LLP Annual Compliance Filing

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

LLP Annual Compliance Filing Online - Process, Documents, Benefits, Cost

LLP Annual Compliance Filing or LLP Annual Filing means the LLPs must submit specific documents to the Ministry of Corporate Affairs every year, even if they did not do any business during the financial year. It is compulsory for every LLP to file annual returns and financial statements.

These LLP Compliance Filings are considered as an official disclosure of financial status, details of partners, and other key activities about the LLP. The main purpose is to keep the LLP open and responsible.

The two main forms that every LLP must file annually are:

- Form 8 – Statement of Account & Solvency: This form includes information related to the LLP’s finances and confirms that it can pay its debts.

- Form 11 – Annual Return: This form includes information related to the partners in LLP and their roles and responsibilities.

There are other event-based compliances such as changes in partners, capital contributions, or the business address within the LLP during the financial year that also apply.

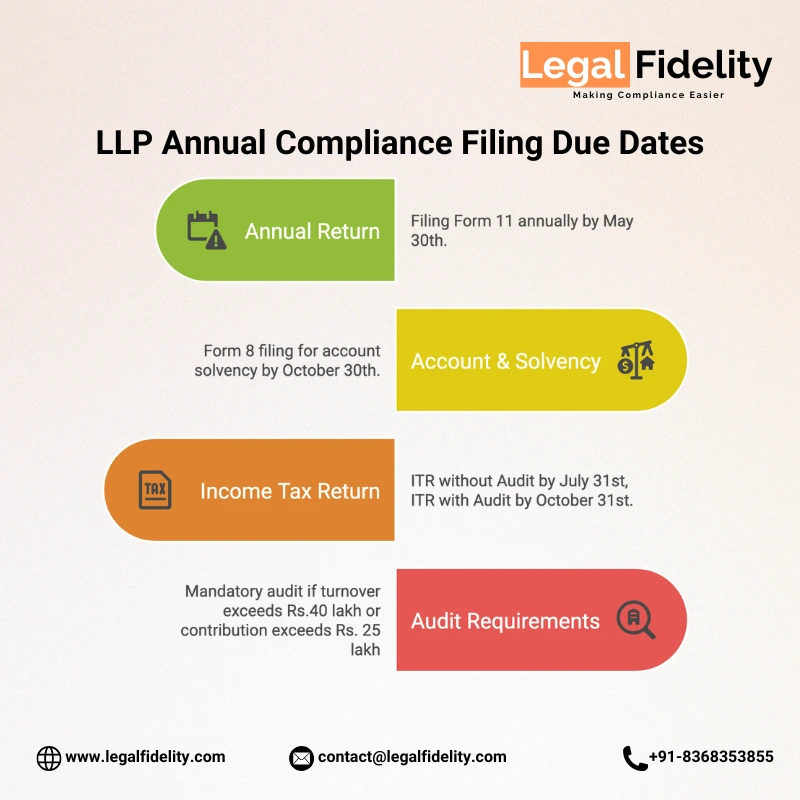

llp annual compliance filing due dates

LLP Annual Compliance Filing in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get LLP Compliance Filed

filed

Documents Required for LLP Annual Compliance Filing

PAN Card of Partners

LLP Agreement

Financial Statements

Certificate of Incorporation

Bank Statements

Benefits of LLP Annual Compliance Filing

Avoids Penalties and Legal Hassles

Improves LLP Credibility and Financial Standing

Complete Peace of Mind

What You Get

Form 8 Filing

Form 11 Filing

ITR Filing

*items vary based on the selected plan

Choose Your Plan

Plan 1

- Form 11 Filing

₹2999 ₹1999

Plan 2

- Form 8 Filing

₹3999 ₹2499

Plan 3

- Form 8 Filing

- Form 11 Filing

₹6999 ₹3999

LLP Annual Compliance Filing in India (2025) – Due Dates, Forms, Process & Penalties

Table of Contents

Introduction

An LLP in India is a form of business structure that combines the features of both Partnership and limited liability. As a result, LLPs are the most popular business structure among professionals and small to medium-sized enterprises that do not want the burden of a company.

Registering an LLP is just a beginning. After registration, all LLPs are required to fulfill certain legal compliances every year, called LLP Annual Compliance Filing.

If these yearly reports are not filed on time, the LLP could be fined, experience legal issues and in serious cases, the government may remove (strike) off the LLP from official records.

