Sole Proprietorship Firm Registration

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Sole Proprietorship Firm Registration Online - Process, Documents, Benefits, Cost

A Sole Proprietorship Firm Registration in India is the simplest form of business. Its Ownership, Management and Control is in the hands of one person only. A sole proprietorship is the best choice for small businesses or the Entrepreneurs who are starting their Entrepreneurship journey. Unlike other business forms, A sole proprietorship is not a separate legal entity from its owner, It means a Sole proprietor is responsible for all business liabilities

Why Choose Legalfidelity for Proprietorship Registration?

- Expert Guidance: Our team of professionals and experts has wide experience in handling Proprietorship Registration across various industries.

- End-to-end support: We bring ease in the registration process by accurate documents filling and submission of application. From advising on the best license to filing the application, we take care of it all from start to end.

- Transparent and Fair Pricing: We provide competitive pricing and transparency in cost with No hidden charges to ensure customer satisfaction.

- Quick Turnaround: We bring ease and accuracy in the registration process to make sure your proprietorship gets approved in minimum time. We offer competitive and fair prices without any hidden costs which deliver premium quality service. Legalfidelity offers customized solutions which meet specific requirements of your business activities. Our expert guided process ensures enhanced compliances while reducing all potential issues.

- MSME Certificate

- GST Certificate

- Shop License

Sole Proprietorship Firm Registration in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Registered

