Limited Liability Partnership (LLP)

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Limited Liability Partnership (LLP) Online - Process, Documents, Benefits, Cost

A Limited Liability Partnership (LLP) is a popular business structure in India. LLP includes features of both a Partnership Firm as well as Private Limited Company. The Limited Liability Partnership (LLP) Act 2008 , Introduced to protect the partners from Unlimited Liability and provide flexibility of Partnership and legal Identity to the business.

Therefore, LLP gives limited liability protection to partners with the benefits of traditional Partnership. LLP as a business structure is suitable for Professionals, startups, and small businesses chooses LLP as an attractive business structure due to their simple formation process, less compliance burden, and tax benefits .

llp registration certificate sample

Limited Liability Partnership (LLP) in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Incorporation

incorporated

Documents Required For Limited Liability Partnership (LLP) Online

ID Proof

Address Proof

Photo

Registered Office Proof

What You Get

Expert consultation on LLP eligibility and name selection

Preparation of documents

Guidance on obtaining DPIN and DSC for partners

Assistance with LLP Agreement preparation

Updates on registration progress

Assistance with registration certificate

Ongoing compliance support

Support for PAN, TAN, and GST

What is a Limited Liability Partnership or LLP?

Table of Contents

- Eligibility Criteria: Minimum Requirements for LLP Registration

- Key Features of Limited Liability Partnership (LLP)

- Multiple Benefits or Advantages of Getting Registered as LLP

- Disadvantages of LLP Registration

- Important Points to consider before Choosing the Name of a LLP

- Documents required for LLP registration

- Checklist or Step By Step Process on How To Register a LLP In India?

- Simple and Effortless LLP Registration Process with LegalFidelity

- Sole Proprietorship vs Limited Liability Partnership (LLP) vs Private Limited Company

- Different Types of LLP Forms used in India

- Time Required of completion of the LLP Registration process

- MCA Compliance after LLP Incorporation

- Fees, Cost & Charges involved in registration process of LLP

- What you will get after Incorporation of LLP

- Factors that delay the registration process

- Taxation aspect of LLP

Limited Liability Partnership (LLP) includes benefits of both Traditional Partnership as well as Private Limited company. In an LLP, Partner enjoys limited liability protection, just like shareholders in the company and simplicity as Partnership. LLP also enjoys benefits like easy incorporation, lesser compliance requirements, Tax benefits and Separate legal Entity.

Limited Liability Partnership (LLP) Act 2008, regulates the Limited Liability Partnership or LLP. Mostly Professionals, startups, and small businesses prefer LLP as an attractive business structure. If LLP incurs losses, its feature of limited liability provides security to personal assets of the partners.

Eligibility Criteria: Minimum Requirements for LLP Registration

- Minimum two Designated Partners & No Maximum Limit on number of Partner:

To Establish the Business needs minimum two designated Partners but it does not have any restriction on upper limit on numbers of Partners. - One Indian Resident Partner: Atleast One Partner in LLP must be an Indian Resident as per the Companies Act 2013.

- Digital Signature Certificate: Every Designated partners are required to get itself Digital Signature to sign the electronic documents related to LLP.

- Registered Office Address: LLP can establish its Registered office either in commercial or Residential premises but it must be situated in India.

- Directors Identification Number (DIN): Requirement of DIN registration and obtaining 8 digit unique is mandatory for every Designated Partner from Ministry of Corporate affairs (MCA).

- No need of minimum Capital: The formation of LLP demands no minimum capital to form LLP.

Your Completion of LLP eligibility requirements, enables you to go ahead with the registration process without facing any delays or rejections from the Registrar of Companies (ROC). It is important comply with the name guidelines of LLP, to avoid the rejection during the registration process of LLP

Key Features of Limited Liability Partnership (LLP)

LLP includes features of both a Partnership as well as Private Limited Company. Key Features are listed below:

- Separate Legal Identity before law: The law consider LLP as a separate legal entity from its partners, allowing it to enter into contracts, own assets and sue or be sued.

- Limited Liability of Partners: Partner are only liable for their contribution in LLP, it means, there personal assets are not at risk.

