GST Registration Online

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

GST Registration Online Online - Process, Documents, Benefits, Cost

GST Registration stands for Goods and Services Tax Registration. It was launched on 1 July 2017 and is seen as one of the biggest tax reforms in India. Before the GST, there are various types of taxes. Value Added Tax (VAT), Luxury Tax, Entertainment Tax, Octroi etc are some examples of State Taxes before GST. On the other hand, CST, Excise Duty, Service Tax etc are some examples of Central Taxes before the introduction of GST.

GST was introduced to replace all these types of taxes. It is an Indirect Tax. GST is a Consumption-Based Tax or a Destination Based Tax meaning GST will be levied at the place where the Goods or Services are consumed. For example, if the product or service is produced in State A and it is consumed in State B, then the tax revenue will be levied by State B and not by State A.

It is also a Value Added Tax meaning GST will be levied on every stage of value addition from manufacturing to final sale to the consumer. The entire GST procedure is completely online.

Gst Registration Certificate Sample

GST Registration Online in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get GST

GST Application

Documents Required For GST Registration Online Online

ID Proof

Address Proof

Photo

Registered Office Proof

What You Get

GST Acknowledgement

What is GST Registration?

GST Registration is the process of getting Goods and Services Tax Identification Number (GSTIN) under GST ACT. It is necessary for Businesses and individuals who meet the eligibility criteria to register Itself under GST ACT to follow with tax regulations. GST registration provides Unified Tax Structure, Input Tax Claims and legal compliances.

Table of Contents

- Who is Required to Register for GST?

- Eligibility Criteria and Turnover Limits for GST Registration

- Tax Slabs under GST

- Voluntary GST Registration for Businesses

- Benefits of GST Registration

- Disadvantages of GST Registration

- Checklist for GST Registration

- Time Required for GST Registration

- Documents You’ll Get After GST Registration

- Cost, Fees, or Charges for GST Registration

- Types of GST Registration

- Types of GST Taxes

- Mandatory GST for Specific Businesses

- What is Form GST REG-01?

- Who Should Apply for GST Registration?

- What is GSTIN and Its Significance?

- What is GST Return Filing?

- What is GST Compliance Rating?

- What is a GST Certificate

- Importance of GST Certificate

- Penalties for Non-Compliance

- Consequences of Not Registering for GST

- Common Mistakes to Avoid After GST Registration

- Things That Delay GST Registration

- Get Expert Consultants & CA for GST Registration at LegalFidelity

- Why Choose a CA for GST Registration?

- Our 4-Step CA Process at LegalFidelity

Who is Required to Register for GST?

Those Businesses and Individuals making supply of goods and services must get registered itself under GST, if meet any of the following conditions: –

- Yearly Turnover limit : Businesses exceeding the prescribed turnover limit of aggregate turnover of ₹40 lakh for goods (₹20 lakh for special category states) and ₹20 lakh for services (₹10 lakh for special category states).

- Interstate Supplies: Any Business doing interstate supply of goods and services must register under GST irrespective of Turnover.

- E-commerce Sellers: Businesses selling through e commerce sites such as Amazon, Flipkart or their own website must get register itself under GST.

- Casual Taxable Persons: Person who occasionally undertakes transactions involving supply of goods or services or both in different states and not having fixed place of business must obtain GST registration.

- Non-Resident Taxable Persons: Person who temporarily engaged in transactions involving supply of goods or services or both and not having fixed place of business in India must obtain GST registration.

- Reverse Charge Mechanism (RCM): A Business or Individual liable to pay GST under the reverse charge mechanism have to mandatorily get registered under GST.

- Input Service Distributors: Input Service Distributor is taxpayer under GST who responsible to allocate the input tax credit received to its units or branches having different GSTIN but registered under the same PAN. Tax Deductors (TDS/TCS): GST registration is mandatory for individuals or Entities who requires to deduct TDS / TCS while making payments for specific goods or services or at the point of sale of goods or services to consumers.