registered

Documents Required For Sole Proprietorship Firm Registration Online

ID Proof

Address Proof

Photo

Registered Office Proof

What You Get

GST Acknowledgement

Proprietorship Certificate

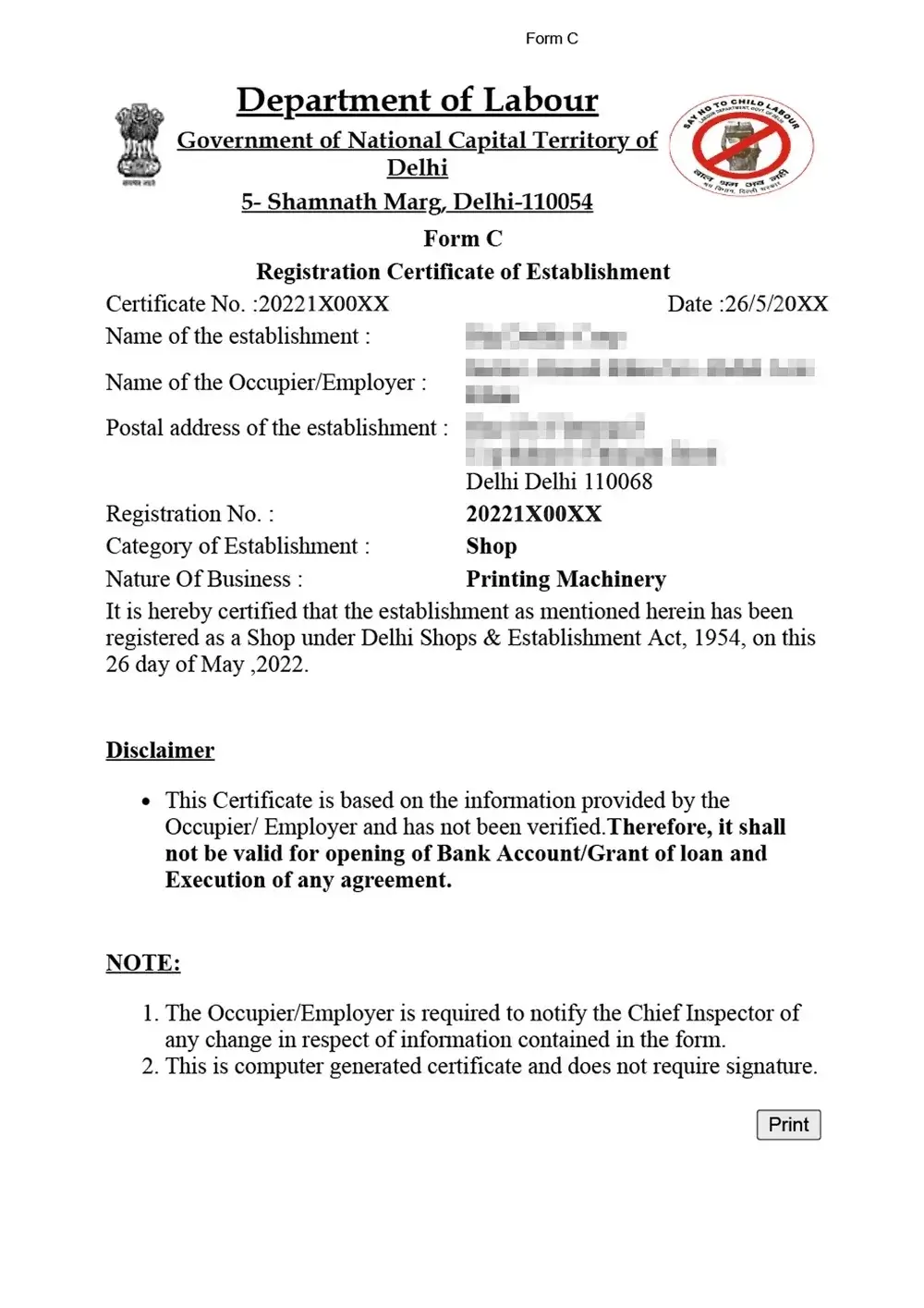

Shop and Establishment Act Registration

*items vary based on the selected plan

What is a Sole Proprietorship Firm Registration?

Table of Contents

A Sole Proprietorship Firm is an entity that is owned, controlled and managed by a single person who is also known as Proprietor. In a Proprietorship, there’s no legal distinction between the Owner and the Proprietorship Firm.

Unlike other forms of legal entities such as Partnership Firm, Private Limited Company, LLP, etc. which may take up to 15-25 days to be registered, the Proprietorship can be started within a few days which makes it a very popular choice of business, to begin with especially among merchants and small traders. We, at LegalFidelity, can help you start your Proprietorship Firm quickly within a few Days.

For a Proprietorship, there’s no specific type of registration. Thus it is identified by other types of registrations such as MSME, GST, etc. to name a few. Also, there’s unlimited liability in Sole Proprietorship aka Sole Trader Registration.

A Sole Proprietorship is an entity controlled and managed by one individual. The Main feature of this form of business is Easy Management and Flexibility. Complex Legal Compliance is not required, which is more preferable by freelancers, Adviser and retailers However, it is not a separate legal entity so personal assets of Sole Proprietor can be affected due to business liabilities.

Most Important Features of a Sole Proprietorship Firm

- Sole Ownership: The Complete Ownership is in the Hands of one person only.

- Easy Setup: Setting up a sole proprietorship is easy with minimum legal documents and cost

- Personal Liability: A Sole Proprietor is solely & responsible for all business liabilities & obligation

- No Perpetual Succession: In the Event of Death of Sole Proprietor, the business ceases to exist.

- Tax Benefits: The Sole Proprietor income is taxed as per the Income tax Slab Rates, which reduces the tax burden.

Who can choose the Sole Proprietorship Firm Registration

A Sole Proprietorship is a flexible business structure which is best suited for the following

- Freelancers and advisers: Graphic Designer or professional who are offering writing and legal consultation

- Small Retails: Shopkeepers, small scale manufacturers and service providers.

- Startup: Business with minimum investment and risks like entrepreneurs who want to start their business to check their business idea.