- No need of minimum Capital for LLP: To get registered as LLP, there is no Minimum capital requirement.

- Ease of Management through LLP Agreement: LLP provides liberty to Partners through LLP Agreement by deciding mutually their terms of operation, profit sharing and responsibilities.

- Perpetual Succession: LLP enjoys its existence indefinitely regardless of whether one or more partner dies, retires, leave or declared insolvent. The continuity of LLP does not get affect by change in its Partners.

- Fewer legal Requirements: Private Limited Company has many compliance requirements. But LLP has less rules and regulation to follow. This means less paper work and less to worry about.

- Transfer of Ownership: In Private limited company, ownership can be transferred by mere transfer of shares by one person to another. LLP do not raise capital by issuing shares. By doing changes in the LLP agreement, LLP can transfer the ownership rights.

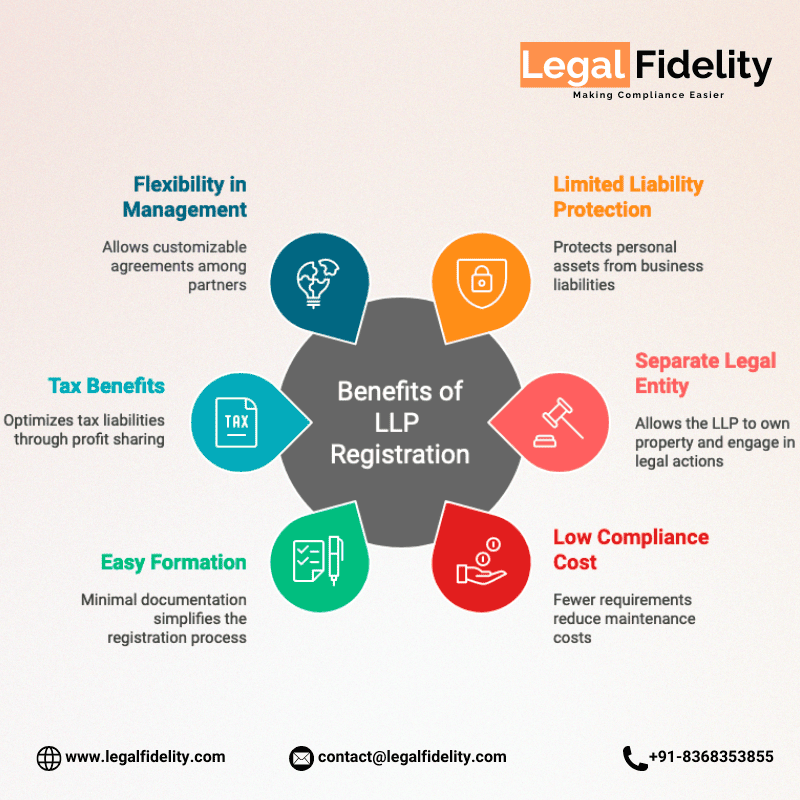

Multiple Benefits or Advantages of Getting Registered as LLP

The various benefits of LLP Registration are as follows:

- Personal Assets of the Partner not at risk: One of the major benefit of LLP is that Partners are only liable for their own agreed contribution . Partners get benefited from Limited liability protection against financial risks that arises due to the Business losses.

- Economical & Time efficient: Basic Benefit of Picking up LLP as Business structure is an economic and time efficient for small businesses. Registration of LLP can takes place with smaller capital requirement and less paper work as compared to Private limited.

- LLP enjoys Tax exemption & Tax benefits: LLP’s profit is taxable in hands of LLP and not in hands of Partners. Additionally Partners in LLP allowed to get their share of profits without paying DDT.

- Minimum Two & Maximum Unlimited Partners: There is no restriction on the upper limit of the partners in the LLP. Large professional firms, legal consultancy firms, and joint ventures needed multiple stakeholders so they can get itself registered as LLP.

- LLP Provides Flexibility in Management: LLP agreements is customized by partners by mutually deciding their operational roles & responsibility, profit-sharing ratios, and other key agreements. It gives a great control and ease in making decision.

