Udyam Registration (MSME)

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Udyam Registration (MSME) Online - Process, Documents, Benefits, Cost

The Government offers an official recognition process known as Udyam Registration for Micro, Small, and Medium Enterprises (MSMEs) in India. It was introduced by the Ministry of Micro, Small and Medium Enterprises (MSME) on 1st July 2020 in the provisions of MSME Development Act, 2006.

In simple terms, it is an identity card of your business. Once MSMEs are registered, a unique certificate with Udyam Registration Number (URN) is generated and an online certificate is issued, which makes the company a recognized MSME.

Udyam Registration Certificate Sample

Udyam Registration (MSME) in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Udyam Certificate

Documents Required for Udyam Registration (MSME)

Aadhaar Card

PAN (Permanent Account Number)

GSTIN (If Applicable)

Business Details

Mobile Number Linked with Aadhaar

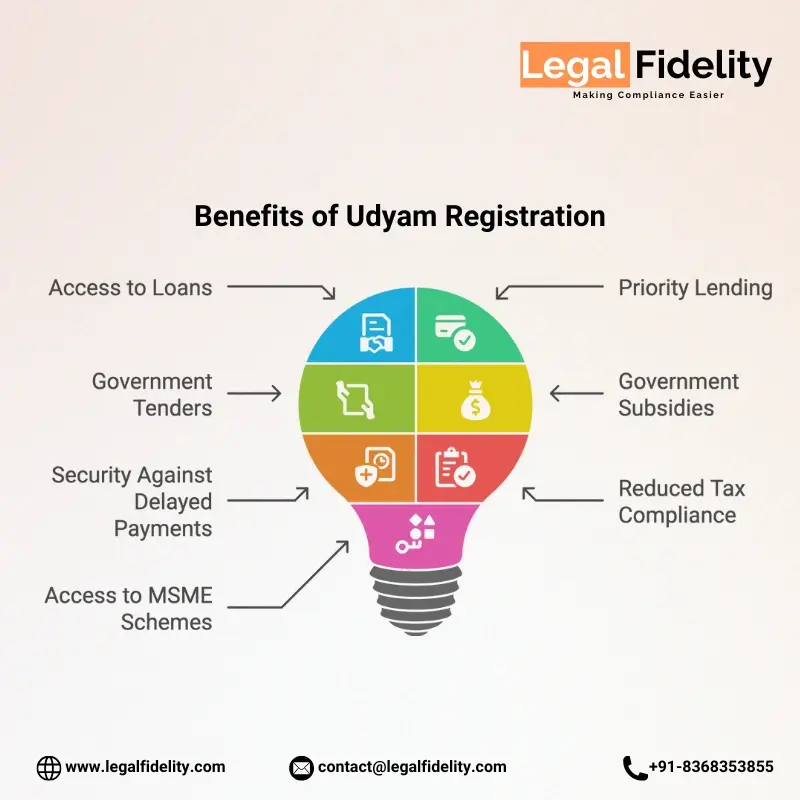

Benefits of Udyam Registration (MSME)

Simple access to loans of MSMEs

Priority lending by banks

Simplifying Government tenders

Exclusive government subsidies

Security against delayed payments

Reduced tax compliance and tax burden

Access to special MSME schemes

What You Get

Udyam Registration Certificate

What is Udyam Registration?

Table of Contents

- Purpose of Udyam Registration

- Features of Udyam Registration

- The importance of Udyam Registration for MSMEs in India

- Udyam Registration Certificate

- What are MSMEs?

- Eligibility for Udyam Registration

- Benefits or Advantages of Udyam Registration

- Documents Required for Udyam Registration

- Step by Step Process on How to apply for Udyam Registration

- Common Challenges in Udyam Registration

- Renewal and Update of Udyam Registration

- Transition from Udyog Aadhaar to Udyam

- Role of MSMEs in the Indian Economy

- Conclusion

The Government offers an official recognition process known as Udyam Registration for Micro, Small, and Medium Enterprises (MSMEs) in India. It was introduced by the Ministry of Micro, Small and Medium Enterprises (MSME) on 1st July 2020 in the provisions of MSME Development Act, 2006.

In simple terms, it is an identity card of your business. Once MSMEs are registered, a unique certificate with Udyam Registration Number (URN) is generated and an online certificate is issued, which makes the company a recognized MSME.

Purpose of Udyam Registration

- To provide a legal identity to each MSME.

- To enable businesses to access easier benefits, subsidies and schemes offered by the government.

- To assist the government monitor the growth of the MSME and tailor improved government policies.

This registration replaced the earlier regime of Udyog Aadhaar Memorandum (UAM) to increase transparency, convenience as well as digitization.