Eligibility Criteria and Turnover Limits for GST Registration

| Supplier Type | Normal Category States | Special Category States |

| For Supplier engaged in sale of Goods only | ₹40 lakh | ₹20 lakh |

| For Supplier engaged in Service only | ₹20 lakh | ₹10 lakh |

Tax Slabs under GST

The Goods & Services are divided into 5 tax slabs in GST. These are namely – 0%, 5%, 12%, 18%, 28%. Also, electricity, alcoholic drinks and petroleum & petroleum products do not come under the GST tax regime. Gold has a special tax rate of 3% while making charges are fixed at 8%. Rough precious & semi-precious stones are levied at 0.25% tax rate.r

For further details on tax rates on various products, visit here.

Voluntary GST Registration for Businesses

All Businesses that do not meet the eligibility requirement are not required to register under GST Act. A Individual or Business may choose to get register under GST on voluntarily basis .

Registering under GST, can be a smart step for Startups, small businesses and Online Businesses. It enhance their credibility, market standing and customer base. Following are the Benefits of Voluntary GST Registration for Businesses:

- Ability to Claim ITC and Reducing Tax Liability.

- Increases Business market standing & Client Trustworthiness

- Eligible to get register on E-Commerce platforms like Flipkart, Amazon etc

- Eligibility for Interstate sales of goods & services

- Eliminate the double taxation effect of taxes, promoting fairness and economic growth

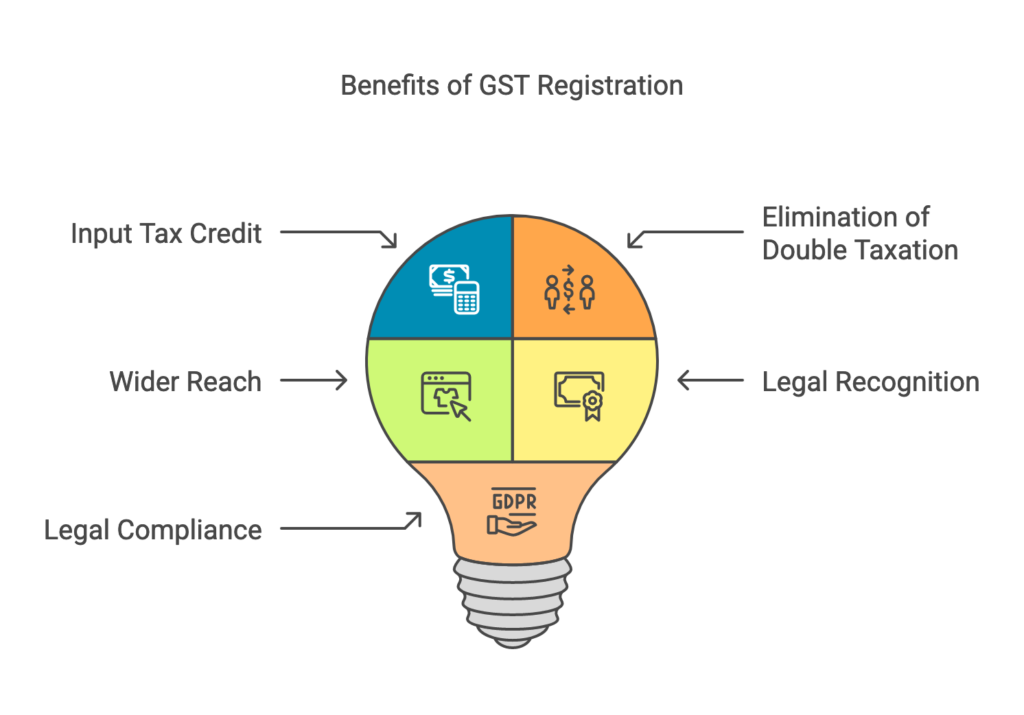

Benefits of GST Registration

- Business Credibility & Growth opportunities: After taking GST. Registration Business gets market acknowledgment and build Trustworthiness. It enables businesses to increase their existence in new areas or markets.

- Tax Savings with Input Tax Credit claims: Business after getting GST registration can claim back the taxes paid. It means business can pay tax after claiming the input tax paid on purchases of goods and services. It reduces overall tax burden.

- Ease of doing Business Across States: GST allows ease in doing interstate business by removing the cascading effect.