Why Annual Compliance Filing is Crucial for LLPs in India

Annual compliance is not just a formality. It is a legal requirement under the Limited Liability Partnership Act, 2008. It is necessary to file certain forms every year. If any LLP fails to meet these requirements, it can attract a penalty of Rs. 100 per day per form with no maximum limit. So, delay or non-compliance may cause huge penalties on the LLPs.

This is why LLP Annual Compliance Filing is important:

- Avoid Penalties: If you file your forms before the due date, it helps you to prevent late fees and unnecessary fines.

- Legal Standing: By completing regular compliances on time, an LLP stays legally active and avoids being treated as inactive or facing removal (strike-off) by the ROC.

- Financial Transparency: LLP having compliant status creates trust among customers, investors, and stakeholders.

- Ease of Funding: LLPs that have consistently followed the rules find it easier to reach investors and get loans, since it proves the business can be trusted.

- Smooth Exit Strategy: If your partners are willing to shut down the LLP or convert it into a company, the LLP’s compliance history must be up-to-date to avoid delays or rejection.

What is LLP Annual Compliance Filing?

LLP Annual Compliance Filing means you have to submit certain documents every year as instructed by the MCA. These filings are mandatory for every LLP. It includes financial status, details of partners, and the solvency status of the business.

Whether the LLP is active or dormant, it must file:

- Annual Return: To be filed in Form 11 within 60 days of the end of the financial year, due by 30th May every year.

- Form 8: To be filed by 30th October each year, which reports the financial position and transactions of the LLP during the year.

Failure or delay in filing these forms can attract massive penalties and may also affect the LLP’s legal status, including the risk of it being marked inactive or removed (struck off) by ROC.

Who Needs to File LLP Annual Compliances?

Every registered LLP in India must file their annual compliances, regardless of their turnover or business activity. This includes:

- Active LLPs: LLPs that are doing any commercial activity.

- Dormant LLPs: LLPs that are not actively doing business or operations for a period of time (generally one year or more) but are still legally registered.

- Newly Registered LLPs: LLPs from their year of registration must comply with the filing requirements.

Even if your LLP has no income, made no transactions, or stayed inactive during the financial year, you still have to file the mandatory forms each year. Non-filing or delay can lead to huge penalties and legal issues.

List of Mandatory Annual Compliances for LLPs

A short summary of the major annual compliance rules for LLPs in India is provided:

| Compliance | Description | Due Date |

|---|---|---|

| Form 11 | Annual Return | 30th May |

| Form 8 | Statement of Account & Solvency | 30th October |

| Income Tax Return | ITR Filing for LLPs | 31st July (Non-audit cases) / 31st October (Audit cases) |

| Audit Requirements | Mandatory if turnover exceeds Rs.40 lakh or contribution exceeds Rs. 25 lakh | Along with ITR filing |

Other event-based filings such as if partners change or if there is a change in capital, the company must submit these details as soon as they occur.

Key Forms for LLP Annual Compliance: Form 8, Form 11 & Others

Form 11

Form 11 is used to file Annual Return. This form contains details of all partners, total contribution made, and other changes made during the year. It is to be filed by 30th May every year.

Form 8

Form 8 is used to file Statement of Account & Solvency. Form 8 is used to file declaration of the LLP’s solvency status and financial statements. It must be filed by 30th October every year.

Income Tax Return : ITR-5

LLPs must file their income tax returns using Form ITR-5, even with zero income.

Audit Report if applicable

LLPs exceeding prescribed financial thresholds need to get their books of accounts audited and submit the audit report.

Due Dates and Deadline for LLP Annual Compliance Filing

Failing to file forms before due date for LLP compliance filings can lead to massive penalties. Here are the key LLP Annual Compliance Filing due dates you should mark in your calendar:

| Compliance | Form | Due Date |

|---|---|---|

| Annual Return | Form 11 | 30th May every year |

| Statement of Account & Solvency | Form 8 | 30th October every year |

| Income Tax Return (ITR-5) | – | 31st July (non-audited LLPs) or 31st October (audited LLPs) |

| Audit Report Submission | – | Same as ITR deadline for audited LLPs |

Note: LLPs with turnover above Rs. 40 lakh or capital contribution exceeding Rs. 25 lakh must get their books of accounts audited by a Chartered Accountant.