Features of Udyam Registration

- Fully digital & paperless: Physical forms and in person office visits are required.

- Aadhaar based registration of MSMEs: Speedy verification with Aadhaar.

- Each enterprise was given a 12-digit permanent Udyam Registration Number (URN).

- Lifetime validity: There is no need to register it again after you are registered.

- Integration with PAN & GST: Once you file both, GST and ITR reports, the business details are updated automatically.

The importance of Udyam Registration for MSMEs in India

Without Udyam Registration, your business can miss:

- Priority Sector Lending: Avail of collateral free and low-interest loans as part of the priority sector lending. Banks can give easy loans to the MSME at a lower rate.

- Government Subsidies & Incentives: Get the benefit of a variety of MSME schemes, subsidies, and incentives which can only be availed by registered enterprises.

- Tenders Eligibility: To participate in the Government and PSU tenders, it is mandatory to have the Udyam registration.

- A legal, trusted government backed identity: This credibility assists you to establish your reputation with consumers, lending banks and business associates.

Thus, the Udyam Registration is a necessary requirement to remain compliant with the law, and to avail the financial, legal, and administrative assistance of the government.

Udyam Registration Certificate

All enterprises receive an electronic Udyam Registration Certificate after a successful registration process, as their proof of official identity as MSME.

The certificate includes:

- Unique Udyam Registration Number (URN): A 12 digit permanent number.

- The type of the enterprise: Micro, Small or Medium.

- QR code: that will be verified immediately.

- Applicant and company information.

This certificate is required when applying to collateral-free loan, government subsidies, priority sector lending and also in tenders.

What are MSMEs?

In July 2020, the government simplified the MSME eligibility and the overall categorization of MSMEs. In the past, this classification of MSME was confusing because it was solely based on investment. A combined Investment-turnover criterion now defines MSMEs and this makes it more practical and inclusive.

| Category | Investment Limit | Turnover Limit |

|---|---|---|

| Micro Enterprises | Up to ₹1 crore | Up to ₹5 crore |

| Small Enterprises | Up to ₹10 crore | Up to ₹50 crore |

| Medium Enterprises | Up to ₹50 crore | Up to ₹250 crore |

Eligibility for Udyam Registration

The following business types are eligible for Udyam:

- Proprietorships: Single owned businesses like shops, freelancers, and small traders.

- Partnership Firms: Partnership Firms businesses that have two or more partners.

- Limited Liability Partnerships (LLP): New structured business entities that provide the flexibility of the partnership with the advantage of limited liability.

- Private Limited & Public Limited Companies: Business incorporated under the Companies act.

- Hindu Undivided Families (HUFs): Businesses run by family.

- Societies, Trusts, and Co-operatives: Social, charitable and community based businesses.

Benefits or Advantages of Udyam Registration

Simple access to loans of MSMEs

Accessibility of finance is one of the biggest challenges of small businesses. With Udyam Registration, you can access collateral free MSME loans under various schemes like the credit guarantee fund where taking money is easier without risking personal assets.

Priority lending by banks

Registered MSMEs are considered by the banks and NBFCs in the priority sector lending. This translates into faster approvals, lower interest rates and a greater probability of getting the funds that you require.

Simplifying Government tenders

Udyam Registration offers your company access to Government e-Marketplace (GeM tenders) and allows you to bid on the Central Public Procurement Portal (CPPP) tenders that are frequently limited only to verified MSMEs.

Exclusive government subsidies

Government subsidies are also available to registered MSMEs on such major costs as ISO certifications, patents, and trademark registrations. This minimizes expenses as it also lets you create a more powerful brand.

Security against delayed payments

Managing Cash flow is a challenge to small businesses. Udyam registered enterprises are legally entitled to be free of delayed payments and can even demand compensation of interests on delayed payments in form of Udyam Act regulations.

Reduced tax compliance and tax burden

Most of the registered MSMEs enjoy these tax concessions and rebates as well as simplified compliance requirements which enable them to concentrate more on business expansion rather than paperwork.

Access to special MSME schemes

Udyam Registration will provide you a gateway to various exclusive MSME schemes and incentives launched by the government to support you through technology upgradation, marketing support, and skill development programmes.

Documents Required for Udyam Registration

The following documents are required for Udyam Registration:

- Aadhaar Card: The Aadhaar of the business owner, promoter, or managing partner is compulsory.

- PAN (Permanent Account Number): PAN Card of the business or individual (proprietor).

- GSTIN (If Applicable): Compulsory for GST registered businesses otherwise optional.

- Business Details:

- Business name

- Date of incorporation

- Type of activity (manufacturing/service/trading)

- Bank account details

- Mobile Number Linked with Aadhaar: For OTP verification.