- Avoid Legal Complexities: Those businesses follow the GST rules and file their returns on timely basis do not risk fines or legal troubles

- Eligibility for Government Contracts: Many government Tenders have requirements to have GST registration.

- Access to E-commerce Platforms: Many online platforms requires sellers to GST registration to list and trade their products.

Disadvantages of GST Registration

- Increased Compliance Requirement : After taking registration, Business have to file regular GST return filing, tax payments, and audits can be time consuming.

- High operational Cost: To comply with the GST compliance, Businesses needs to hire tax consultants and accountants which increases their expenses.

- Cash Flow issues: Small Businesses need to face cash flow problem. As they must pay GST on their sales in advance, even before receiving payment from customers.

- Penalties for non compliance : If GST registered Businesses, fails to comply with GST compliances. They need to face Penalties and legal consequences

- Complex Filing process : The process of filing GST returns and keeping records of transactions can be difficult task for smaller businesses.

Checklist for GST Registration

Before starting the registration process of GST, must ensure you have following documents:

- PAN card of the business or applicant

- Aadhaar card of the proprietor/partners/directors

- Proof of Business’s legal existence (like partnership deed, incorporation certificate)

- Address proof of the business (electricity bill, rent agreement, etc.)

- Bank account statement or canceled cheque.

- Digital signature Certificate to attest the documents (if applicable)

- Details of Authorized signatory

Time Required for GST Registration

The GST registration process generally takes 7 to 10 working days from the date of application, as long as documents are submitted correctly and verified.

Documents You’ll Get After GST Registration

After successful completion of registration, you will receive:

- Certificate of Registration (Form GST REG-06) – GST certificate is Proof of successful registration. It contains details of GSTIN, Legal Name, Trade Name, and other business information.

- GSTIN (GST Identification Number): A 15-digit unique number for your business given to each business registered under the GST system.

- Login details for GST Portal: After successful registration, you will receive an email containing your GSTIN and a temporary password. To file GST returns and comply with GST compliances.

Cost, Fees, or Charges for GST Registration

- Government Fees: The Government does not charge any fee for GST registration i.e free of Cost

- Professional Fees: Professional such as CA or tax consultant can be hired to provide help with your GST registration, their fees can range from ₹500 to ₹3,000 depending on complexity.

Types of GST Registration

- Regular GST Registration: Every Business whose turnover crosses threshold of total yearly turnover of ₹40 lakh for goods (₹20 lakh for special category states) and ₹20 lakh for services (₹10 lakh for special category states). Taxpayer are needed to pay GST on their sales and can also claim input tax credit paid on their purchases.

- Composition Scheme Registration: It is simplified tax scheme that brings ease for small businesses with a turnover of less than ₹1.5 crore. They can not claim input tax credit. Business registered under this scheme pay a fixed percentage of their turnover as tax.

- Casual Taxable Person Registration: Person who operate Business occasionally involving supply of goods or services or both in different states and not having fixed place of business must obtain GST registration.

- Non-Resident Taxable Person Registration: Business who temporarily involved in transactions related to supply of goods or services or both and not having fixed place of business in India need to comply with Indian tax laws.

- E-commerce & TDS/TCS Registration: Business doing Online selling their goods or services through platforms like Amazon or Flipkart, meesho etc. All the business selling goods or services through online Platform need to get registered under GST for claiming the tax deducted by e-commerce operators.

Types of GST Taxes

- CGST (Central Goods and Services Tax): CGST is imposed by Central Government on supply of goods & services within a same state.

- SGST (State Goods and Services Tax): SGST is imposed by State Government on supply of goods & services within a same state.

- IGST (Integrated Goods and Services Tax): The tax is applied when supply of goods or services are made from one state to other state. IGST is collected by the Central Government. Later shared between the state where the goods or services are consumed and the state where the goods or services are sold.

Mandatory GST for Specific Businesses

Specified businesses must register for GST, Irrespective of Turnover limit:

- Interstate Suppliers: Businesses involved in supply of goods or services from one state to other.

- E-commerce Operators: Business involved supply of goods and services through Online platform like Flipkart or Amazon etc. E-commerce platform are responsible for collecting and paying GST, must also deduct TCS at a specified rate from the payment made to sellers.

