Gem Registration in Telangana

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Gem Registration in Telangana Online - Process, Documents, Benefits, Cost

In the case of businesses in Telangana, GeM Registration in Telangana will open up the opportunity to supply directly to government buyers. It requires some documents, schedules, and regulations but in return, it provides:

The Government e-Marketplace (GeM) is the Government of India's official online government buying and selling platform, run by the Ministry of Commerce and Industry.

On this platform, government departments and Public Sector Units (PSUs) must procure goods and services directly with the registered sellers without using middlemen in a fair, transparent, and no middleman manner.

- wider market and access

- quick payments

- equal opportunities between the small and big businesses

Here we cover all aspects of GeM, including registration, documentation, processing time, fees, main advantages, and commonly asked questions in simple terms.

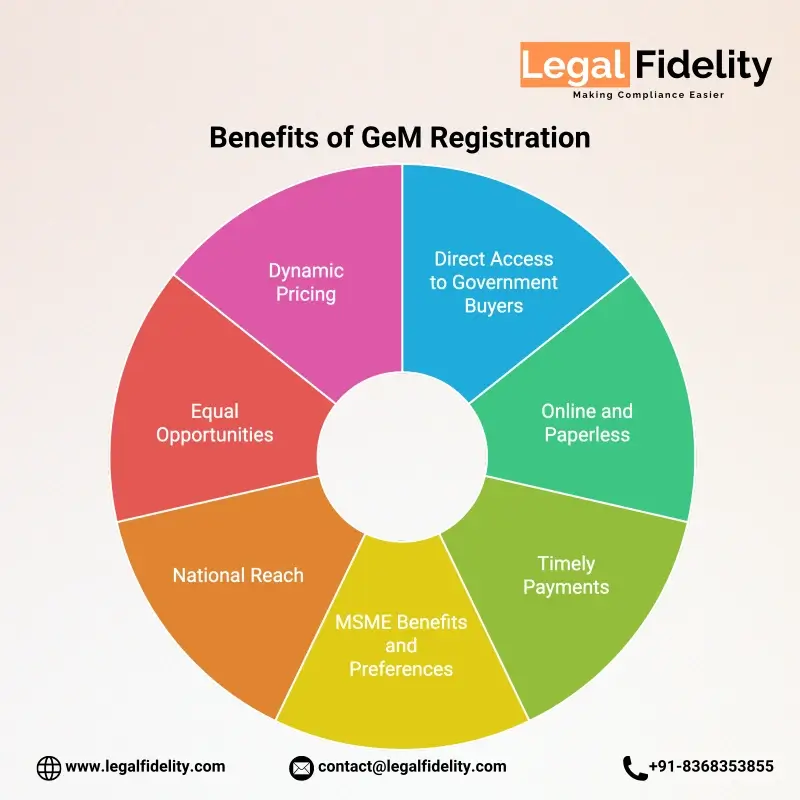

Gem Registration Benefits

Gem Registration in Telangana in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Gem Registration

Documents Required for Gem Registration in Telangana

PAN Card and Aadhaar Card

GST Certificate

Udyam or MSME Certificate

Bank Details with Cancelled Cheque

Income Tax Return (ITR)

Business Incorporation Papers

Trademark or Brand Authorization

Benefits of Gem Registration in Telangana

Direct Access to Government Buyers

Online and Paperless

Timely Payments

MSME Benefits and Preferences

National Reach

Equal Opportunities

Dynamic Pricing

What You Get

Gem Registration

GEM Registration in Telangana

Table of Contents

- What is GeM Registration in Telangana?

- Why is GeM Registration Important in Telangana?

- Step by Step Process of GeM Registration in Telangana

- Documents Required for GeM Registration in Telangana

- Cost of GeM Registration in Telangana

- Time Required for GeM Registration in Telangana

- Benefits of GeM Registration in Telangana

- Common Challenges & How to Avoid Them

- Conclusion

What is GeM Registration in Telangana?

GeM Registration is the process of registering your business under the Government e-Marketplace (GeM) portal, the official portal used by the Government of India to conduct public procurement. It is controlled by the Ministry of Commerce & Industry; this makes it a system of selling goods and services to the government legally.

Once registered, a business may:

- Advertise its products and services online.

- Participate in tenders and bids, offered by different departments.

- Get government buyers who purchase directly without intermediaries.

Who can register?