- Individual with Low Capital: Who want to start with minimal capital for setting up a sole proprietorship a minimum cost is involved

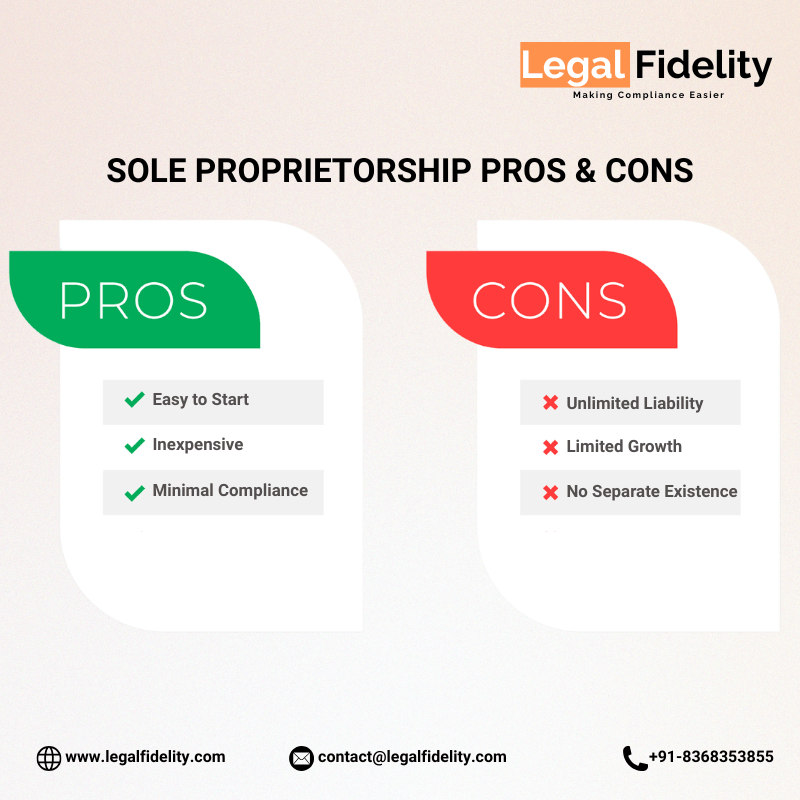

Benefits of Sole Proprietorship Firm Registration

Easy to start

A sole proprietorship is easy to start as it requires only simple registrations such as GST, MSME. Also, only simple documents are required such as PAN Card, Aadhaar Card, etc. along with Proof of Address. Due to this fact, a Sole Proprietorship can be started effectively within a few Days.

Inexpensive

One of the main reasons why small traders and merchants choose Proprietorship is because it is economical.

Minimal Compliance

Unlike other legal entities such as One Person Company (OPC) or LLP etc. there are no annual compliances in Proprietorships. Due to this, it is one of the most common forms of business in India, utilized by small traders and merchants especially those operating in the unorganized sectors.

Disadvantages/ Drawbacks of Sole Proprietorship FIrm Registration

Unlimited Liability

A Sole Proprietor personal asset is affected in case of business loans or legal claims.

Limited Growth

A Sole Proprietor may face limited growth due to limited funds. Without banks and investor involvement a business may face limited growth due to limited availability of funds.

No Separate legal entity

A separate legal entity is an important feature for business growth. Generally banks or investor are investing on those firms which have the separate legal entity features because in the event of death of proprietor the sole proprietorship ceases to exist, leading to operational closure.

Checklist or Step by Step process on How to Register a Sole Proprietorship Firm

Step 1: Choosing a Business Name

The Name must be unique and reflect the nature of business. Although there is no restriction in choosing the name of business, to protect yourself from future legal complications it is advisable for a sole proprietor to not to choose names that are similar or identical with existing trademarks. You can check The Name on this portal https://tmrsearch.ipindia.gov.in/tmrpublicsearch/

Step 2: Pan Card

A Proprietor has to obtain a valid PAN Card before proceeding for Sole Proprietorship Firm Registration. Ensure that PAN card details are correct & updated.

Step 3: Aadhaar Card Linked with a Valid Mobile Number

Ensure that the aadhaar card is linked with a valid mobile number so that an OTP can be submitted during the verification process.

