Partnership Firm Registration

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Partnership Firm Registration Online - Process, Documents, Benefits, Cost

Nowadays Partnership firm Registration is one of the most common business structure in India. Choosing Partnership firms as business structure have many advantages to new startups, like flexibility, ease of incorporation, and minimal compliance requirements. If you are planning to register your Business as partnership firm in India. It is important to focus on key points such as understanding the registration process, legal factors, advantages, and disadvantages is crucial.

Here, You will find all crucial information about Partnership firm registration in India such as details explaining process, eligibility requirements and legal aspects and fees and documents required .

Partnership Firm Registration Agreement Sample

Partnership Firm Registration in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Partnership

legally recognized.

Documents Required For Partnership Firm Registration Online

ID Proof

Address Proof

Photo

Registered Office Proof

What You Get

Partnership Deed

Partnership PAN

Partnership TAN

What is a Partnership Firm?

Table of Contents

Indian Partnership Act, 1932 regulates all the partnership firms in India. This business structure is usually used by small and medium enterprises due to its simplicity and low regulatory requirements. A Partnership firm is a business entity incorporated by two or more individuals who agree to share profits, losses, and responsibilities as per the terms decided in a Partnership Deed.

Definition and Meaning

A partnership firm is defined as:

“An association of two or more persons who agree to share the profits of a business carried on by all or any of them acting for all.”

This means that all partners collectively manages the firm’s operations, risks, and profits & losses according to their agreed-upon proportions

Features of a Partnership Firm

- Two or more Partners : To legally incorporate the Partnership firm it requires minimum two partners

- Collective Responsibility: Partners Jointly manages the firm’s responsibility.

- Agreed Profit & Loss Sharing : The firm’s profits and losses are divided among partners as per terms decided in the Partnership Deed.

- Unlimited Liability: Every Partner is Personally liable to repay the firm’s debt.

- No Separate Legal Entity: In the eye of law, Partnership firm is not recognized as separate legal Entity, like business companies.

Law Governing Partnership Firm Registration in India

The Indian Partnership Act, 1932

The Indian Partnership Act, 1932 regulates and defines laws relating to the partnership firms in India:

- The rights, duties, and responsibilities of partners.

- Rules related to registration and dissolution of a partnership firm.

- Agreed Terms in the partnership agreement, related to profit sharing, liabilities, and dispute resolution.

Legal Standing of a Registered vs. Unregistered Firm

Registered Partnership Firm

- Registered Firm is Legally recognized by authorities.

- It holds a capability to file a legal court case to protect its legal rights

- Eligible to avail the benefits from government schemes and financial assistance.

Unregistered Partnership Firm

- Third Party cannot be sued by unregistered firms in case of disputes.

- Unregistered Firm may face issues in obtaining loans.

- Unregistered firms have Limited legal protections, in case of dispute resolution or liability

Registration of Partnership Firm is not mandatory by the Law, though it is recommended to Serious Business Entrepreneurs to get the Partnership Firm registered as registration provides legal protection and other advantages.

Importance of Registering a Partnership Firm

Partnership firm can operate without registration, though registering the Partnership Firm offers several benefits:

- Legal Recognition: A registered partnership firm recognized as a legal entity with the ability to enter into contracts, own property, and engage in legal actions and remedy if case of any breach in terms of agreement. Registered Firm is legally recognized as a separate entity which boosts its credibility and trustworthiness among clients, vendors etc.

- Right to Sue Third Parties: A registered partnership firm can file a court case against the Third Parties like customer, creditors or other business in case of dispute. Firm holds capability to file a legal court case to protect its legal rights.

- Claiming Set-Off in Legal Cases: If Registered firm is sued, it has the right to submit a counterclaim (set-off) in the same legal proceeding. If a firm owed money or has claims against the plaintiff, it can raise them in court, which is not possible in case of an unregistered Firm.

- Easier Access to Loans & Government Benefits: Registered firm can benefit from for multiple government schemes, subsidies, and Tax benefits, particularly for Micro, Small, and Medium Enterprises (MSMEs). Also registered firms finds it easier to get loans from Banks and financial institutions because registration shows more structured and transparent legal framework.