- Casual Taxable Persons: Businesses with temporary involved in supply of goods or services or both in different states. These businesses are required to obtain GST registration because they engaged in taxable supplies.

- Non-Resident Taxable Persons: Foreign businesses or individuals making sale of goods or services in India without a permanent establishment here. GST registration is mandatory for them to comply with Indian tax laws when they do business in India.

- Agents and Input Service Distributors: Those Businesses are responsible under GST for distributing input tax credits received to its units having different GSTIN but registered under the same PAN.

- TDS/TCS Deductors : Business that are required to deduct TDS / TCS while making payments for specific goods or services or at the point of sale of goods or services to consumers.

- Online Information & Database Access (OIDAR) Services: These are foreign companies or digital service providers offering online services, such as digital content, software, or cloud-based applications.

What is Form GST REG-01?

Form GST REG-01 is used by businesses and individuals who wish to get Goods and Services Tax Identification Number. Form GST REG-01 is the application form used for GST registration in India. The form is divided into two parts:

- Part A: It contains basic necessary details like PAN of the applicant, Email Id, Mobile Number.

- Part B – This sections contains more business information, such as Business Name, Business Address, Bank Account Details, Supporting Documents such as proof of business address, identity proof, and other necessary documents.

After submission of application form, Application Reference Number (ARN) is generated. It enables the applicant to track the status of their GST registration application.

Who Should Apply for GST Registration?

GST Registration is mandatory for businesses and individuals falling under specific categories to ensure compliance with the Goods and Services Tax law. Following categories must apply for GST registration:

- Businesses with yearly turnover exceeding ₹40 lakh (₹20 lakh for services and special category states).

- Interstate suppliers of goods and services.

- Sellers and operators working on E-commerce Platforms.

- Exporters and importers.

- Casual and Non-resident taxable persons.

- Agents and intermediaries supplying taxable goods/services.

- Companies dealing in reverse charge transactions.

What is GSTIN and Its Significance?

Goods and Services Tax Identification Number is a unique 15-digit identification number given to Businesses registered under GST regime. The significane of GSTIN is as follows:

- Legitimacy – It shows business compliance with GST laws.

- Tax Credits – It is necessary for claiming Input Tax Credit (ITC).

- Interstate Trade – It Enables businesses to do business in different states.

- GST Return Filing – It is necessary for filing tax returns and payments.

What is GST Return Filing?

GST return filing means the process of submitting tax details like sales, purchases, and tax collected to the government as per the GST requirements. Below mentioned are the Important types of GST returns that businesses need to file:

- GSTR-1 : This return is used to provide details of outward supplies of goods and services. It can be filed Monthly or quarterly depending on type of business. the turnover or for Business.

- GSTR-3B: A summary return that includes a summary of all the outward and inward supplies. This return provides details of the taxes payable. Businesses file this return on a monthly basis and use it to pay their GST.

- GSTR-9: GSTR 9 is the annual return for registered Businesses. It gives a complete overview of the business’s transactions over the financial year and is used for reconciliation.

- GSTR-4: Small businesses with a turnover below the threshold limit and registered under Composition Scheme. This scheme simplifies tax filing by offering a fixed rate of tax.

What is GST Compliance Rating?

Government gives rating to the businesses so that other businesses can see how compliant they are with the tax department. It is called GST compliance rating. This rating will be calculated based on guideline such as

- Make sure to file monthly and Annual returns on time

- Furnishing correct details of input credits used

- Accuracy of taxes paid

- Following all the important GST regulations and requirements.

A better GST compliance rating is beneficial for businesses as it improves their trustworthiness. It allows for smoother and quicker processing of their GST obligation.

What is a GST Certificate

A GST Certificate is an official document issued by the government to businesses after they successfully register under the GST laws. This certificate is crucial as it confirms a business’s registration and contains important information, such as:

- GSTIN (Goods and Services Tax Identification Number): y registered business gets a unique identification number under GST.

- Legal Name and Trade Name of the Business

- Type of GST Registration: Type of Registration whether businesses is regular taxpayer or composite scheme.