- Lesser Compliance requirements: The compliance requirement of LLP is lower as compared to Private Limited. The Basic tax filings along with annual reports maintain smooth running of operations.

Disadvantages of LLP Registration

Before selecting the LLP as business structure, every entrepreneur must understand the advantages and disadvantage:

- Access to Limited Funding opportunities: LLP does not allowed to raise funds from the investors by selling their shares as Private Limited company do so. This restriction makes it challenging for emerging businesses when they try to raise fund from Investors.

- Fewer Legal Requirements: Every LLP or Company should follow Legal rules & regulations that MCA has issued. However LLP have fewer compliances to comply with. The Basic tax filings along with annual reports maintain smooth running of operations, non compliance can attract penalty.

- Complexity in Transferring ownership: Company transfer ownership by selling shares by one person to another. LLP is restricted to raise capital by selling shares. By doing changes in the LLP agreement, LLP can transfer the ownership rights.

- Higher Tax Burden in certain case: LLPs are taxed at a 30% rate irrespective of the turnover. Sometimes LLPs have to pay higher tax as compared to Private limited. As LLP cannot claim the corporate tax deductions that other business structures can utilize

Important Points to consider before Choosing the Name of a LLP

The guidelines regarding the LLP name has been issued by Ministry of Corporate Affairs (MCA). Name of of the LLP should be unique and relevant to your business. Every entrepreneur must ensure MCA compliance while deciding the name and it is also aiding in Brand identity and trustworthiness. Choosing appropriate name for your LLP is most crucial step in the registration process.

- Name of LLP must be not different from any other existing company or LLP to prevent possible legal problems.

- MCA rules prevents usage of particulars words which are inappropriate for being used in the business name.

- Every LLP name should end with “Limited Liability Partnership” or “LLP” to specify the business structure identification.

- Name should indicate the the nature of your business and be catchy to remember.

- Ensure name of new LLP should not match with the existing Registered trademark

- Avoid names which creates false impression about the relationship with Government or any misleading association.

Documents required for LLP registration

For Partners:

- Pan card is the mandatory document, which all partners need to provide for registration

- It is an Legal requirement for every partner that they must have Aadhar card as an identity proof.

- In case of foreign nationals or NRIs, Copy of Passport is compulsory requirement.

- The documents for Address proof include Driving License, Utility Bill, Bank Statement.

- Every partners need to provide its Passport sized photograph for Identity verification,

For Registered Office:

- In case of Rented office, then Rent Agreement is required.

- No Objection Certificate (NOC) is required from the property owner if office is rented or leased.

- Ownership proof is needed if property is owned by one of the partner.

- Utility Bill like water or Electricity bill required to verify the office address.

Checklist or Step By Step Process on How To Register a LLP In India?

Step 1: Obtain a Digital Signature Certificate (DSC)

First step for all the designated partners is to get yourself a Digital signature certificate, as all the fillings with the MCA are done electronically. DSC is electronic key and legally valid to certify the documents submitted to MCA. It can be bought from certified agencies such as eMudhra, Sify, or NSDL.

Step 2: Obtain Director Identification Number (DIN)

Every individual intending to become designated partners in an LLP, need to apply for a DIN through the MCA portal. DIN is an unique 8-digit identification number. It is mandatory requirement and valid for Lifetime unless deactivated.

Step 3: Choose a Unique and Catchy name for LLP

Application through RUN LLP (Reserve Unique Name – LLP) required to submitted for Name reservation on MCA. Once the name has been approved. It will valid for 20 days within which incorporation must be complete.

Step 4: Fill the required “FiLLiP” form for LLP incorporation

The incorporation of the LLP can be done through the Fillip Form available on the MCA. All the Details related to the LLP, designated partners, and registered office address is required to filled in the form. Supporting documents like DIN, Pan Card, Aadhar Card for all partners and name reservation approvals, proof of registered office, must be attached.

Step 5: LLP Agreement Drafting

LLP agreement specify the rights, duties, and responsibilities of the partners. It must be drafted and Filled within 30 days of Incorporation. It also includes information like capital contribution, profit-sharing ratios, and dispute resolution mechanisms.