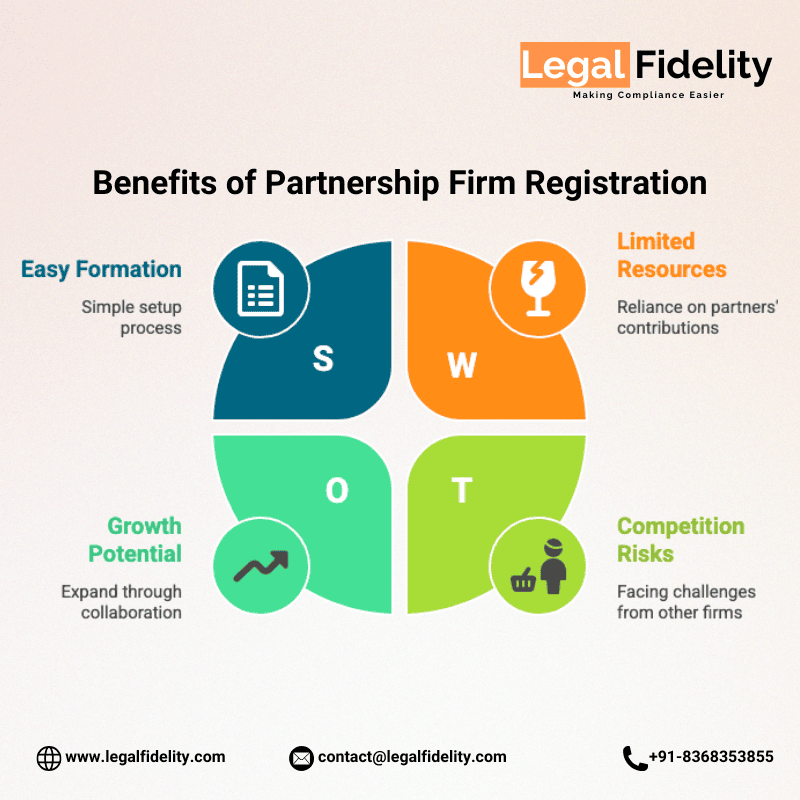

Advantages of a Partnership Firm in India

Many entrepreneurs choose a partnership firm as business structure because it offers a straightforward approach to starting and managing a business. Here are some key benefits:

1. Easy to Incorporate

- Setting up a partnership firm is easy and does not need much paperwork or legal processes. There are no complex legal formalities.

- You need to get prepared a partnership deed that describes the agreement between partners and a PAN registration for the firm.

2. Fewer Legal Compliance Requirements

- Unlike companies, a partnership firm does not require an audit unless its turnover exceeds ₹1 crore in a Financial year.

- Partnership firm required to comply with Fewer Tax rules are simpler as compared to companies, making it easier to manage the finance and operations.

3. Quick Decision-Making

- In Partnership firm there is no need to hold the board meetings or shareholder approvals to make decisions, here Partners can make decisions quickly.

- Partners have Flexibility in management and operations as per agreed terms in partnership deed, without too many formalities

4. Profit & Loss Sharing

- Partners share the profits and losses of the firm according to the agreed Profit sharing ratio in the Partnership Deed.

- Responsibilities are shared among the partners, it encourages accountability and contribution among partners.

Disadvantages of a Partnership Firm in India

Even with multiple benefits, a partnership firm also has some limitations listed below:

1. Unlimited Liability

- In a Partnership firm, If the business fails or incur losses, Personal assets of the Partners may be used to pay off the debts.

- It means Partners are personally liable for the business’s debts.

2. No Perpetual Succession

- The business will be discontinued, if a partner dies, retires, or leaves the partnership firm.

- Due to uncertainty in Business existences it can be challenging for the business to make plan for the long term.

3. Limited Resources

- The availability of financial resources for the business depends on what the partners put in.

- It can be difficult to expand the business as compared to private limited companies

4. Difficulty in Raising Funds

- Raising loans or Investments from banks or investors is quite difficult for partnership firms,

- Banks or Investors generally prefer registered companies. As you know Partnerships can not sell shares to raise money either.