LLP Annual Compliance Calendar (2025 Edition)

To ensure your LLP stays compliant and prevent penalties, below listed are the 2025 LLP Annual Compliance Calendar for LLPs in India:

| Month | Compliance Activity |

|---|---|

| March 31 | Close of Financial Year |

| April – May | Prepare Form 11 |

| 30th May | File Form 11 with MCA |

| June – July | Prepare and file Income Tax Return (ITR-5) for non-audited LLPs |

| July 31 | Last date for ITR (non-audited LLPs) |

| August – October | Prepare Form 8 & audit accounts (if applicable) |

| October 30 | File Form 8 with MCA |

| October 31 | Last date for ITR (audited LLPs) |

If you strictly follow the compliance calendar, you can avoid having to pay huge penalties because of late or missed due dates.

Step-by-Step Process for LLP Annual Compliance Filing

Step 1: Obtain Necessary Documents

Obtain the necessary documents together and they should include financial statements and the complete details of all partners.

Step 2: Form 11 Preparation & Filing

Use Form 11 to file Annual Return and fill in partner details, capital contribution made, and any changes during the financial year. File Annual return in Form 11 with MCA by 30th May to avoid late fees.

Step 3: Form 8 Preparation & Filing

Properly close Books of Accounts for the financial year. Prepare a summary of your LLP’s financials and confirm that it can pay its debts, then file Statement of Accounts & Solvency in Form 8.

Step 4: Get the Books Audited

If your LLP’s turnover is above Rs. 40 lakh or capital contribution is above Rs. 25 lakh, get the books audited by a Chartered Accountant. File Form 8 with MCA by 31st July if audit is not required or by 31st October if audit is applicable.

Step 5: ITR Filing

Collect all necessary documents and details and file ITR-5 with Income Tax Department before due date.

Step 6: Additional Things to Consider

Always keep the Acknowledgement email, filing receipts, and proofs for your future records. It is recommended to hire professionals like LegalFidelity to ensure your annual compliances are completed before due date efficiently and without mistakes at affordable prices.

Documents Required for LLP Annual Compliance Filing

- LLP Agreement as well as details of any amendments made during the year

- Details of partners such as names, contributions made by each partner

- PAN Card of LLP

- Financial Statements of LLP like Balance Sheet, P&L

- Bank Statements showing all transactions of LLP

- DSC (Digital Signature Certificate) of authorized partner to sign and file the form

- You must have an Audit Report certified by a Chartered Accountant, if applicable

- Income Tax Login Credentials to file the LLP’s ITR

Keeping the important documents on hand helps you complete the filing process effortlessly and quickly.

Filing Fees & Government Charges for LLP Annual Compliance Filing

Government Fees

The government filing fees for LLP annual compliance are based on the LLP’s capital contribution amount:

| LLP Contribution | Form 11 Fee | Form 8 Fee |

|---|---|---|

| Up to Rs.1 lakh | Rs. 50 | Rs. 50 |

| Rs.1 lakh – Rs. 5 lakh | Rs. 100 | Rs. 100 |

| Rs. 5 lakh – Rs. 10 lakh | Rs.150 | Rs.150 |

| Rs.10 lakh – Rs.25 lakh | Rs.200 | Rs. 200 |

| Rs.25 lakh – Rs.100 lakh | Rs.400 | Rs. 400 |

| Above Rs.1 crore | Rs. 600 | Rs. 600 |

Note: These fees are standard charges by MCA. Additional charges may apply for late filing.

Extra Costs: Related to Professional Fees, Late Filing Penalties

- Professional Charges: Taking help from a Chartered Accountant or compliance expert consultant may charge you between Rs. 2,000 – Rs.10,000 based on complexity and services offered.

- Late Filing Penalty:

MCA imposes a penalty of Rs. 100 per day per form for delays, with no cap on the maximum penalty.

| Delay | Penalty |

|---|---|

| 1 Month | Rs. 3,000 (approx) |

| 3 Months | Rs.9,000 (approx) |

| 6 Months | Rs. 18,000 (approx) |

Important: These penalties are per Form, meaning if both Form 8 and Form 11 are delayed, the total fine doubles.

Penalties & Legal Consequences for Late or Non-Filing of LLP Annual Compliances

If you do not complete the annual filing compliances on time, massive penalties are imposed by the Ministry of Corporate Affairs (MCA). This can cause serious consequences for LLPs in India.