Step 6: Certificate of Incorporation of LLP

MCA issues Certificate of Incorporation, once the LLP Fillip form gets approved. Certificate of Incorporation signifies the LLP’s legal existence. Certificate contains date of Incorporation, Name of LLP and details of registered address and unique LLPIN ,which provide a unique identity to LLP.

Step 7: Permanent Account Number (PAN) & Tax Deduction and Collection Account Number (TAN)

After Incorporation, you must apply for the PAN & TAN for taxation purpose. It is mandatory to have Pan card for Bank account opening and ensuring tax compliances.

Simple and Effortless LLP Registration Process with LegalFidelity

LegalFidelity provides you the Effortless LLP registration process through their professional expertise of many years along with expert guidance to handle yours needs with ease. We provide complete package of services from document preparation, name approval obtaining DIN and DSC , and end-to-end support. Our Expert Team ensure the hassle free and smooth registration process by satisfying all MCA requirements, reducing the chances of rejection.

Key Reasons to choose Legalfidelity:

- Complete Support from beginning to end such as document collection and preparation to filing with MCA.

- Expert guidance on choosing the suitable business structure to start the business.

- Ensuring quick LLP registration process with minimal paperwork.

- Our Affordable pricing ensures Transparent and competitive service fees.

Sole Proprietorship vs Limited Liability Partnership (LLP) vs Private Limited Company

It is necessary to understand the key differences before choosing the appropriate Business structure. Let us understand by comparative analysis:

| Feature | Proprietorship | LLP | Private Limited Company |

|---|---|---|---|

| Liability | Unlimited | Limited | Limited |

| Registration Requirement | Not mandatory | Mandatory | Mandatory |

| Compliance | Low | Moderate | High |

| Tax Benefits | Individual tax rate | 30% + surcharge | 25% + surcharge |

| Ownership | Single owner | Minimum 2 partners | Minimum 2 shareholders |

| Decision-making | Sole proprietor | Shared among partners | Board of directors |

| Credibility & Growth | Low | Medium | High |

| External Funding | Not available | Limited | Easily available |

Different Types of LLP Forms used in India

Different LLP form are required for different compliance and operational purposes. List of the LLP forms mentioned below:

- FiLLiP – Used for LLP incorporation.

- Form 3 – Required to submit details of the LLP Agreement.

- Form 8 – Each year all the LLPs required to submit the Statement of Account and Solvency in Form8.

- Form 11 – Every LLP should file Annual return of LLP, annually.

- Form 24 – If LLP gets dissolved then Application in Form 24 will be filed for LLP closure.

- Form 4 – Any Change in Partner, like appointment, cessation, or change in designation of partners filled in form 4.

- Form 15 – Details of Change of registered office address filled in form 15.

- Form 23 – Application for seeking MCA approval for specific LLP activities.

Time Required of completion of the LLP Registration process

Time it takes to complete the registration process depends upon various factors like , name approval, document preparation, processing of DSC & DIN and the Ministry of Corporate Affairs (MCA) processing time.

Ideally it takes 10 to 15 working days to complete the process if everything goes smoothly and there are no issues or delays in collecting the documents and details. Below mentioned is the estimated time required for each step:-

- Digital Signature Certificate (DSC): It will take 1-2 days for getting DSC. This is necessary for all the partners to get itself a DSC to sign the e- LLP documents.

- Director Identification Number (DIN): It takes 1 day to get the unique identification number for each partner who will be a designated partner in LLP.

- Name Approval: It will take 2 to 4 days for getting name approve from MCA. Name should not resemble with any other existing company or LLP to avoid legal dispute

- Filing LLP Incorporation Form (FiLLiP): After getting name approval, FiLLiP form is required to be filled to get the LLP officially registered. This step requires 5 to7 days.

- LLP Agreement Drafting & Filing: Now, LLP Agreement needs to be file with MCA, It will take 3 to 5 days. LLP Agreement mentions the detailed roles, responsibilities, and profit-sharing of the partners in the LLP.

Keep in mind that Timeline of processing of LLP registration, can be affected by any discrepancy in documents or details provided. If all your documents and details filled correctly and everything goes smoothly, the whole process should get completed quickly!