- Validity Period: It remains valid indefinitely unless taxpayer decides to cancel or surrender or tax authority revoke registration due to compliance reasons.

Importance of GST Certificate

- Legal Requirement: Taking registration is necessary for businesses exceeding the prescribed turnover threshold.

- Claiming Input Tax Credit (ITC): It is necessary to claim Input tax credits on business purchases to reduce overall tax burden.

- Facilitates Interstate Trade: Mandatory for businesses to carry out trade from one state to another.

- Boosts Business Credibility : It increases the trustworthiness of the business among customers, suppliers, and partners.

Penalties for Non-Compliance

Non Compliance of GST rules and regulations attracts penalties including:

- Late Filing Penalty: If you miss filing your regular returns ₹200 per day Late fees. This can increases to 5000/- and ₹20 for NIL returns increases to ₹500/-

- Non-Registration Penalty: If you do not register under GST when required. You will be charged 10% of the tax due or minimum of ₹10,000. If the offender intentionally fails to pay taxes, the penalty is 100% of the tax due.

- Fraudulent Activities: Engaging in fraudulent practices can result in Penalty of 100% of the tax due or Rs. 10,000 whichever is higher. It can also lead to imprisonment.

- Wrong ITC Claims: You will charged Penalty equal to the amount of tax wrongly claimed.

Consequences of Not Registering for GST

- Legal Actions: If you do not register for GST when required. Fines or legal proceedings can be imposed by tax authorities.

- Lost Business Opportunities : Many businesses prefer working with GST registered Businesses.

- No ITC: Without GST registration. You are not able to claim Input Tax Credit paid on purchases leading to increase the costs significantly.

- Restricted Market access: Non registration in GST Law, Restricts ability to engage in interstate transactions.

- Penalty : You may attract penalty of 100% of the tax due or Rs. 10,000 whichever is higher.

Common Mistakes to Avoid After GST Registration

After taking GST registration sometimes many Business makes mistakes. List of Common errors are:

- Use of Incorrect GSTIN : Use of incorrect GSTIN on invoices can lead to penalties.

- Delayed Returns: Failing to submit GST returns on time can lead to huge penalties or even possible cancellation of GST registration.

- Improper ITC Claims: Claiming wrong Input Credit for ineligible expenses or on purchases can attract penalties.

- Failure to Update Business Details: Not updating Changes in business information like business address, email ID, contact number with the GST authorities

- Ignoring Compliance Notices: Failing to respond on timely basis to Tax authorities can lead to serious legal issues.

Things That Delay GST Registration

- Incomplete and incorrect Documentation: Missing essential documents like PAN or address proof.

- Mismatch in Business Information: Mismatch between PAN and Aadhaar details of applicant registration may be delayed or rejected.

- Incorrect Bank Details: Incorrect bank account information or IFSC codes can cause delays.

- OTP Verification Issues: Failure to complete to complete OTP verification process can lead to delays.

- Pending Tax Dues: Any pending tax dues or unresolved tax issues can delay the approval process.

Get Expert Consultants & CA for GST Registration at LegalFidelity

Looking for a Expert Consultant or CA for GST registration? You are in the right place.

At LegalFidelity, our expert and experienced team of Chartered Accountants make the GST registration process simple, hassle free, and fully compliant with GST laws.

It does not matter if you are a small business owner, freelancer, startup, or part of an MSME, LegalFidelity is here to help.

You stay stress free and we will handle everything from start to end from documentation to final approval, so you do not have to worry about errors or delays.

Why Choose a CA for GST Registration?

Getting help from a Chartered Accountant (CA) is a smart choice and ensures your GST registration is:

- CA knows exactly how to fill and file your GST application correctly on the first attempt

- Tax laws keeps changing, so CAs stay updated with the latest tax laws to ensure your GST registration is always filed correctly with the laws

- Every business is different from each another. Our CA will understand your work and guide you with best advice that suits your business type.

- We will provide support after post-registration such as GST return, updates and query whenever you need.

At LegalFidelity, you get immediate end-to-end personal support from a dedicated CA. Without any middlemen, Just expert care for your GST requirement.

