Gumasta License Registration

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Gumasta License Registration Online - Process, Documents, Benefits, Cost

If you want to begin any type of business in Maharashtra, whether this is a shop, office, restaurant, or service center then you must have a Gumasta License Registration.

The Gumasta License is an informal term used to refer to the Shop and Establishment License in Maharashtra, which is issued under the Maharashtra Shops and Establishments (Regulation of Employment and Service Conditions) Act, 2017. It is also known as BMC Registration by many people as it is provided by the Municipal Corporation Greater Maharashtra (MCGM/BMC).

The Gumasta or Commercial Establishment License is a license needed almost in all kinds of businesses, such as:

- Retail Store for clothing, grocery and electronics, etc.

- Wholesale traders

- Commercial offices like IT companies, consultancy, startups, agencies

- Restaurants, cafes, and eateries

- Service providers like repair shops, coaching classes, salons, clinics, etc.

Gumasta License Certificate Sample

Gumasta License Registration in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Gumasta License

Documents Required for Gumasta License Registration

ID Proof of the Applicant

Address Proof of Establishment

Photograph

Business Proof

Employee Details (where relevant)

The additional licenses in act as required

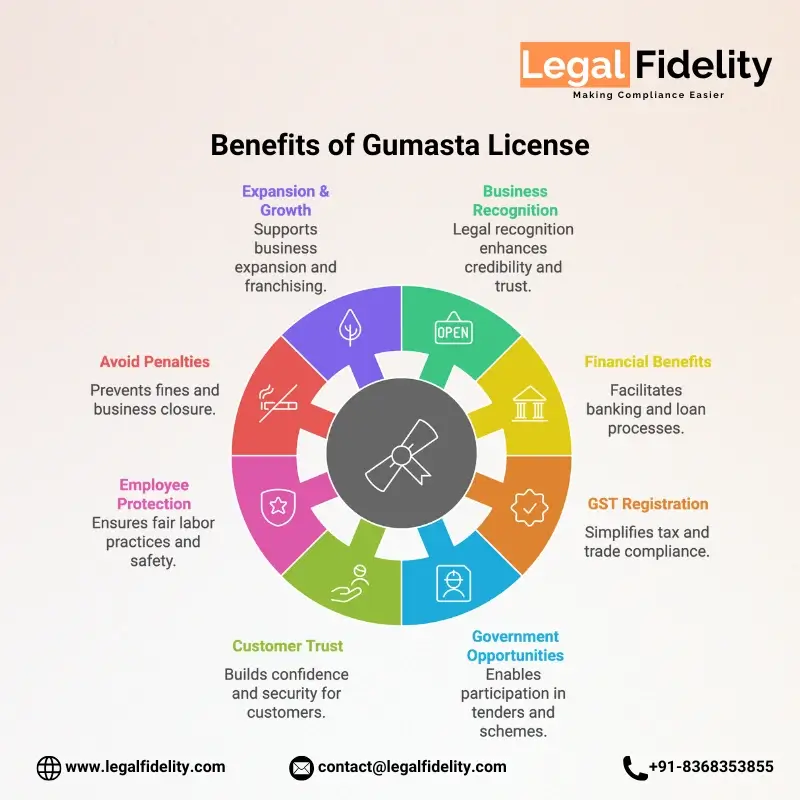

Benefits of Gumasta License Registration

Business recognition

Banking and financial benefits

GST & other registrations

Government tenders & schemes

Customer & investor trust

Employee protection

Avoid penalties

Expansion & growth

What You Get

Gumasta Acknowledgement

What is a Gumasta License?

Table of Contents

- What is a Gumasta License?

- Why is the Gumasta License Registration Necessary in Maharashtra?

- Who Needs a Gumasta License?

- Benefits of Gumasta License

- Eligibility to Obtain Gumasta Registration in Maharashtra

- Documents required for Gumasta License Registration in Maharashtra

- Step-by-Step Process on How to Register for Gumasta License in Maharashtra

- Validity of Gumasta License

- Renewal Process for Gumasta License

- Fees and Charges for Gumasta License in Maharashtra

- Penalty for Non Compliance of Gumasta License

- What is the Difference between Udyam Registration and Gumasta License

- Gumasta License vs Shop and Establishment License

- Why Choose LegalFidelity for Gumasta License in Maharashtra

- Conclusion

If you want to begin any type of business in Maharashtra, whether this is a shop, office, restaurant, or service center then you must have a Gumasta License.

The Gumasta License is an informal term used to refer to the Shop and Establishment License in Maharashtra, which is issued under the Maharashtra Shops and Establishments (Regulation of Employment and Service Conditions) Act, 2017. It is also known as BMC Registration by many people as it is provided by the Municipal Corporation Greater Maharashtra (MCGM/BMC).