Step 4: Business Address Proof

Provide a business address proof, like:

- Utility Bill(Water, Electricity etc)

- Rent Agreement(If Rented)

- Ownership Documents (if you are the owner)

Step 5: GST Registration(If Applicable)

If Business crosses Rs 40 Lacs of Turnover Annually (Applicable in case of Manufacturing, Trading sector) and Rs 20 Lacs (Applicable in case of Service Sector). For Special Category For Some States it is Rs 20 Lacs (Applicable in case of Manufacturing, Trading sector) and Rs 10 Lacs (Applicable in case of Service Sector), Then GST Registration is mandatory. GST Registration allows businesses to collect & Remit taxes and allow you to take input tax credit for business purchases.

Step 6: MSME(Udyam) Registration/Udyog Aadhaar Registration

Registration of Udyam Registration under MSME provides many benefits, including Govt Schemes, Subsidy and priority sector lending.

Step 7: Opening of bank account

A Sole Proprietor has to open a Current Account in the name of Firm so that Individual and Business finances can be recorded separately. For opening of current account generally bank wants a business registration certificate, like GST or Shop license

Step 8: Additional Licences (Shop License, FSSAI, Gumasta etc)

Depending upon the nature of business, A Sole Proprietor has to take additional license. For example

- Shop and Establishment Licence: Mandatory for Physical Shops and Commercial Establishments.

- FSSAI License: For Business involving in Food Related activities

- Trade License: Required for some business, it’s a state specific municipal registration applicable state to state.

Documents Required for Sole Proprietorship Firm Registration

List of Mandatory Documents:

- Identity Proof: Proprietor PAN, Aadhaar Card or Voter ID.

- Address Proof: Utility Bill, Rent Agreement if Rented

- Business Address Proof: Consent Letter or Rent agreement if the premises is on rent.

- GST Registration Certificate: If Applicable

- MSME Registration Certificate: For Business registering under Udyam Portal

- Additional Licence: Depends upon nature of business like shop act, food license, trade license etc

Taxation & Compliance for Sole Proprietorships

Income Tax Filing

An Income of Sole Proprietor is taxed as per proprietor personal income and it is subject to different Rate and Slab. For reducing the income tax burden A sole proprietor can claim rent, utilities or business expenses.

GST Filing

If registered in GST, A Sole Proprietor has to submit a GST Return. Under this return it includes the details about sale, purchase and tax paid. Non Filing of GST Return results in you paying a penalty along with the interest.

Other Compliance Applicable

- Professional Tax: A proprietor may be required to take Professional Tax registration which is state subject and varies from state to state.

- Tax Deducted at source (TDS): For making business payment to vendors or for salary payment TDS is applicable and is required to deduct TDS as per Income tax Act.

By following the above mentioned compliance a proprietor can ensure smooth running of business and avoid any legal issues.

Time taken for Sole Proprietorship Firm Registration Online

Time required for registration of proprietorship varies on various factors like type of license and efficiency of local authorities. Here’s the estimated timeline:

- Selection of Business Name: Instant, provided it must be unique

- Documents collection: 2-3 days

- GST Registration: generally 10-15 days

- MSME Udyam Registration: 1-2 days

- Other License: Depends upon the authority like FSSAI department may take 7-10 days.

Cost or Fees for Setting up of Sole Proprietorship Firm Registration

It Varies and depends upon the registration, state and the assistance of professionals required. The process of registration involves technical knowledge hence it is better to avail the services of some professional like us who can help you in successfully taking the registration and avoid unnecessary delay in setting up of your business.

For Proprietorship Registration, we have packages starting from Rs. 1499 only.

Why Choose a Consultant or CA for Sole Proprietorship Firm Registration

- Correct Selection of documents: Selecting the correct documents ensures the smooth approval of your license.

- Compliance Knowledge: A professional has better understanding of rules and regulation who can guide you better to file the requisite return on time and protect you from penalties.