- Form 11 Annual Return: Rs. 100 per day of delay without any upper limit

- Form 8 Statement of Account & Solvency: Rs. 100 per day of delay

- Income Tax Return: Rs. 1,000 to Rs. 10,000 depending on your total income and how late the filing is done under Section 234F

Example Penalty Calculation:

If you miss the filing of both Form 8 and Form 11 by 30 days late, the total penalty could be:

- Rs. 100 × 30 (Form 11) = Rs. 3,000

- Rs. 100 × 30 (Form 8) = Rs. 3,000

- Total = Rs. 6,000 + applicable GST

Note: Penalties are per Form, so missing both adds up fast and increases daily. It may impact LLP’s cash flow as well as future compliance.

Impact on LLP Status and Legal Risks due to Non-Compliance

Delayed or non-filing of LLP compliance forms is not only about paying fines but can seriously affect your LLP’s standing and cause legal issues. Here’s what can go wrong:

- Your LLP could be marked as Defaulting or Non-Compliant on the MCA portal

- Banks and financial institutions usually avoid providing loans to non-compliant LLPs, making them ineligible to apply for loans or contracts

- If LLP keeps missing the annual filing requirements, the partners may be declared disqualified under certain circumstances

- If non-compliance continues for a longer period, MCA may even shut down or strike off the name of the LLP

- LLPs may face legal issues when converting into a private limited company or registering any charges until compliances are completed

It is recommended to appoint professionals like Legalfidelity who will ensure your LLP maintains compliance status efficiently and affordably.

Benefits of Timely LLP Annual Compliance Filing

Avoiding Penalties and Legal Hassles

One major benefit of timely compliance filing by LLPs is avoiding late fees, notices, and legal actions. Benefits include:

- Save money on penalties by completing compliances on time — no late fees or big penalties, keep more money in your pocket!

- Timely filing brings peace by avoiding stress from MCA notices or scrutiny

- Customers and investors prefer working with compliant LLPs, building a strong reputation

- Timely compliance protects partners from future disputes or legal liabilities due to negligence

Timely Compliance Improving LLP Credibility and Financial Standing

Keeping the LLP compliant not only avoids penalties. It actually makes your business more transparent, professional, and trustworthy. Here is how it helps you by staying up to date with filings:

- Clients, investors, and lenders are more interested to work with you when they see your LLP as in compliance with the rules.

- Completing regular compliance on time improves creditworthiness and bank loan eligibility.

- When your legal compliance and paperwork is up to date, it enhances your reputation during audits or allows you to apply for big projects or government tenders without stress.

- If you are planning to convert LLP into a Private Limited company, clean and regular compliance records make the process faster and smoother.

- Having a clean and steady compliance record provides a strong base and adds long-term value to your business.

LLP Annual Compliance for New LLPs

First-Year Compliance Requirements

Even newly incorporated LLPs must complete specific compliances within the same financial year, depending on their incorporation date. Here’s a quick tips:

| Incorporation Period | First-Year Compliance |

|---|---|

| On or before 30th Sept | Full compliance: Form 11, Form 8, ITR |

| After 30th Sept | Form 11 only, Form 8 & ITR can be carried to next FY in some cases |

Conditions apply: Take suggestion from a CA or compliance expert of Legalfidelity for your specific case.

Compliance Tips for Newly Incorporated LLPs

- Create a Compliance Calendar after incorporation of LLP.

- Apply for DSC and DIN immediately for authorized partners.

- Open a dedicated bank account in the name of LLP and maintain clean transaction records.

- Maintain books of accounts from day one properly.

- Consult a professional like LegalFidelity for correct and hassle-free ITR and MCA forms.

- Keep track of due dates even if you have not started business operations.

Pro tip: Even if your LLP is dormant or you did not do any business during the financial year, you still have to file your annual returns.

Common Mistakes & How to Avoid Them

Mistakes in LLP Annual Compliance Filing & How to Prevent Them

Many times, LLPs make errors when filing compliance which can result in huge penalties or inactive status. Here you can see the common mistakes and know how to deal with them:

- Missing Deadlines

Mistake: Failing to remember the important due dates like Form 11 or Form 8.

Fix: Setup documents as a compliance calendar and regularly check it. - Incorrect Information in Forms

Mistake: Providing inaccurate or mismatched details of partners, financial details, or important event dates.

Fix: Double-check every field and keep records updated. - Not Maintaining Books of Accounts

Mistake: Assuming that if there is no business, there is no need for record-keeping.