Step by Step Process on How to apply for Udyam Registration

The Udyam Registration process may seem confusing, time consuming and prone to mistakes. That is where LegalFidelity comes in to ensure that the whole process is hassle free, quick and stress free to the entrepreneurs in Mumbai.

Step 1: Consultation & Understanding Your Business

Our professionals will know the nature of your business, investment and your turnover first. This will assist in rightly categorizing your business Micro, Small, or Medium according to governmental regulations right from the beginning.

Step 2: Easy Document Preparation

We assist in collecting and arranging the necessary information like Aadhaar, PAN, GST if applicable and other company details. Saves your time and avoids mistakes that can lead to rejection.

Step 3: Filing Done by Experts

Rather than struggling with the online portal, our team submits the application on behalf of you appropriately and within the MSME requirements. This reduces the chances of mistakes or unwarranted delays.

Step 4: Quick Processing & Updates

We track your application and inform you on every stage, until you get your Udyam Registration Number (URN) and digital certificate.

Step 5: Support Even After Registration

Our experts provide post registration guidance related to loan at lower rates, provision of subsidies and schemes, and bidding in government contracts.

Common Challenges in Udyam Registration

Although Udyam Registration itself is easy and online, there are several challenges most entrepreneurs go through. Being aware of them can make your preparation easier and prevent any delays.

Aadhaar Linking Issues

- In some cases, the registration fails because of the Aadhaar-PAN mismatch.

- The most common arenas of concern include the difference in names, or wrong information, between Aadhaar and PAN records.

Technical Glitches

- The process can be delayed by the Udyam portal problem or not being available due to maintenance.

- Other common problems with different users include OTP not received during Aadhaar verification.

Document Verification Problems

- Data on PAN or GST databases may not always match, which is why there might be problems with the verification of the Udyam document.

- Sometimes the system might put the business in the incorrect category like Micro, Small or Medium as an error in auto-filling.

Lack of Awareness

- Most businessmen are not even aware of the process or advantages of registering their businesses.

- Small traders also fail to register because of the challenges in MSME awareness or lack of the necessary guidance.

Language Barrier

The portal is mostly in English and Hindi and may not suit the regional entrepreneurs to complete the registration conveniently.

Renewal and Update of Udyam Registration

The most significant thing about Udyam is that the MSME certificate is valid lifetime. That is, after registering, there will be no Udyam renewal procedure, the certificate will be valid indefinitely.

But they must update the contents of the certificate in case changes occur like:

- Change of business name or address.

- Change in PAN or Aadhaar information.

- Change in investment or turnover, where the change in the business category may occur such as Micro, Small and Medium.

Why Updating is Necessary

Updating your details helps you to avoid inconveniences when taking a loan, availing subsidies, or participating in government programs. It also avoids mistakes of verification of banks and authorities.

Transition from Udyog Aadhaar to Udyam

Before July 2020, MSMEs used to be registered through the Udyog Aadhaar Memorandum (UAM) system. Although it was a significant step towards the MSMEs recognition, it had several drawbacks:

- Many businesses ended up with multiple registrations, which created confusion.

- No real time verifications were performed, which lowered the reliability of the process.

- Any modification of information or correction of wrong information was usually a complex and time consuming task.

To fix these gaps, The Ministry of MSME developed the Udyam Registration portal on 1st July 2020, which is considered a total digital transformation in MSME compliance.

With Udyam, things became much easier:

- One enterprise, one registration: each company will be issued a unique Udyam Registration Number (URN).

- Aadhaar based registration: where PAN is validated offers clear and instant validation.

- Automatic updating: due to GST and Income Tax Return filings eliminate paperwork and keep both records current.

Role of MSMEs in the Indian Economy

SMEs are known to be referred to as the backbone of the Indian economy. They have an immense contribution to make:

- Provide almost 30 percent of Indian GDP.

- Contribute 45 percent to the total exports in India by the MSMEs.

- Facilitate the employment of more than 110 million people in the country.

More than numbers, MSMEs make significant contributions to the economy:

- Promote entrepreneurship and innovation at the ground level.

- Contribute to regional growth, particularly semi-urban and rural regions.

- Aid to stabilize development between urban and rural India to lower the economic imbalances.

Conclusion

Udyam Registration opens the door to government programs, financial support, tax incentives, and greater credibility, providing your business with a solid base to build on.

With the right registration guidance, your business will be in a good position to grow sustainably, enjoy legal protection, and market opportunities.

Faqs about Udyam Registration (MSME)

What is Udyam registration?

Udyam registration is an officially recognized government process under MSME Development Act of the Government of India 2006. Businesses can register themselves to obtain legal status and benefits.What documents are required for Udyam registration?

