal access to online customs services.

This registration allows businesses to file and trace shipping bills, pay custom duties, submit documents, and track cargo clearance online — making trade operations faster and in accordance with the Indian Customs Act, 1962.

Who Needs ICEGATE Registration?

Importers & Exporters

In case you possess an IEC (Importer Exporter Code), ICEGATE registration is obligatory. It allows you to make import and export applications, pay custom duties, and track your packages online.

Customs House Agents (CHAs)

Many businesses hire CHAs to handle customs procedures on their behalf. ICEGATE registration is required to enable these agents to file papers and clear goods on behalf of clients.

Banks

ICEGATE is used by authorized banks to connect AD codes, allowing online payment of customs duty. These services cannot be carried out without registration.

Shipping Agents & Airlines

They submit cargo and flight manifests electronically through ICEGATE. This ensures quick clearance and easy movement of goods.

Custodians and Logistics Companies

These agencies deal with cargo in ports, airports, and warehouses. ICEGATE assists them in coordinating clearances with customs digitally.

Benefits of ICEGATE Registration

- Hassle-Free Customs Clearance: With online filing of bills of entry and shipping bills, goods are cleared quickly without repeated visits to customs offices or heavy reliance on agents.

- Reduced Paperwork: The majority of processes are digitalized — less paperwork, simplified compliance, and no chance of losing crucial records.

- Faster Approvals & Tracking: Since documents go directly to customs online, approvals are quicker. Users can also track shipments, payments, and clearance in real time.

- Transparency in Trade: The system ensures clear communication, accurate duty calculation, and smooth processing of refunds, building confidence with both government and global trade partners.

- Integration: It links trade information with customs, banks, and DGFT for smooth operations.

Documents Required for ICEGATE Registration

| Document | Description |

|---|---|

| IEC Certificate | A valid Importer Exporter Code issued by the DGFT since ICEGATE is interconnected with IEC. |

| PAN Card | Tax identification of the owner or business entity through PAN card. |

| Digital Signature Certificate (DSC) | Class 3 DSC is required to attain full access, secure entry, and lawful filing. |

| GSTIN | Required where the business is registered under GST to relate customs with GST compliance. |

| ID Proof and Address Proof of Authorized Signatory | Aadhaar, Passport, or Driving License to verify the person’s identity. |

| Bank Details / AD Code Letter | Provided by an authorized bank; required when paying customs duties, refunds, and verifying exporter credentials. |

Types of ICEGATE Registration

According to CBIC rules, ICEGATE offers various types of registration depending on the kind of user and the level of access:

Registration of Partnerships and Organizations

- Applicable for Customs Brokers, Companies, or Partnerships.

- Allows creation of multiple authorized users under the same account.

- Ensures that every employee operates under the supervision of the main entity.

Auto and Simplified Registration

- Designed for IEC holders who do not have a DSC.

- Provides basic features such as document tracking, status checking, and restricted access.

- Ineligible to file or sign papers.

With DSC / Without DSC

| Type | Access Level |

|---|---|

| With DSC (Class 3 Digital Signature Certificate) | Full access to file Bills of Entry, Shipping Bills, make online payments, and sign digitally. |

| Without DSC | Limited functions such as tracking, query replies, and information access. |

Parent and Child User System

- Parent User: The main account holder such as Importer, Exporter, CHA, or Company.

- Child Users: Sub-accounts created under the parent account for employees.

This system ensures data protection, access control, and accountability as per standard customs data management procedures.

Step-by-Step ICEGATE Registration with LegalFidelity

The ICEGATE registration process can be complex since it requires verifying IEC-PAN, validating DSC, connecting AD Code, and configuring the appropriate port. But with LegalFidelity, you can relax — we manage the entire process from start to finish.

- Initial Consultation: We begin by understanding your business and verifying eligibility. Our team explains all requirements clearly so you know exactly what’s needed.

- Document Review: We thoroughly check your IEC, PAN, GSTIN, AD Code, and ID proof to prevent any errors that could lead to rejection.

- Application Submission: Our professionals submit your ICEGATE registration application on your behalf, ensuring it aligns with your business profile.

- Bank and Port Setup: We connect your AD Code and bank details to the correct port to ensure smooth customs payments and operations.

- Approval & Support: Once registration is approved, we assist you in accessing the portal and provide continuous guidance on compliance.

Post-Registration Actions on ICEGATE Portal

Linking AD Code and Bank Account

Connect your AD code with your bank by submitting the AD Code letter of your authorized bank. This ensures that payment of customs duty and refunds are deposited into the correct account.

Port Configuration

You must select the customs ports where you will conduct import or export operations. This step allows you to submit documents and clearances at the correct port.

Accessing Services

Once your account setup is complete, you can access multiple online services on ICEGATE, including:

- Filing of shipping bills or bills of entry

- Online customs duty payment

- Shipment and refund tracking

- Secure communication with customs officials

ICEGATE Registration Fees

Most companies prefer to seek professional assistance from consultants, customs brokers, or compliance experts like LegalFidelity. A professional service charge applies in such cases. The cost typically varies depending on the type of support you need and the service provider you choose.