The Gumasta or Commercial Establishment License is a license needed almost in all kinds of businesses, such as:

- Retail Store for clothing, grocery and electronics, etc.

- Wholesale traders

- Commercial offices like IT companies, consultancy, startups, agencies

- Restaurants, cafes, and eateries

- Service providers like repair shops, coaching classes, salons, clinics, etc.

What is a Gumasta License?

The Shop and Establishment License is also called the Gumasta License locally within Maharashtra. Gumasta Certificate is basically a certificate that proves your business is registered with the Municipal Corporation of Greater Maharashtra (BMC/MCGM).

This license is mandatory in accordance with the Maharashtra Shops and Establishments Act, 2017, and without it, your business is illegal.

The Gumasta License is useful in many situations like:

- The bank opening of a current account

- Making an application for government registrations like GST

- Useful in obtaining approvals, tenders or contracts with companies and government bodies

Why is the Gumasta License Registration Necessary in Maharashtra?

The purpose of Gumasta License is:

- It is a statutory requirement to initiate or carry any kind of commercial activity in Maharashtra.

- It allows the government to monitor businesses and make sure that employers are adhering to the regulations.

- It also becomes the evidence of the legal existence of your business.

Obtaining a Gumasta certification is not only following rules, it also helps make your business more credible and trustworthy to the banks, customers, and government authorities.

Who Needs a Gumasta License?

If you want to begin any type of business in Maharashtra, whether this is a shop, office, restaurant, or service center then you must have a Gumasta License.

Here are some examples of who requires Gumasta License:

- Gumasta License for Shop: All the retailing shops such as clothing stores, grocery shops, stationery items, electronics shops, medical stores and the wholesale shops.

- Gumasta License for Office: Corporate offices, professional service firms, consultants, lawyers, accountants, IT companies, marketing agencies, startups.

- Restaurants, Cafés & Hotels: Food establishments such as restaurants, cafes, bakeries, catering services, and hotels.

- Educational Institutions: The coaching classes, training institutions, private schools and tuition classes.

- Small Businesses & Startups

- Online Businesses with Premises: Online business or an e-commerce business having an office, shop or warehouse in Maharashtra.

- Freelancers Gumasta License: Freelancers or home based business owners employing staff or assistants.

Benefits of Gumasta License

The key advantages of a Gumasta license are:

- Business recognition: The Gumasta License provides legal recognition to your shop, office or entity. It shows that your business is registered and legally compliant.

- Banking and financial benefits: It is used to open a current bank account in the name of your business and is also useful during the time of taking business loans.

- GST & other registrations: A Gumasta Certificate is usually required to register under GST and other trade licenses and other government approvals.

- Government tenders & schemes: When a business has a Gumasta License, it may apply government tenders, subsidies, and benefits under programs such as MSME and Startup India.

- Customer & investor trust: Legal recognition enhances credibility. By registering the business, customers feel more secure doing business with the business and investors get the sense of professionalism in the business.

- Employee protection act license: The license is listed under the Maharashtra Shops and Establishments Act, 2017. Therefore there will be good wages, regulated working hours, holidays and safe work environments.

- Avoid penalties: Without a Gumasta License, there can be severe fines or even closure by the BMC. Having it makes you legal trouble free.

- Expansion & growth: As a legally recognized registered business, expansion or starting up of new branches or into franchising becomes easily achievable.

Eligibility to Obtain Gumasta Registration in Maharashtra

The Gumasta License Eligibility Rules in Maharashtra are as follows:

- No minimum business size requirement: You have to apply even if you are a small proprietorship, home based business or startup.

- Compulsory regardless of the number of employees: Whether you have employees or not, it is obligatory provided you are operating a commercial premise.

- New as well as established businesses: Both are required to comply or otherwise they will be penalized.

Documents required for Gumasta License Registration in Maharashtra

When you apply for a Gumasta Certificate, some documents must be presented to confirm your identity, your business establishment and business activity. According to the Maharashtra Shops and Establishments Act 2017, the following is the list of Gumasta documents:

- Name Proof of the Applicant: Any one of the following is acceptable such as Aadhaar Card, PAN Card, Passport or Voter ID.

- Address Proof of Establishment: Submit the copy according to the type of place whether it is owned or rented, latest Electricity Bill, Rent Agreement in case of rented property, and Property Tax Receipt in case of owned property.

- Photograph: Passport size picture of the owner of the business or the applicant.