Eligibility Criteria for Partnership Firm Registration in India

Before starting the registration process of a partnership firm, must ensure you meet the eligibility criteria:

1. Minimum & Maximum Number of Partners

- A partnership must have at least two partners to start the business as Partnership firm.

- The upper limit of number of partners is 50, according to the Companies Act, 2013.

2. Age and Legal Requirements

- All partners must at least attained the age of 18 years (Major).

- Partners must be legally capable of entering into a contract as per the Indian Contract Act, 1872.

3. Indian Citizens and Foreign Nationals

- A partnership firm can be easily formed by partners who are Indian citizens.

- Foreign nationals, including Non-Resident Indians and foreign companies, can also become partners, after complying with certain rules under the Foreign Exchange Management Act (FEMA).

Documents Required for Partnership Firm Registration

To register a partnership firm in India, you need to submit certain documents to prove the identity of partners, business address, and firm details. Below is a list of the required documents:

1. Identity Proof of All Partners (PAN, Aadhaar)

- PAN Card of all partners (needed for tax purposes).

- Other documents can be submitted as identity proof such as Aadhaar Card, Voter ID, or Passport.

2. Address Proof of Registered office (Electricity Bill, Rent Agreement)

- Utility bill like Electricity, Water Bill or Gas Bill can be provided as a proof of the registered office.

- If registered office is rented, Rent Agreement & No Objection Certificate (NOC) from the landlord are needed.

3. Partnership Deed

Partnership deed is the legally written document that outlines the terms of the partnership, like profit sharing ratio, roles and responsibility and Capital contribution etc., must be signed and notarized by all partners.

4. Additional Documents for Online Registration

- Digital Signature Certificate (DSC) for online submission of form.

- GST Registration Certificate (if applicable).

- Shops & Establishment Act registration (for businesses with a physical location).

What is a Partnership Deed?

A Partnership Deed is a legally wriiten agreement between two or more individuals who intend to conduct the business togther that specifies how the business will operate, how decisions will be made, and how the roles and responsibilities shares and Profit & loss will be shared.

Partnership Deed helps to ensure that every partner is on the same page and can avoid disputes in the future for smooth running of the business.

Definition & Purpose

A Partnership Deed is a written contract between partners in a partnership business. It describes the following Terms of Partnership:

- Business Operations: It outlines the day-to-day activities of firm and processes a business uses to increase the value of the enterprise and earn a profit.

- Rights and Responsibilities of Partners: It defines role, responsibilities, and obligations of each partner in the business to prevent disputes and ensure smooth business operations.

- Financial Aspects: How profits or losses generated from business will be shared, how much each partner will contribute to the capital, and how withdrawals from the business can be made.

Key Elements of a Partnership Deed

General Details

- The Name of the Partnership Firm

- Name and Addresses of all Partners

- Business Address where the partnership is registered.

- Details of Nature of the Partnership Firm

Specific Details

- How the Profit and Losses will be divided among partners.

- Capital contribution by each partner through money, assset or property to start the business.

- This inculdes Salaries, commissions, and other benefits may be received for services in the business.

- It describes the Process for admission, resignation, or removal of partners from Partnership Firm.

- It specifies how any Dispute among partners will be resolved.

A Partnership Deed is a legal document which clearly outlines the role, responsibilities and Profit sharing ratio, of each partner making business management smoother and prevents disputes.

Checklist for Partnership Firm Registration in India

To get registered as Partnership firm ensuring a smooth registration process, follow this step-by step checklist:

- Choose a unique name for the partnership firm.

- Draft and notarize the Partnership Deed.

- Obtain PAN & TAN for tax compliance.

- Prepare identity & address proof of partners.

- Get a Digital Signature Certificate (DSC) (for online registration).

- File the Partnership Firm Registration application with the respective State Registrar of Firms.

- Receive the Registration Certificate and start business operations.

Online Partnership Firm Registration Process in India

Here’s a simplified and easy-to-understand process for registering a partnership firm in India

Step 1: Selecting a Unique Name for the Partnership Firm

- Choose a name that is not similar to others and not already in use as company name or TradeMark.