You will need the Aadhaar number of the business owner such as Proprietor, Partner or Director, PAN card, and the basic details of the business name, address, nature of business and the bank details. In case your business is registered under GST, the GST details will also be required.Who is eligible for Udyam registration?

Any business involved in manufacturing, trading or service activities, and within the MSME limits of investments and turnover can be registered.Is GST compulsory for Udyam registration?

No, a GST number isn't mandatory to get Udyam Registration. It is compulsory only when the business is liable to get registered under GST laws.What are the Udyam registration fees?

A professional fee may be charged in case you hire any professional to get your MSME certificate faster, hassle free process and within minimum time.Is Udyam registration good or bad?

It is highly advantageous. It assists you in having your business recognized by the government and to benefit in terms of subsidies, lower interest loans, and priority in government tendersWhat is the reason for Udyam registration?

It grants your company official MSME status which is required to receive benefits under central and state government programs to support small businesses.Who is eligible for MSME registration?

Any commercial enterprise that:

Actually founded like proprietorship, partnership, company etc

Working in manufacturing, services, or trading

And meets the investment and turnover thresholds of MSMEsWhat is the turnover limit for MSME?

Micro Enterprise: Up to Rs. 2.5 crore of investment and turnover of up to Rs.10 crore

Small Enterprise: Investment not more than Rs. 25 crore and a turnover up to Rs. 100 crore

The investment is less than Rs.125 crore and turnover is less than Rs 500 crore.What is the difference between Udyam and MSME?

SME is the legal definition of the sector such as Micro, Small, Medium Enterprises. Udyam is the formal registration procedure to be treated as an MSME under the MSME Development Act, 2006.What are the benefits of MSME or Udyam registration?

MSME registered businesses get:

Preference in government contracts

Subsidies on bank interest and electricity

Collateral free loans

Quick issuance of licenses and registrationsCan I open a current account with Udyam registration?

Yes, the Udyam certificate is treated by banks as a valid documentation of business, and it makes current account opening easy.Is Udyam certificate proof of business?

Yes, it is an official government issued document that demonstrates that your business exists and has been registered as MSME.Is a bank account mandatory for Udyam registration?

It is not necessary to have a bank account in order to become a registered user, but having one makes receiving payments and receiving benefits easierIs Udyam registration mandatory for a company?

Udyam Registration is mandatory in case the company wants to avail MSME benefits such as subsidies, tenders, or loans. It is not a legal requirement otherwiseHow long is the Udyam certificate valid?

It is valid for a lifetime. It does not require renewal unless you have made changes to your business.How to get Udyam certificate from GST number?

When a business has GST Registration, Udyam can be obtained using the GST number. You can consult LegalFidelity's experts for getting the Udyam Registration.How can I find my Udyam number from my PAN card?

Udyam number can easily be recovered using mobile number and PAN.What is the Udyam Registration Certificate PDF?

It is the digital certificate offered by the government after Udyam Registration. It contains your Udyam number and business information.How do I update my Udyam certificate?

On the Udyam portal, using your PAN and OTP, you can log in at any time and change your business-related information, in case of an update.How to read Udyam number?

It is a 19-digit Unique Identification Number allotted on the registration of your MSME. It always begin with the 'UDYAM-XX-XX-XXXXXXXHow many days will it take to get a Udyam certificate?

The certificate is normally issued within a few days after the application process is completed and verified.Can I register Udyam without GST?

Yes, provided that your business is not subject to GST registration. When you have a GST liability, then GST is compulsory.How many types of Udyam certificates are there?

A single certificate of registration is available, and that is the Udyam MSME Registration Certificate.Whose PAN card is required for MSME registration?

Under proprietorship: PAN of the owner

In case of partnership firm: Partnership firm PAN

For Company/LLP: PAN of company or LLPIs Udyam registration mandatory for opening a current account?

Not a legal requirement but is compulsory in many banks to have a current account under MSME category or availing MSME loan schemes.Is MSME registration compulsory?

No, it is not mandatory by law but one needs to provide it in order to be able to enjoy MSME benefits provided by the governmentFor whom is Udyam registration required?

It applies to entrepreneurs, startups, manufactures, and service providers who wish to be formally recognized as MSMEs and access financial and policy support.

Get In Touch

Customer Reviews For Udyam Registration (MSME)

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Shruti T

Excellent service, very professional and responsive.

AKASH S

I would definitely use their services again!

NEHA P

I was pleasantly surprised by their efficiency.

Sunil A

I felt valued as a customer. Great experience!

ANJALI N

The team is very knowledgeable and helpful.

SHARMILA S

Amazing service! Quick and hassle-free process.