- Business Proof:

- PAN Card of the business or the owner is necessary in all cases

- Certificate of Incorporation of Private Limited Company or LLP

- Partnership Deed for Partnership Firms

- Sole proprietorship Declaration

- Employee Details (where relevant):

- Employee names

- Number of employees altogether

- Nature and kind of work performed by the employees

- The additional licenses in act as required:

- Restaurants, cafes, hotels, or food businesses are required to hold a FSSAI License

- GST Registration of the business that are liable under GST law

- Other relevant registrations such as MSME, Professional Tax, etc.

Step-by-Step Process on How to Register for Gumasta License in Maharashtra

In practical situations, minor mistakes during form filling or uploading documents may lead to unwarranted delays or even refusal.

This is why a lot of business owners choose expert help over DIY filing. LegalFidelity makes everything easy and stress-free. We do the documentation, filing, and follow ups accurately. Our experts also ensure an error-free, and hassle-free process, so you concentrate on running your business and leave compliance to the experts.

Validity of Gumasta License

Gumasta License in Maharashtra is issued for a specified period based on the fees you pay during application. Generally, its duration can be 1 year to 5 years.

Renewal Process for Gumasta License

Once the Gumasta License validity expires, you must renew Gumasta License in Maharashtra in order to make sure that your business is within the legal framework. The renewal is easily done on the MCGM (BMC) portal.

- Renewal Period: You are to make sure that before the expiry date you have renewed otherwise you will be penalized.

- Non-Renewal Consequences: In case of failure to renew the Gumasta, the license can be subject to fines, late charges, or even cancellation by the BMC.

All business owners must monitor their Gumasta renewal term to avoid any legal complications and run their business without any difficulties.

Fees and Charges for Gumasta License in Maharashtra

Not every business will pay the same price of obtaining a Gumasta License in Maharashtra. The BMC license fee structure is determined depending on some few factors such as:

- Number of employees in your shop or establishment

- Type of business activity (shop, office, restaurant, service, etc.)

Also, the professional fees for Gumasta License Application Filing varies depending on the complexity of the application.

Penalty for Non Compliance of Gumasta License

It is illegal to carry on business in Maharashtra without a Gumasta license or the Maharashtra Shops and Establishment Act. These cases are considered serious by the BMC and non-compliance can lead to:

- Fines: The monetary fines are heavy and based on the type of business and length of violating the compliances.

- Shop Closure: Your shop, office or establishment can be given closure orders until the license is acquired.

- Legal action: Ongoing activities without registration may become the target of legal actions and trials.

- Renewal delays: You will be charged late fees and penalties in cases where you do not renew your Gumasta license on time.

- Permanent Suspension: Repeated violations can even lead to a permanent license suspension, as well as the exclusion of business.

In short, not complying with your own shop act license may cost you far more than merely applying or renewing in time.

What is the Difference between Udyam Registration and Gumasta License

Gumasta vs Udyam Registration is the confusion that most business owners in Maharashtra have. Even though they are both necessary, they are applied to different purposes:

| Gumasta License (Shop Act License) | Udyam Registration (MSME Registration) |

|---|---|

| A state-level compliance under the Maharashtra Shops & Establishments Act. | A registration offered by the central government for Micro, Small, and Medium Enterprises (MSMEs). |

| Granted by the Municipal Corporation of Greater Maharashtra (BMC). | Provides official recognition as an MSME. |

| Primarily regulates working circumstances, employees rights, remuneration, and legality of business. | Provides several benefits, such as tax benefits, government subsidies, low interest-rate loans, and favor in government bids. |

| An essential requirement to be able to run a shop, office, restaurant and other establishments in Maharashtra. | Not linked to the working conditions of the employees but targeted business growth and support. |

Gumasta would ensure your business is legally registered in Maharashtra and Udyam would help your business to access MSME benefits nationally. Depending on your type of business, Gumasta and MSME registration can be complementary to each other.

Gumasta License vs Shop and Establishment License

Many people wonder about Gumasta vs Shop Act License. The truth is, they are essentially the same thing.

The term “Gumasta” is the local name commonly used in Maharashtra, but the official legal name is Shop and Establishment License under the Maharashtra Shops and Establishments Act, 2017.

All the businesses which have commercial premises such as shops, offices, restaurants and service centers are required to do it. The license ensures that your business operates legally, complies with employee regulations, and meets the standards set by the Shop and Establishment Act Maharashtra.

Gumasta is simply the word used by people in Maharashtra to denote a shop license which is the same registration under the eyes of the law.

This license is essential in order to operate any commercial organization without fines or legal complications.

Why Choose LegalFidelity for Gumasta License in Maharashtra

The choice of partners is an important process in terms of getting your Gumasta License in Maharashtra. LegalFidelity has positioned itself as one of the best Gumasta License agencies in Maharashtra which clients have confidence in regardless of whether they are startups, small companies or even established companies.