- Do not use names that mislead or sound similar to existing businesses.

Step 2: Drafting the Partnership Deed

- Important step is to Draft a Partnership Deed. It is advisable to get the agreement drafted by legal professional, outlining the roles, responsibility and Profit sharing ratio of all partners.

- It must be signed by all partners and notarized on stamp paper.

Step 3: Obtain a Digital Signature Certificate (DSC)

- For Online Filling of Forms, Partners need DSC for digital signatures.

- If needed, Apply for a Class 2 or Class 3 DSC from a certified agency.

Step 4: Apply for PAN and TAN

- Make an application for a Permanent Account Number (PAN) for your firm from the Income Tax Department

- If needed, register for Tax Deduction & Collection Account Number (TAN).

Step 5: Filing the Application for Registration

We will file your application for partnership firm registration.

Step 6: Verification and Issuance of Certificate

- The Registrar of Firms will verify your all the documents submitted with Application Form.

- If all requirements and Documents are correct and verified, the Certificate of Registration is issued.

Once Registration Certificate issued by the Authority, your firm is legally registered, and you can start business operations!

Time Required for Partnership Firm Registration in India

The time required to register a partnership firm in India depends on several factors:

- Online vs. Offline Process: Online registration takes 7–10 days, while offline Tradtional method involves submitting the partnership deed and required documents to the Registrar of Firms may take 2–3 weeks.

- Processing Time of Application : Some states process applications faster than others.

- Document Verification: If all documents are accurate and verfied, you will get approval faster.

Generally, partnership firm registration in India is completed within 10–15 business days.

Partnership Firm Registration Fees in India

Government Fees:

- The official registration fee is different depending on the state but generally ranges from ₹500 to ₹2,000.

Additional Costs:

- Stamp Duty: Stamp duty charges depend on Capital Contribution of minimum Rs. 500 to 5,000.

- Notarization Charges: Notary Charges for Partnership deed range between Rs. 200 to 1,000.

- Legal/Professional Fees: Cost of Hiring Professionals will amount to Rs. 2,000 to 10,000.

The total cost of partnership firm registration in India typically falls between Rs. 5,000 and Rs.15,000, depending on legal and professional assistance.

Compliance after Partnership Firm Registration

After successful registration of your partnership firm, it is important to follow various Tax and Legal Laws, and financial obligations. So that Firm remains compliant and in good market standing. Below are the primary compliance requirements:

Tax and Legal Obligations

1. PAN & TAN Registration

- A partnership firm needs a Permanent Account Number (PAN)

- If Partnership firm are liable to deduct or collect tax at source, a Tax Deduction & Collection Account Number (TAN) is mandatory.

2. GST Registration

- Required if annual turnover exceeds ₹40 lakhs (₹20 lakhs for service businesses).

- A Lower threshold limit will apply if annual turnover exceeds ₹20 lakhs (₹10 lakhs for service businesses), for special category states

3. Income Tax Return Filing

- The firm has to file an ITR annually, irrespective of taxable income is generated or not by the Firm

4. TDS Compliance

- Firm must file TDS return quarterly, if the firm deducts TDS on salaries or vendor payments.

Annual Filing & Audit Requirements

- Financial Statements Preparation & Filling: Firms should maintain proper accounts must prepare profit & loss statements and balance sheets.

- Tax Audit (if applicable): Tax Audit is mandatory if a firm’s turnover exceeds ₹1 crore for businesses or Rs.50 lakhs for professionals.

- GST Returns Filing: Filling of Monthly/quarterly GST returns are depends on the firm’s turnover and registration type.

- Renewal of Licenses: If the firm has additional licenses, such as Shops & Establishment Registration, timely renewal may be required.

Keeping these compliances up to date, It ensures smooth business operations and avoids legal penalties.