- Time Saving: Professional helps you in saving your precious time in setting up your business. Every registration has different set documents applicable & timelines to submit the information about your business so it is better to submit the correct documents on time for smooth approval of your registration.

- Avoid Penalties: They help you in avoiding penalties.

PAN Card required For registering a sole proprietorship

For proprietorship firm registration A Pan Card is required which is the most important documents for every financial and taxation related matters.

- A Sole Proprietor can obtain a PAN Card through NSDL or UTITSL Portal.

- Submit ID proof and Address Proof, If accepted, PAN Card will be dispatched in 10-15 Days at the given address.

GST Registration for Sole Proprietorship

Businesses whose business turnover is more than the limited has to take GST Registration mandatory. Benefits for taking GST Registration includes:

- Collection of GST from customers

- The Proprietor can claim input tax credit, reduce overall tax liability on product or services.

- Increase Credibility in customers and vendors.

MSME or Udyog Aadhaar or Udyam Registration

MSME Registration is a step taken by the government to promote the small sector. Benefits for MSME registration are given below:

- Lower Interest Loan

- Subsidy in Patent and Trademark Registration

- Exemption in tax laws

Opening a Bank Account for Sole Proprietorship

It is important to open a current account of your business so that individual finance and business finances can be recorded separately. It helps you in tracking your income and expenses during the financial year. Opening a bank account of your sole proprietorship is simple process by visiting the bank and submit the required documents like

- GST/ MSME or any registration Certificate

- PAN of Proprietor

- Aadhaar of Proprietor

- Photo of Proprietor

Importance of bank account for Sole Proprietorship

- Simplification of financial management: It helps you in recording of individual and business transactions.

- Increases Credibility: It increases credibility of business in the eye of banking authorities.

- Easy Auditing: It provides ease in the audit and inspection process and provides you with more authentic figures of your business.

Steps to open a Current Account of your Sole Proprietorship

Choosing a Bank: Choose a Bank which provides more facilities likes Internet Banking, Overdraft Facility or Lower Maintenance Fund etc

Selection of requisite documents: Proprietor PAN Card, Aadhaar Card, Registration Certificate like GST/MSME/ or other registration certificate are required for opening of current account.

Submission of documents: Visit Branch and submit the above mentioned along with the account opening form signed and stamped of sole proprietorship.

Verification and Activation of Account: Bank will verify all the documents and open the current account in the name of you firm.

Pro Tips:

- Maintaining the minimum balance to protect you from penalty. Every bank has its different Minimum Balance Limit of maintaining the account.

- Choose that bank which offers more facilities and their annual charges are low.

- Choose a bank in your local nearby area so that you can visit the bank easily as & when required.

Obtaining a Shop and establishment license For your Sole Proprietorship

Shop and Establishment license is an important registration certificate for businesses who are opening either physically or in a commercial establishment. This license is a state specific license granted by the local municipality and falls under the labour laws also it protects the right of employees.

What is Shop and Establishment License?

Shop or Establishment Act is a State specific law which signifies the working environment, employees rights as well as ensure the smooth working of business. Generally Retailers, Offices, Restaurants or service providers require this license mandatorily.

Benefits of having Shop and Establishment Registration

Legal Compliance: To protect you from the penalties of labour or employment regulations.

Employee Welfare: Provides a correct working environment, employee holidays and helps in fixing the wages of employees.

Business Credibility: It increases the credibility of business.

How to Apply for Shop and Establishment License

- Submit the application form with the help of a consultant or person who is dealing in labour laws.

- Selection of required documents for the license Like PAN, Aadhaar, No. of employees or nature of business etc.

- Pay fees to the concerned authority.

- Once it is approved, you can have the registration certificate of the shop and establishment license. It may take 15-20 days for approval by the authority.

Important factors:

- Renew your license as and when required.

- If there is change in the details of employees or employer submit the correction form to make it updated.