This is why businesses choose LegalFidelity for Gumasta License:

- Expert professionals: Our team is knowledgeable in BMC processes and makes sure that your application is taken up correctly and efficiently.

- Clear pricing: We are honest and transparent, and we do not have any hidden costs or unexpected fees.

- Quick turnaround: We make sure that your license is promptly processed with the dedicated assistance without any unnecessary delays.

- Trusted by many: Businesses in Maharashtra depend on us as their shop license consultant in Maharashtra.

- Services to every business type: Whether you are a startup, a small store owner, or a manager at a large company, we serve all of your needs.

By using LegalFidelity services, you will save time and effort, and you will feel confident knowing that your Gumasta License application is safely managed.

Conclusion

Gumasta License in Maharashtra is not merely a formality, but a legal requirement of any business. The license not only assures compliance to the shop acts in Maharashtra, but also protects the welfare of the employees, and brings credibility to the shop with its clients, banks and the government.

A valid Gumasta License is required whether you are opening a bank account, registering GST, taking loans or even in tenders. The postponement of the process can result in punishment and unjustified complexity.

Faqs about Gumasta License Registration

Who needs a Gumasta License in Maharashtra?

All the shops and businesses or commercial establishments operating in Maharashtra require a Gumasta License according to Maharashtra Shops and Establishments Act.

What is the meaning of Gumasta?

Gumasta License: Shop or establishment license given by the Maharashtra government to be able to legally operate a shop or establishment.

Are Udyam and Gumasta the same?

No. Udyam is central level MSME registration, whereas Gumasta is a state license to operate a business, or shop.

How much time does a Gumasta License take?

When your documents are in order and complete the license is normally issued within 7-10 working days.

What is the difference between Gumasta and Shop and Establishment?

There is no difference. The formal name is Shop and Establishment License, however, in Maharashtra people generally refer to it as Gumasta License.

How to open a Shop Act License online?

It can be highly confusing to get a Gumasta License in Maharashtra without knowing the legal aspects of the process. That is where LegalFidelity is presented as a reliable Gumasta license consultant in Maharashtra. Our team offers full step-by-step support so that your registration can be without any hassles.

What is the Gumasta system?

The Gumasta system refers to the procedure to register and control businesses according to the Maharashtra Shops and Establishments Act. It makes sure that the business environment is operating within the law and that the rights of employees are not violated.

How to download Gumasta Certificate in Mumbai?

When your license is accepted, you can access it online at the official Labour Department portal, add your information, and download the certificate.

What are the two functions of Gumasta / Gomastha?

Historically, a Gomastha was a company agent, but in Maharashtra, Gumasta refers to regulating businesses and ensuring employee rights.

What do you mean by Gomastha?

It originally meant an agent/representative. In Maharashtra, the term evolved into “Gumasta License” for shops.

How to apply for a Gumasta License in MP?

In the case of MP, the application is handled via the Madhya Pradesh Shop Establishment portal. Although the process seems easy on paper, most business owners experience delays or rejection because of incorrect documentation or application. Our experts at LegalFidelity handle the registration process without any hassle.

What is the meaning of Laghu Udyog?

Laghu Udyog is a small scale business or small industry. These are typically small-scale businesses in terms of investment and labor.

Who needs a Gumasta License?

All businesses, stores, commercial establishments, freelancers with office, professional firms, or firms functioning in Maharashtra are liable to possess a Gumasta License according to law.

What is the validity of the Gumasta License in Maharashtra?

The license lasts between 1 and 5 years based on the choice you make and the charges paid. Before expiry, it has to be renewed to avoid fines.

What is the cost of a Gumasta License in Maharashtra?

The charges vary based on the number of employees, type of business activity and duration of license (between 1–5 years) and professional fees. It can vary between 1,000 and 10,000 on average. Higher amounts may be paid by larger businesses.

How to get a Shop License in Maharashtra?

You can hire a LegalFidelity expert to get the Shop License in Maharashtra. Just submit your ID, address proof, business documents, and pay the fee.

How many licenses are required for a retail store?

At minimum, you will require a Gumasta License at least. You can also need GST registration when turnover goes above the limit and FSSAI License when it is related to food business.

Get In Touch

Customer Reviews For Gumasta License Registration

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Tanya K

They exceeded my expectations with their service.

Riya R

Their attention to detail sets them apart.

Riya S

One of the best service providers I have come across!

MEENA M

Super responsive and dedicated to customer satisfaction.

Anjali K

Their commitment to quality is commendable.

SANDEEP C

Best service at the best price. 100% satisfied!