MCA Compliance after LLP Incorporation

Once an LLP gets successfully registered, it must comply to various MCA compliance requirements to keep LLP legally active. Below mentioned are compliance requirements after incorporation:

1) Form 11 Annual Return Filling

An LLP needs to file Form 11 on May 30th each year on the MCA annually. This form provides information about the number of partners and changes made during the year.

2) Form 8 for Statement of Accounts & Solvency

LLPs must maintain complete financial records and submit Form 8 with details of assets, liabilities, and solvency status on October 30th each year.

3) Return of Income Tax ( ITR Filing)

An LLP must file its annual Income Tax Return to the Income Tax Department

- The due date for LLPs that do not need audits falls on July 31st.

- With audit requirement, the due date extends to September 30th.

4) Other Regulatory Filings

- GST Registration & Filing (if applicable): The requirement under GST applies to all LLPs which need to submit monthly or quarterly GST returns upon registration under GST.

- TDS Filing (if applicable): LLPs must submit TDS returns through TDS Filing whenever they act as tax deducting agencies (corporations).

5) Event Based Filings

Organizations need to use Form 3 & Form 4 for disclosing all modifications that occur within their LLP structure including partner additions and removals.

Fees, Cost & Charges involved in registration process of LLP

The expenses for an LLP registration in India depends on various factors. For example, government fees, professional service costs, stamp duty taxes etc. We, at LegalFidelity, provide cheapest LLP Registration package. From document preparation, name approval obtaining DIN and DSC , and end-to-end support. Our Expert Team ensure the hassle free and smooth registration process by satisfying all MCA requirements, reducing the chances of rejection.

What you will get after Incorporation of LLP

After completion of registration process, you will get the following documents:

- Certificate of Incorporation – It is issued by the MCA, after successful completion of Registration process. It includes details of LLP Name, unique LLPIN, Registered office address and Pan No. of LLP.

- LLP Identification Number (LLPIN) – It is an unique identification number of the LLP. It gives legal Identity to LLP, assigned by MCA.

- DSC & DIN for Partners – You will get the DIN & DSC which is mandatory requirement for LLP registration. It is required to submit and sign the electronic documents of LLP.

- LLP Agreement – LLP Agreement is the key document describing the roles and responsibilities of Partner and taxation purpose.

- PAN & TAN for LLP – It is mandatory requirement to have the Pan Card of LLP for account opening in the name of LLP.

- GST Registration Certificate (if applicable) – GST registration certificate, if LLP gets registered under GST

Factors that delay the registration process

Key factors associated with the delay in the registration process, mentioned below:

1. Incomplete or Mismatched details in the documents:

- Mismatch in name of partners mentioned in Pan card and address proof.

- Incorrect details in DSC or DIN application.

2. Delays in MCA Processing

- High volume of applications processing on MCA Portal leading to backlog.

- If Additional documents and details requested by the MCA

3. Issue in Name Approval

- Sometimes Name of the LLP, resembles or identical to the name which is already taken.

- If selected name is not comply with MCA name guidelines

4. Payment or Technical Issues

- Sometimes due to Technical Errors may occur during government fee payments.

- MCA portal downtime or server issues

5. Non-Availability of Partners for DSC & DIN Verification

- Sometime it is quite difficult to take partner signatures, which cause delay in filling.

- Errors or Mismatched in Aadhaar or PAN details used for DSC application.

For hassle free registration process and prevent complications, companies should avoid these abovementioned issues.

Taxation aspect of LLP

Taxation rules of Limited Liability Partnership (LLP) are same as Traditional Partnership Firms. It means that profit is taxed in hands of LLP, not in hands of Partners.

1. Income Tax Rate

Tax Liability lies on LLP as it is charged at rate of flat 30% on net profit. Additionally the LLP is required to pay 12.5% surcharge if total income exceeds Rs. 1 crore and 4% Health and education cess.

2. Alternate Minimum Tax (AMT)

LLP is liable to pay Alternate Minimum Tax is 18.5% of adjusted total income.