Types of business in India that can be registered under sole proprietorship

A sole proprietorship in India is easy to form and operate so the following types of business generally open in a sole proprietorship form. List of Businesses that can be registered in sole proprietorship.

1. Retail Businesses

- Grocery stores

- Clothing boutiques

- Electronics shops

- Pharmacies

2. Service-Based Businesses

- Freelance writing and content creation

- Graphic designing

- Web development and IT services

- Consultancy services (financial, legal, HR, etc.)

3. Home-Based Businesses

- Home bakeries

- Handmade crafts and jewelry

- Tutoring services

- Online selling via marketplaces like Amazon or Flipkart

4. Food and Beverage Businesses

- Small cafes or tea stalls

- Food delivery services

- Catering businesses

- Tiffin services

5. Health and Wellness Businesses

- Yoga instructors

- Personal trainers

- Diet and nutrition consulting

6. Creative Businesses

- Photography studios

- Event planning

- Art studios

- Music or dance schools

7. Repair and Maintenance Services

- Electricians

- Plumbers

- Mobile and electronics repair shops

- Carpenters

8. Agricultural and Farming Activities

- Small-scale farming

- Floriculture businesses

- Organic produce selling

9. Trading Businesses

- Import/export businesses

- Wholesale trading

- Stationery or office supplies

10. Educational Services

- Coaching centers

- Private tutoring

- Skill development workshops

The above mentioned business generally is in the form of sole proprietorship as it provides flexibility and easy incorporation and minimum compliance and is handled by the single owner. A sole proprietorship is best suited for micro or medium enterprises in India.

Proprietorship vs Partnership vs Limited Liability Partnership (LLP) vs Company

Choosing the right business structure is critical for the success of your venture. Below is a comparison table highlighting the key differences among Proprietorship, Partnership, LLP, and Company.

| Feature | Proprietorship | Partnership | LLP | Company |

|---|---|---|---|---|

| Ownership | Single owner | Two or more partners | Two or more partners | Shareholders |

| Legal Identity | No separate legal entity | No separate legal entity | Separate legal entity | Separate legal entity |

| Liability | Unlimited liability | Unlimited liability | Limited liability | Limited liability |

| Compliance Requirements | Minimal | Moderate | Moderate to high | High |

| Taxation | Taxed as individual income | Taxed as personal income | Taxed as a partnership firm | Corporate tax rates |

| Ease of Formation | Easy and cost-effective | Easy and cost-effective | Moderate | Complex and expensive |

| Funding Options | Limited to personal funds | Limited to partner contributions | Can raise funds through partners | Can raise funds via equity |

| Continuity | Ends with proprietor’s death | Ends with dissolution agreement | Continues irrespective of changes | Continues irrespective of changes |

| Regulatory Oversight | Low | Low to moderate | Moderate | High |

Important Points:

- Sole Proprietorship is the best option for small scale business. While a partnership works well for businesses in which multiple owners share responsibilities.

- LLP provides limited liability protection to its partner maintaining operational flexibility.

- A company is suitable for larger businesses that require scalability and external funding.

- Understanding these differences helps the emerging select the most appropriate structure for your business needs.

Conclusion

Sole Proprietorship Firm Registration is one of the simplest and most efficient ways to start your journey as an entrepreneur. It is an attractive choice for small business owners and sole traders, because of its basic structure, reduced compliance requirements and low cost.

Many times, it becomes challenging to understand and handle the legal compliance related to the registration process without the expert guidance.

At LegalFidelity , we offer you an ease and hassle free registration process from start to finish.

Your proprietorship firm registration will be handled by our expert team without any complications, which allows you to focus on growing your business to achieve the heights.

Our team will manage the whole registration process with accuracy and transparency from obtaining necessary licenses to managing the legal compliance. Selecting LegalFidelity as your trusted partner to handle your registration process will be a great choice towards Starting a successful business today

Faqs about Sole Proprietorship Firm Registration

What is Proprietorship Registration?