Our 4-Step CA Process at LegalFidelity

Step 1: Free Expert Consultation

Talk to our GST specialist CA, who will understand your business type and advice accordingly on your eligibility and document requirements.

Step 2: Document Collection & Review

Upload the documents as advice with security of upload documents. Our team verifies everything to make sure it’s correct

Step 3: GST Application Filing by CA

A qualified Chartered Accountant fills out and files your GST application properly on your behalf.

Step 4: Get ARN & GSTIN Updates

Once the application filed, you will receive your ARN within 24 hours. We keep you updated regularly until you get your GSTIN

Faqs about GST Registration Online

What is GST Registration?

GST Registration stands for Goods and Services Tax Registration. It was launched on 1 July 2017 via the 122nd Amendment of the Constitution of India.

How do I apply for a GST Registration in India?

We, at LegalFidelity, can help you get your business registered under the GST and avail those benefits. The process is entirely online.

Will I get a physical copy of the GST Certificate?

No, only a soft copy of the certificate is issued by the Government.Is Aadhaar mandatory for GST Registration online?

Yes, from 1 January 2020, the GST Network has decided to make Aadhaar authentication or physical verification mandatory for new GST Registration.Who is required to register under GST?

For a business, annual turnover of which exceeds Rs. 40 lacs(Rs. 10 Lacs for Himachal Pradesh, Jammu & Kashmir, North-Eastern States and Uttrakhand), then GST Registration is mandatory.Is GST Registration compulsory?

For businesses with the Annual turnover below Rs. 40 lacs(Rs. 10 Lacs for Himachal Pradesh, Jammu & Kashmir, North-Eastern States and Uttrakhand), the GST Registration is optional. While for others with the Annual turnover exceeding Rs. 40 lacs, the GST Registration is mandatory.

Additionally, for the following businesses, GST Registration is mandatory:

- Input Service Distributors (ISDs)

- Agents of any supplier

- Businesses under the reverse charge mechanism

- E-commerce Aggregators

- Businesses selling via E-commerce Aggregators

What is the validity period of the GST Registration Certificate?

For regular businesses, GST Registration Certificate does not have an expiry date. It is valid until it is cancelled or surrendered.Is GST registration free?

There are many steps in GST registration, including document verification, business type and details and compliance checks. Although it may appear simple, mistakes can cause delay or rejections. To prevent any issues, LegalFidelity provides offers expert-guided GST registration, ensuring a seamless and error free experience.How do I apply for a GST number?

Applying for a GST registration, businesses needs various documents, choosing the right GST category and satisfying compliance requirements. At LegalFidelity, we specialize in providing end-to-end GST registration services, from document preparation to application submission, ensuring accurate and timely results.What is the GST income limit?

Businesses exceeding the prescribed turnover limit of aggregate turnover of ₹40 lakh for goods (₹20 lakh for special category states) and ₹20 lakh for services (₹10 lakh for special category states).

Can I apply for GST without a business?

No, GST registration is good for businesses only. However, individuals can register as proprietors if they involved in taxable business transactions.Who is not eligible for GST?

Business Entity that do not exceeds the turnover threshold limit, making supplies of exempted goods or services, or operate as salaried individuals are not eligible for GST registration.What is the minimum turnover for GST?

Businesses exceeding the specified turnover limit of total turnover of ₹40 lakh for goods (₹20 lakh for special category states) and ₹20 lakh for services (₹10 lakh for special category states).

Can a normal person apply for GST?

A normal person can apply for GST registration if they run a business or provide taxable services. Salaried individuals do not need to get GST registration.What is the fee for GST?

The cost of GST registration depends on factors like business type, level of professional expertise and assistance required. LegalFidelity provides affordable and transparent pricing for GST registration. We make it easy for businesses to register without any complications and delay.What is the ₹40 lakh limit in GST?

The ₹40 lakh limit refers to the yearly turnover limit for GST registration for businesses making supply of goods only (₹20 lakh for businesses providing service only ).Who is mandatory for GST?

Businesses engaged in inter-state trade, e-commerce sellers, export-import businesses, and those crossing the turnover limit must register for GST.Is GST required for small businesses?