Time Taken for ICEGATE Registration

The approval process usually takes approximately 1 to 3 working days.

Why Choose LegalFidelity for ICEGATE Registration

- Expert Guidance: Our compliance team ensures that all your documents are properly verified and conform to DGFT, RBI, and Customs requirements, helping you avoid preventable errors.

- Faster and Error-Free Registration: We ensure that common mistakes like PAN and IEC mismatches or expired DSCs are avoided, resulting in quicker approvals and fewer rejections.

- Complete Compliance Support: Our services extend beyond registration — we assist with AD code linking, port setup, and post-registration compliance.

Conclusion

Smooth and compliant import and export operations are only possible with proper ICEGATE registration. With the right guidance, the process becomes easy and error-free. LegalFidelity ensures that businesses complete their registration swiftly, accurately, and in full compliance with customs regulations — making it a reliable partner in facilitating seamless international trade.

Faqs about Icegate Registration

What is ICEGATE?

The official online portal of Indian Customs is known as ICEGATE where importers, exporters and agents are able to submit documents, payment and track shipment.

What is the purpose of ICEGATE?

It simplifies the process of customs clearance by providing the opportunity to file documents online, pay taxes, and monitor their status in real time.

Is ICEGATE registration compulsory?

Yes, It is mandatory for importers, exporters, Customs House Agents (CHAs), and others wishing to complete customs documentation and duty payments.

How do I register in ICEGATE?

Registration is done using IEC, PAN, DSC, and other necessary documents.

How much does it cost to register with ICEGATE?

For hassle free ICEGATE registration, most businesses prefer taking assistance of experts to help them register which may attract some service fee.

How long does ICEGATE registration take?

It takes about 2 to 3 working days to be approved provided that all the documents are right.

What documents are required for ICEGATE registration?

You need an IEC certificate, PAN and Class 3 DSC, address proof and ID proof of the applicant, bank details and AD code and GSTIN where applicable.

Which DSC is required for ICEGATE registration?

Registration and safe online filing needs Class 3 Digital Signature Certificate (DSC).

How to register my AD code in ICEGATE?

An AD code letter can be obtained by applying to your bank, and uploaded on the ICEGATE portal to connect your bank account with customs.

Is it mandatory to register an AD code in ICEGATE?

Yes, AD code registration is compulsory to pay duties and get export benefits directly in your bank account.

What is the fee for AD code registration?

AD code registration does not involve any government fee. The banks can impose nominal service fees.

How to activate a bank account in ICEGATE?

Once AD code is registered, log in on ICEGATE and ask your bank account to be activated to make payment of duty and refunds.

How to link GST with ICEGATE?

On ICEGATE, you are able to associate GSTIN with your IEC by updating the user profile and submitting it back to get approved.

How to pay customs duty through ICEGATE?

The payment of customs duty can be done online through ICEGATE portal through net banking, debit or credit cards or NEFT or RTGS with registered banks.

How to pay customs duty without ICEGATE registration?

The e-payment facility may be used through banks, however, in case of some routine transactions, ICEGATE will have to be registered.

How to generate a challan in ICEGATE?

Login into ICEGATE, select the e-payment option, fill in the bill details and print a challan to pay customs duty.

How to check the exchange rate in ICEGATE?

The Indian Customs-notified exchange rates may be verified in the Exchange Rate section on the ICEGATE portal.

How to get a shipping bill from ICEGATE?

Under Reports or document tracking in ICEGATE, exporters have access to download a copy of their shipping bills.

What are the common issues during ICEGATE registration?

Common problems are PAN and IEC mismatch, invalid DSC, incorrect document uploads and AD code errors.

What to do after ICEGATE registration?

After registration, connect your AD code, port setting, bank accounts activation and begin filling in your customs documents online.

How to get an ICEGATE certificate?

After registration you are able to download ICEGATE registration acknowledgment and Certificate from your account dashboard.

What is the difference between ICEGATE and DGFT?

DGFT handles the foreign trade policies and IEC. ICEGATE is the customs e-filing gateway which deals with clearance, payment of duties and facilitation of trade.

Which ministry controls ICEGATE?

The ICEGATE is run by the Central Board of Ind indirect Taxes and Customs (CBIC) within the ministry of Finance, Government of India.

How to register for port in ICEGATE?

ICEGATE registration allows you to configure your port using the portal, by choosing the port of clearance you prefer.

Get In Touch

Customer Reviews For Icegate Registration

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Akash A

Amazing service! Quick and hassle-free process.

Tanya K

Excellent service, very professional and responsive.

AMIT A

I was pleasantly surprised by their efficiency.

NEHA P

A stress-free experience from start to finish.

BHAVYA R

They took care of everything so I didn’t have to worry.

ANJALI N

I felt valued as a customer. Great experience!