3. Dividend Distribution Tax (DDT) Exemption

LLPs are exempted from paying Dividend Distribution Tax (DDT) when sharing profits to partners unlike private limited companies.

4. Tax Deducted at Source (TDS)

TDS will be deduct while doing payments like salary, professional fees, rent, and contractor payments etc. as per IT Rules by LLP.

5. Goods and Services Tax (GST)

- Business engaged in supply of goods whose yearly turnover exceeds Rs 40 lakhs and in service whose turnover exceeds Rs. 20 Lakhs in a financial year.

- Under GST Rules, Monthly (GSTR-1, GSTR-3B) or quarterly returns will be filed under composite or QRMP scheme.

6. Tax Benefits & Deductions

LLPs can avail tax deductions on:

- Depreciation on business assets: Deduction of Depreciation on business assets like buildings, Plant & machinery, and equipment is available for LLPs.

- Expenses related to business operations: Deductions can be claimed for operating expenses related to business like rent, salaries, utilities, and other operating expenses.

- Interest paid to partners on capital contributions

- Expenses on Research and Development: The deduction of upto 150% of their R&D expenses can claim be claimed if LLP involved in research and development activities under Rules of IT.

LLP should keep proper track of accounting records and timely filing of tax returns. LLPs can grab tax savings benefits and ensure smooth compliance.

Faqs about Limited Liability Partnership (LLP)

How many partners are required for the incorporation of an LLP?

A minimum of 2 partners are required to form an LLP as per the LLP Act, 2008. No maximum limit for the number of partners in the LLPCan an NRI/Foreign National become a partner in LLP?

Yes, an NRI or Foreign National can be a partner in the LLP. The only requirement is that at least one Designated Partner should be a resident of IndiaDoes one have to be physically present during the incorporation of the LLP?

No, at LegalFidelity.com, the LLP registration process in completely online. You just need to send scanned copies of all the documents required for the incorporation.Can I register an LLP at my residence?

Yes, you can register an LLP at your residence. You only need to submit any utility bill along with the No Objection Certificate (NOC)Can the LLP be converted to a Pvt. Ltd. Company?

Yes, the LLP can be converted to a Private Limited Company.

Is it possible to convert a Partnership Firm to an LLP?

Yes, the conversion of a Partnership Firm to an LLP is possible.Can I be a Partner if I am already employed?

Yes, one can be a partner in an LLP, Director of a Private Limited Company or OPC even if he is already employed. There are no such restrictions. However, you must ensure that your employment agreement does not contain any restrictions for you to become a Director of any company or a Partner in an LLP.

Is FDI allowed in an LLP?

Yes, FDI or Foreign Direct Investment is allowed.Can a Pvt. Ltd. Company be converted to other legal entities?

Yes, the Pvt. Ltd. Company can be converted to other legal entities such as Public Limited Company, One Person Company (OPC) or the Limited Liability Partnership (LLP). But it cannot be converted to a Partnership or a Sole Proprietorship

How long does it take to register LLP in India?

To get registered as LLP, it will take 7 to 15 working days depending upon the timeline how fast the documents are completed, verified and approved by MCA.Can a single person register the LLP?

No, LLP must have minimum two designated partners to process the registration as LLP and there is no maximum limit on how many partners an LLP can have

Is LLP a good choice for Startups?

Yes, LLP is a go to option for service-based startups and small businesses due to their fewer compliance requirement, economical in cost and limited liability protection .

What is the minimum capital requirement for LLP?

Any startup or Entrepreneur can get registered as LLP , as there is no minimum capital requirement mentioned in the rules. Business can get registered as LLP with any amount.

What are the tax benefits of an LLP?

LLPs are not required to pay Dividend Distribution Tax (DDT), when the LLP distributes profits to its partners. LLP has lower tax burden compared to private companies.

Is an LLP required to file annual returns?

Yes, Every LLPs must income tax returns annually with the MCA and income tax returns i.e Annual Return.

Can LLP be converted into Private Limited Company?

Yes, The conversion of LLP into a private limited company can be done by following the rules & regulations provided by MCA. The approval of conversion is provided by MCA and ROC.