Yes, if small business’s the turnover crosses the prescribed limit or dealing in inter-state supplies, small businesses need to register for GST.What are the benefits of GST?

GST eliminates cascading effect, single tax regime , simplifies compliance, allows to claim input tax credit, and promotes ease of doing business.Who has to pay GST?

Businesses registered under GST are responsible for collecting and paying GST on taxable goods and services. Consumers pay GST as part of the price of the product.Can I sell on Amazon without GST?

No, sellers on Amazon India, Flipkart etc. must have a GST registration, except if they sell exempted categories like books or unregistered handicrafts.Can I get GST without a shop?

Yes, individuals can register under GST even without a physical shop as long as they provide taxable goods or services online or offline.How much does GST cost?

The expense on GST registration include compliance of rules and regulations, and filling of regular return. Instead of struggling with the difficulties alone, businesses can put their trust on LegalFidelity for expert GST services at competitive rates.Can I register GST myself?

While it is possible to complete GST registration on your own. Sometimes incorrect or mismatch in details of documents can lead to delays or sometimes rejections. LegalFidelity’s professional ensure a smooth registration process, saving you time and effort.Who requires a GST number?

Any business exceeding the turnover threshold, making inter-state supplies of goods and services , or operating through e-commerce needs a GST number.What is the CA fee for GST registration?

Chartered Accountants and professionals may charge different fees for GST registration and compliance services. LegalFidelity provides expert guidance for GST registration at an affordable price. We ensures businesses comply with all legal requirements without any hidden costs.What is the minimum amount for GST registration?

The minimum turnover threshold required for GST registration is ₹40 lakh for goods and ₹20 lakh for services (₹20 lakh and ₹10 lakh for special category states).How to calculate GST?

GST is calculated using the following formula:

GST Amount = (Original Price X GST Rate) / 100

For example, if a product costs ₹1,000 and GST is 18%, the GST amount is ₹180. So, the total price including GST would be:

Total Price = ₹1,000 + ₹180 = ₹1,180 .Is a GST certificate free?

To Get GST certificate, It includes submitting the correct documentation and following to tax law. LegalFidelity simplifies the process by taking care of all the necessary steps, keeping in view that businesses receive their GST certificate without any delays or complications.Can a salaried person apply for GST?

No, salaried individuals do not require GST registration unless they run a business or provide taxable supply of goods or services separately.How do I start a GST business?

Foremost step to start a registered business you need to have business plan, proper documentation, and GST registration.Who needs to file for GST?

All businesses registered under GST must file GST returns either on monthly, quarterly, or annually depending on their category.Who will pay GST?

Registered businesses are responsible to collect GST from consumers and paying it to the government. Ultimately, the consumer bears the cost of the GST included in the product or service price.How much turnover is required for GST?

To satisfy the requirement for GST registration, a business must have a turnover exceeding ₹40 lakh for goods and ₹20 lakh for services (₹20 lakh and ₹10 lakh for special category states).Who applies for GST registration?

Business owners, entrepreneurs, and professionals involved in taxable goods or services must register itself under GST.How does GST work?

GST is a multi-stage, destination-based tax that is applied at each stage of the supply chain. Busineinput tax credits input tax credits to set off the tax paid on their purchases from tax collect on sales.

Do I need a Chartered Accountant to register for GST?

It is not mandatory by law, choosing to get advice from qualified and experienced CAs will be a great idea. At LegalFidelity, we ensure your application is filed correctly and avoids future legal complications.How much does it cost to get GST registration through a CA?

At LegalFidelity, our GST Registration packages are starting from just Rs. 1499 with end to end support from our qualified CAsCan I talk to a CA before registering?

Yes of course! At Legal Fidelity we provide a free consultation with our in-house Chartered Accountants. We ensure hassle free registration process with no hidden charges.

Get In Touch

Customer Reviews For GST Registration Online

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Vikram S

I felt valued as a customer. Great experience!

Akash A

Handled my queries with patience and professionalism.

Shruti T

Amazing service! Quick and hassle-free process.

NEHA P

Extremely reliable and trustworthy service provider.

AKASH S

One of the best service providers I have come across!

NIDHI C

Their commitment to quality is commendable.