Partnership Firm vs. Proprietorship vs. LLP vs. Company

Before starting your own business, it is important to choose the right legal structure.

| Feature | Partnership Firm | Sole Proprietorship | LLP (Limited Liability Partnership) | Private Limited Company |

|---|---|---|---|---|

| Legal Identity | Not separate from partners | Not separate from owner | Separate legal entity | Separate legal entity |

| Liability | Unlimited liability | Unlimited liability | Limited liability | Limited liability |

| Members | Minimum 2 Partners | Single owner | At least 2 partners | Minimum 2 directors |

| Requirements | Lower Compliance | Minimum Compliance | Moderate Compliance | High Compliance |

| Registration Requirement | Voluntary but recommended | Voluntary but recommended | Mandatory | Mandatory |

| Suitable For | Small traders or businesses with multiple owners | Individuals & single-owner businesses | New startups & professional firms | High-growth businesses & investors |

Why to Choose LegalFidelity for Your Partnership Firm Registration?

At LegalFidelity, we simplify and makes the process of Partnership Firm Registration hassle free by taking care of all the legal formalities. Here are the key points, why we are the best choice for you:

Benefits of using LegalFidelity for Partnership Firm Registration

- End-to-End Guidance and Support: Our expert will provide complete services and support from documentation, drafting the Partnership Deed to obtaining the necessary approvals for registration.

- Affordable Pricing: We offers Transparent pricing structure so that your firm registered at competitive prices with no hidden costs.

- Expert Legal Guidance: Our expert legal team will assist on each and every step. We ensure your business is fully compliant with Indian laws.

- Quick Processing: We ensure seamless and speedy process, so that you will receive the registration certificate as soon as possible.

- Post-Registration assistance: After successful completion of registration process, we continue to serve you with our services like GST registration, tax filing, and ongoing legal compliance requirements.

Faqs about Partnership Firm Registration

What is a Partnership Registration?

A Partnership is an agreement between two or more persons to manage and operate a business and to share the profits of a business according to the Terms and Conditions set forth in the Partnership Deed. The business can be carried out together by all the partners or any one partner representing the others.Who should set up a Partnership Firm?

For small businesses, Partnership Firm Registration online is the right choice as it requires minimal compliance. Low cost and minimal compliance make online Partnership Firm Registration a suitable choice.Who is an Active Partner?

An active partner also known as a managing partner is a partner in the partnership who is actively involved in the daily operations of the partnership. The active partner also participates in the management meetings and discusses business reviews and action plan of the Partnership Firm with other partners for the period in consideration.Who is a Sleeping Partner?

A sleeping partner also known as a dormant partner is a partner who infuses capital in the business and shares profit & loss as per the partnership agreement. However, he/she is neither involved in the business activities of the partnership nor attends the management meetings of the firm.What are the annual compliance for maintaining a Partnership Firm ?

The annual compliance for a Partnership Firm are : • Partnership Firm’s GST Return Filing (if applicable) • Each Partner’s individual Income Tax ReturnHow is a partnership firm registered?

Registration process of partnership firm, includes below mentioned steps:

- Name must be unique and not resembles to any existing business or registered trademark.

- Draft a Partnership Deed which outlines the roles, and responsibilities and profit-sharing of the Partners.

- Online filing of application form for firm registration requires Digital Signature Certificate.

- Necessary to obtain the PAN of the Fim and TAN for tax compliance.

- File the application with the Registrar of Firms.

- Pay the required stamp duty according to the capital contribution and registration fee.

- Registrar of the firm after due verification will issue the Certificate of Registration once verified.

What is the minimum capital for a partnership firm?

There is no minimum capital requirement to start a partnership firm in India.How do I register a private partnership?

A private partnership is registered like any other partnership firm by drafting a Partnership Deed and submitting it to the Registrar of Firms with necessary documents and fees.What is the tax rate for partnership firms?

Tax rate for Partnership firms in India is Flat 30% on total income, plus:

- Surcharge of 12% levied, if income exceeds Rs. 1 crore.

- Health & Education Cess of 4% is added to the total tax payable.

What documents are required for partnership firm registration?

- Identity Proof: PAN and Aadhaar of partners.

- Address Proof: Address Proof can be following like Utility bill, rent agreement, or ownership proof.

- Partnership Deed: It must be stamped and signed by all partner, notarized agreement.