What happens if LLP compliance is not followed?

If LLP fails to comply with the MCA guidelines then penalty starting from Rs. 100 per day can be levied. Legal Action or Dissolution of LLP can be ordered by the MCA.

Can LLPs raise funding from investors?

No, LLP do not allowed to raise equity funding from the investors as they do not issue share, Like Private Limited companies.Can an LLP own property?

Yes, As LLP is a legal entity separate from its partners. It can buy or sell the Assets, land, and property in its name.What is the validity of an LLP once registered?

Once LLP gets Successfully registered, LLP has perpetual succession. It means continues to exits even if one or more partner dies, retires, leave or declared insolvent. So, the continuity of LLP does not get affect by change in its Partners.

Is an LLP required to get a GST registration?

GST is required once the LLP exceeds the threshold limit. LLPs engaged in supply of goods whose yearly turnover exceeds Rs 40 lakhs (₹20 lakh for special category states) and in service whose turnover exceeds Rs. 20 Lakhs (₹10 lakh for special category states), in a financial year.

What is the difference between an LLP and a traditional partnership firm?

Unlike a traditional partnership firms, LLP provides limited liability protection to its partners and has a separate legal identity from its Partners.

Who are eligible for LLP?

Any individual, company, or foreign entity or NRIs can become a partner in an LLP. Law mandates that, LLP must have at least one designated partner which must be an Indian resident.How much does an LLP cost?

The cost of LLP registration depends on various factors: professional fees and government charges the number of partners and state of incorporation.Is GST required for LLP?

Yes, you have to register the LLP under GST Act, If your overall turnover exceeded ₹40 lakhs in regular category states and ₹20 lakhs in special category states, in case of goods.How to register LLP?

There are 5 important Steps in LLP registration process:

- Getting DSC & DIN for Designated Partners of the LLP

- Reservation and approval of the name of LLP from MCA.

- Preparation of Necessary Documents and Drafting of LLP agreement to submit with MCA.

- Submission of the Fillip form for incorporation of LLP with MCA.

- After getting approval of LLP, MCA will provide the certificate of Incorporation and you can apply for PAN & TAN for LLP.

What is DPIN (Designated Partner Identification Number)?

MCA will grants the DPIN (Designated Partner Identification Number)to individuals who wants to take position as designated partners in an LLP. The Unique identification number consist of 8- digit with lifetime validity unless deactivated.What is LLP registration?

LLP registration means a legal process of Incorporating the Limited Liability Partnership under the Limited Liability Partnership Act, 2008 in India.Which is better: LLP or Private Limited Company?

Choice of business structure as LLP or Private Limited company, depends on the business model and future expansion plans.

- LLP is suitable for small businesses and professional firms due to lower compliance costs.

- A Private Limited Company is better for startups looking for funding and has better scalability.

How to start an LLP?

The registration process of LLP is completely Online. All you need to do is to share the document online. We will process the application starting from Name approval, DSC, DIN to end to end support. Regular follow-ups will be done by our experts.How to be a Partner in an LLP?

The designated Partner must be a natural person who is above 18 years of age and sound mind. Even the NRIs, Foreign nationals including Foreign Companies can incorporate an LLP in India, having at least one designated partner as Indian resident.Who pays the debts of an LLP?

The LLP, being a separate legal entity before law is responsible for its own debts. The personal assets of the partners remain secured unless they have given personal guarantees.What are the limitations of LLP?

- LLPs cannot raise equity capital from investors, as they do not have share capital like Private Limited.

- Higher penalties for non-compliance (₹100 per day) which continues until the filing is completed.

- LLPs are not suitable for the businesses or Startups focusing on high-growth and seeking venture capital and scalability.

Get In Touch

Customer Reviews For Limited Liability Partnership (LLP)

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

NIDHI C

Extremely reliable and trustworthy service provider.

AKASH S

I would definitely use their services again!

Anjali K

Trustworthy and dependable. I’m really happy with them!

ANJALI N

Amazing service! Quick and hassle-free process.

BHAVYA R

Highly skilled team delivering quality service.

Tanya K

Seamless experience! Would recommend to everyone.