A Sole Proprietorship is an entity that is owned, controlled and managed by a single person who is also known as Proprietor.How do I register a Proprietorship in India?

For a Sole Proprietorship, there’s no specific type of registration. Thus it is identified by other types of registrations such as MSME Registration, GST Registration, etc. We, at LegalFidelity, can help you start your Proprietorship Firm effectively within a few Days only.

Is GST mandatory for Sole Proprietorship?

If the Sole Proprietorship has an annual turnover of less than Rs. 40 Lacs, then GST Registration is not mandatory for Sole Proprietorship

Is Current Account mandatory for Sole Proprietorship?

No, Current Account is not mandatory but it is advisable to open current account for Sole Proprietorship.Who can be a Sole Proprietor?

Any Indian citizen having basic documents such as PAN Card, Aadhar Card, etc. can become a Proprietor.

Will I get a Registration Certificate?

Since Proprietorships are recognized by alternate forms of Registrations such as MSME, GST, etc. you won’t get a Proprietorship Certificate in Proprietorship Registration.What documents are required for starting a Proprietorship Business in India?

Only basic documents are required such as PAN Card, Aadhaar Card, etc. along with Address Proof are required to start a Sole Proprietorship business in India.How long does it take to get started with Sole Proprietorship?

We, at LegalFidelity, can help you start your Proprietorship Firm effectively within a few Days only.Can I convert Proprietorship to Private Limited Company, LLP, etc?

Yes, it is possible to convert Proprietorships to other legal entities such as Private Limited Company, LLP, OPC, etc. The procedure is a little bit complex, but it is still possible. Many Proprietorships convert to Private Limited or Partnerships etc. at a later stage.What is a Proprietorship Firm?

A Proprietorship firm is a sole-proprietorship business entity that is simple to set up and manage, providing complete control to the proprietor.Who can register a Proprietorship Firm?

Anyone who wants to start a business And wants to work as a sole proprietor, he can register a proprietorship firm.Can I open a business bank account in the name of my proprietorship firm?

Yes, you can open a business bank account in the name of a proprietorship firm. You need to submit documents like your proof of your GST registration and registered address proof like Utility bill or Rent agreement etc and PAN CardWhat is the cost of registering a proprietorship firm?

The cost varies depending on the registrations required, such as GST, Enterprise, or Shops and Establishment licenses. Generally, the packages for Proprietorship Firm Registration starts from Rs.1499 onlyDo I need a Shops and Establishment Act license for my proprietorship?

Yes, this license is mandatory for most businesses operating in commercial establishments.Are there any audit requirements for proprietorship firms?

Proprietorship firms are not subject to mandatory audit unless their turnover exceeds the limits prescribed under tax laws.What are the tax implications for proprietorship firms?

The owner's income is taxed as personal income under the Income Tax Act.Can a Proprietorship Firm Have Employees?

Yes, a proprietorship firm can hire employees, but the owner is responsible for compliance with labor laws.Is Udyam Registration mandatory for proprietorship firms?

Although it is not mandatory, Udyam registration offers benefits like subsidies and easy access to government schemes.What happens to a proprietorship firm if the owner dies?

A proprietorship firm ceases to exist after the death of the owner because it is not a separate legal entity.Can I operate multiple businesses under one proprietorship?

Yes, you can operate multiple businesses under single proprietorship with different business names under your personal PAN. It is advisable to maintain separate accounts and registrations for each.

Get In Touch

Customer Reviews For Sole Proprietorship Firm Registration

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

AKASH S

Trustworthy and dependable. I’m really happy with them!

MEENA M

Highly professional and efficient. I am very satisfied.

Tanya K

Best service at the best price. 100% satisfied!

POOJA M

They exceeded my expectations with their service.

Riya S

I felt valued as a customer. Great experience!

KAVITA D

Their attention to detail sets them apart.