- Firm Address Proof: Electricity bill or lease agreement of firm's address.

Can husband and wife be partners in a partnership firm?

Yes, a husband and wife can be partners in a partnership firm. However, their relationship does not provide any tax benefits unless they are running separate business operations.Is notary compulsory for a partnership deed?

It is not legally mandatory to notarize the agreement but highly recommended for legal validity. Some states may require registration with the sub-registrar instead.What is the registration fee for a partnership firm?

The registration fee varies depending on the state but generally ranges from Rs. 500 to Rs. 5,000.What is the maximum number of partners in a partnership firm?

A partnership firm can have a maximum of 50 partners.Is GST registration mandatory for partnership firms?

GST registration is mandatory if turnover exceeds ₹40 lakhs (₹20 lakhs for service providers) or if the firm engaged in interstate supplies of goods and services.What is the difference between an LLP and a partnership firm?

Feature Partnership Firm LLP (Limited Liability Partnership) Legal Validity No separate legal identity from partners Separate legal entity Liability Unlimited liability of Partners Limited liability of Partners Registration Requirement Voluntary Mandatory Compliance Lower compliance requirement Moderate compliances What is the GST registration fee for partnership firms?

There is no government fee for GST registration, but professional service charges may apply.How to convert a proprietorship to a partnership?

- Draft a new Partnership Deed including details of new partners.

- Must apply for the PAN for the new partnership firm.

- Transfer business assets from proprietorship to partnership.

- Licenses such as GST registration, and bank accounts.

Who cannot be a partner in a partnership firm?

- Minors (except as beneficiaries).

- Insolvent persons.

- Persons disqualified by law.

What is the stamp duty for a partnership firm?

Stamp duty is ₹500 to ₹5,000, depending on capital contribution.What is Form 2 in a partnership firm?

If any changes made in a partnership firm’s details, then Firm must noitify such changes in the Form 2 such as a new partner, address change, or firm dissolution.What is the time limit for registering a partnership firm?

There is no strict deadline, but it is advisable to register within one year of starting the business.Who signs the partnership registration form?

All partners must sign the registration form, or an authorized partner can sign on behalf of all.How much stamp duty is required for a partnership deed?

The stamp duty depends and varies state by state but is typically 1% of the capital contribution made by partners, subject to a minimum of Rs. 500 and a maximum of Rs.5,000.What is the CST registration fee for partnership firms?

CST (Central Sales Tax) is no longer applicable after the introduction of GST in 2017.What happens if a partnership firm is not registered?

An unregistered firm cannot sue in court for business disputes, and partners cannot enforce rights legally. However, it can still operate as a business entity.What are the three elements of a partnership?

- Agreement between two or more persons

- Profit-sharing

- Business carried on by all or any one on behalf of others

How many people can be in a partnership?

A partnership firm can have 2 to 50 partnersWho can be a partner in a firm?

Any individual, company, or LLP can be a partner, except those legally barred.Who is a secret partner?

A secret partner means who invests in a firm but does not publicly reveal their involvement. They still share the profits and losses of the Firm.What are the rights of a partner?

- Right to take part in business decisions

- Right to share profits and to be indemnified by the firm for expenses incurred and liabilities incurred in the course of business operations.

- Right to inspect books of accounts of the firm

- A partner can retire from the firm by giving notice and obtaining consent of all other partners

What are the advantages of a partnership firm?

- Easy to form with minimal documentation - Registration of Partnership firm requires minimal documentation and legal formalities.

- Fewer compliance requirements - Fewer regulations compared to LLPs and companies which lower the cost.

- More financial resources - Firms can raise the finance through contribute capital from partners.

- Shared responsibilities among Partners - Responsibility of business decision and risks are divided among partners.

Get In Touch

Customer Reviews For Partnership Firm Registration

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Vikram S

One of the best service providers I have come across!

POOJA M

Excellent service, very professional and responsive.

NIDHI C

I was impressed by the speed and accuracy of their work.

AKASH S

Very professional and transparent in their dealings.

Riya S

A stress-free experience from start to finish.

ANJALI N

Affordable pricing with top-notch service quality!