- Sellers: Manufacturers, merchants, service providers, MSMEs, startups, and even persons with qualified businesses.

- Buyers: Government ministries, departments, PSUs, and autonomous agencies that are legally required to purchase via GeM.

In simple words, the GeM Registration is the legal access point by which businesses can provide to the government in a transparent and accessible manner.

Why is GeM Registration Important in Telangana?

Telangana is a business hub where GeM Registration can open numerous opportunities. After registering themselves on the GEM Portal, sellers have access to the platform to offer their goods to thousands of government buyers comprising departments, PSUs and local bodies.

The portal will also guarantee a clear and effective procurement process where all sellers, including those who are a large company or a small startup, will be given an equal chance to compete in bids and deliver directly to the government.

The other major benefit is quick and guaranteed payments, with no intermediaries. This does not only improve the cash flow, but also builds confidence among the small traders and manufacturers.

In short, GeM makes business with the government accessible and fair to all.

Step by Step Process of GeM Registration in Telangana

- Contact LegalFidelity LegalFidelity will always be the right choice rather than trying to go through the GeM registration process on your own. Professional knowledge makes the registration process hassle free, right and easy.

- Share Details and Documents All you have to do is send out your basic business details and the required documents to the LegalFidelity team. They also verify details to ensure it is as per GeM requirements.

- Application Filling LegalFidelity fills in and prepares your GeM application accurately and without any mistakes so that all your entries are clear and in accordance with government regulations.

- Application Submission After the application is ready, it is formally filed on GeM portal under the guidance of LegalFidelity.

- Verification LegalFidelity team monitors the government checking phase and ensures that the process is fast and with fewer mistakes.

- Successful Registration Once you are approved you are registered on GeM as an official business and now you are able to list products, bid on tenders and be approached by government orders directly.

Documents Required for GeM Registration in Telangana

In order to accomplish GeM registration in Telangana, a business has to submit some documents in accordance with the government regulations. These include:

- PAN Card and Aadhaar Card: A simple identity document of the business owner.

- GST Certificate: This is required to be provided by GST registered businesses.

- Udyam or MSME Certificate: This is optional, but very beneficial in availing MSME benefits.

- Bank Details with Cancelled Cheque: To settle the payments of government purchasers.

- Income Tax Return (ITR): It may be necessary in some cases to access the vendors.

- Business Incorporation Papers: Partnership Deed or Certificate of Incorporation (COI), depending on the type of entity.

- Trademark or Brand Authorization: Required when you are an Original Equipment Manufacturer (OEM) or when you are selling under a brand.

Cost of GeM Registration in Telangana

The basic registration on GeM is chargeable with a fee. According to government policies, some deposits and fees can be paid depending on your business turnover and needs:

One Time Caution Money Deposit (Refundable):

| Business Turnover | Deposit Amount |

|---|---|

| Up to Rs. 1 Crore | Rs. 5,000 |

| Between Rs. 1 to 10 Crore | Rs. 10,000 |

| Above Rs. 10 Crore | Rs. 25,000 |

- Vendor Assessment Fee: Appropriate fee with GST necessary in case you want to be treated as an OEM or to sell under your own brand.

- Professional or Consultant Fee: Businesses normally want to seek professional help, like LegalFidelity to get registered without making any errors. The price of the service can be Rs. 2,000 to Rs. 10,000, depending on the extent of the support.

Time Required for GeM Registration in Telangana

The time spent in GeM registration depends on the different processes involved in the process:

- Simple Registration: Usually completed within 1 to 2 working days, provided that the information and the documents are properly presented.

- Document Verification: Government authorities take about 3-5 working days to verify and confirm the documents.

- Vendor Assessment (where necessary): Assessment, particularly of an OEM or brand seller, can take approximately 10 to 15 working days.

- Time of overall completion: The whole process of registration takes 7 to 15 working days in most situations, when all documents are correct and valid.

Benefits of GeM Registration in Telangana

- Direct Access to Government Buyers: Registered businesses are able to sell to ministries, departments and PSUs without using intermediaries.

- Online and Paperless: The whole process is digital, and therefore, it is simpler to run your business effectively.

- Timely Payments: Government buyers usually pay within 10 days, which enhances cash flow.

- MSME Benefits and Preferences: Government policies provide special benefits and preferences to small and medium enterprises.

- National Reach: Sellers have the opportunity to sell their products or services throughout India, covering a larger customer base.

- Equal Opportunities: The startups and the existing companies are competing at a level playing field.

- Dynamic Pricing: Sellers can also adjust the prices according to the market trends and demand.

Common Challenges & How to Avoid Them

- Wrong Documents: Make sure that your PAN, Aadhaar and GST numbers are matching with your application to prevent rejection.

- Incomplete Profile: Complete all the required fields correctly, as an incomplete profile will slow things down.

- Wrong Product Category: Choose the right product or service codes to appear in the appropriate searches.

- Wrong Product Category: Select the correct product or service codes to be listed in the correct searches.

Conclusion

GeM Registration in Telangana acts as a powerful agent that enables Telangana enterprises to contact government purchasers, boost sales, and build credibility. With more and more government departments beginning to use GeM in their purchases, it has become a big business opportunity.

It normally requires 7-15 days, and registering it is quicker, error-free, and completely compliant with the assistance of the experts at LegalFidelity. LegalFidelity ensures the success of smooth entry and long-term success that can be experienced on the GeM platform.

Faqs about Gem Registration in Telangana

Is GeM registration mandatory for all businesses in Telangana?

No, it is not complusory. But, any company seeking to provide goods or services to the government departments or PSUs has to be registered on GeM.

How long is GeM compulsory registration valid?

Your registration will continue as long as your business is in compliance with the rules and you pay the required caution money deposit.

Can MSMEs in Telangana register on GeM?

Indeed, the government policies provide MSMEs and startups with special benefits, preferences, and exemptions in order to register.

Is GST mandatory for GeM registration?

GST registration is needed in most categories. Certain businesses are legally exempt of GST, however, some may still be registered.

What is the cost of GeM registration in Telangana?

Although there is a fee if you hire a professional like Legalfidelity, to get registered on the portal. Also, there are caution money and vendor assessment charges that may be charged based on your turnover and category.

Do I need a DSC (Digital Signature) for GeM registration?

No, there is no requirement to have a DSC at this point. The process of verification is normally done using a secure OTP.

Can a freelancer or service provider register on GeM?

Yes, individual service providers and freelancers can also get registered and provide their services to government buyers.

What is vendor assessment in GeM?

Vendor assessment is the quality and capability test made by the certified bodies, such as QCI, to ascertain that the suppliers match the demanded standards.

How do I list new products on GeM?

Once logged in, navigate to My Account, choose Add New Product or Service and fill in the details and submit to be approved.

Can I participate in tenders immediately after registration?

Yes, you can begin to take part in tenders as soon as your profile and documents are checked by the authorities.

Is GeM registration valid across India or only in Telangana?

The registration of the GeM can be used nationwide and hence you are able to sell your Products and services to the government purchasers in any part of India.

Can I update my details after registration?

Yes, You can update your business information, product listings and other information any time with your account.

Are there penalties for wrong information?

Yes, sharing of false or misleading information may result in suspension or even blacklisting by the service.

Do I need a trademark for listing products?

It is not compulsory to all sellers, but it is advisable when you are selling branded goods, or when the seller is an OEM.

What are the payment terms for on GeM?

Government purchasers must make the payment within 10 days after accepting your product or service.

Can multiple users manage one GeM account?

Yes, GeM has the option of adding secondary users to the primary account in order to run the operations effectively.

How do I withdraw caution money?

The refund of caution money can be requested by you in case you choose to stop using the platform after the official procedure.

Can startups register without turnover proof?

Yes, startups can be registered under special government conditions even without turnover evidence.

Is support available locally in Telangana?

Yes, in Telangana there are some local consultants and service providers such as Legalfidelity who will assist in registration, products and Services listing and other registration related queries.

Where can I get help if my application is stuck?

You can call on GeM helpdesk, official support, or even hire a professional consultant in Telangana such as Legalfidelity to assist you in GeM registration process, quicker approval and hassle free process.

Get In Touch

Customer Reviews For Gem Registration in Telangana

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Riya R

Extremely reliable and trustworthy service provider.

Anjali K

I was pleasantly surprised by their efficiency.

Rahul N

A stress-free experience from start to finish.

AKASH S

Very professional and transparent in their dealings.

ANJALI N

Amazing service! Quick and hassle-free process.

NIDHI C

Highly professional and efficient. I am very satisfied.