Fix: Keep financial books from Day 1, even if you have not started business activities. - Filing Only with Income Tax and Skipping MCA

Mistake: Filing your LLP’s ITR but ignoring MCA Form 8 and 11.

Fix: Remember, MCA forms need to be filed by every LLP, including those with nil returns. - Assuming New LLPs Don’t Need to File

Mistake: Thinking compliance is only needed after revenue generation.

Fix: File your MCA forms based on incorporation date, regardless of revenue generation. - Not Seeking Professional Help

Mistake: Handling compliance and filing requirements on your own without understanding the legal requirements.

Fix: It is better to take support from experts such as LegalFidelity who provides stress-free and best services. Using professionals with great experience, LegalFidelity completes all forms accurately, in compliance with government timelines, always on time, and at affordable prices.

Avoiding these mistakes saves time, money, and your LLP’s reputation.

LLP Annual Compliance Filing Services by LegalFidelity

At LegalFidelity, we understand that LLP annual compliance can feel stressful with multiple form filing and strict due dates, and constant updates from MCA. That is why at LegalFidelity we offer a one-stop solution with end-to-end LLP compliance filing, making the process easy and hassle-free.

Our LLP Compliance Filing Services Include:

- We offer preparation and filing of MCA Forms such as Form 8, Form 11, and your ITR correctly and promptly according to the details of your business.

- You will get a dedicated compliance manager who guides you at each and every step and keeps your LLP fully compliant with MCA rules.

- You will receive timely reminders for details before all due dates so that you never miss a deadline and have no last-minute stress.

- We also provide expert support for maintaining books of accounts or audit completion.

- Our services are designed to meet your LLP’s needs at affordable pricing with no hidden charges.

- We also help in applying for DSC, DIN, and other related filings with MCA and IT department.

Thousands of LLPs put their trust in us because we combine expertise, efficiency, and genuine care to provide you affordable and accurate services, so you can focus on growing your business while we take care of the compliance, documentation, and filing.

Why Choose Us for Your LLP Compliances

- Experienced CA & CS Team: Your filings are handled accurately and in compliance with expert guidance.

- On-Time Filings: With our proactive system, we ensure that you never miss a deadline and your LLP stays on track always.

- Prompt Support: You can easily reach us promptly via mail, WhatsApp, and call assistance whenever you need us.

- Custom Packages: We have customized packages for every type of business, whether you are startups, SMEs, or dormant LLPs matching your business needs.

- 100% Data Security: We ensure your information stays secure and never compromise on privacy.

We do not just file your forms, we ensure your LLP stays compliant, penalty-free, and audit-ready.

Conclusion

To sum it up, LLP annual compliance filing is not optional. It is a mandatory legal requirement to complete the annual compliances. Filing your returns and financials on time helps you:

- Avoid strict penalties, legal notices, or even the risk of your LLP being struck off by the MCA.

- Protect interests of partners and ensure transparency, eliminating the risk of disqualification of partners due to non-filing.

- Build credibility and trust among clients, investors, and banks.

- Ensure smooth business operations and stay eligible for tenders, loans, government registrations, or future conversions into a Pvt Ltd company etc.

Even if your LLP is inactive or has not commenced business activities, you still need to file annual forms. Compliance is your responsibility, no matter what stage your business is in.

Get Started with Filing Today

Do not wait until the last minute. Start your LLP annual compliance filing with LegalFidelity today.

Call us, chat with an expert, or book your filing online now in a few clicks.

Still have doubts or questions? Reach out to us at LegalFidelity — we are here to help every step of the way!

Faqs about LLP Annual Compliance Filing

What is the annual compliance for LLP?

Annual compliance for LLP means filings mandatory forms with the Ministry of Corporate Affairs (MCA), such as submitting Form 8 Statement of Account & Solvency and Form 11 Annual Return and paying the necessary government fees. This helps to keep your LLP active and legal status.Can LLP be closed without annual filing?

No, you cannot legally closed LLP without completing all overdue annual compliance filings. If you do not comply with legal laws it may attract monetary penalties and complicate the legal process involved in closure the LLP.What happens if an LLP misses the compliance deadline?

If you miss the annual compliance deadlines may results in penalties and late fees increasing day by day. If the delay continues for too long, may result in the LLP being strike off from the register which has affect its legal role and survival.Can LLPs apply for extension or exemption of annual compliance?

Most of the times, an LLP will not be exempt from any annual compliance requirements. Extensions to file returns may be requested in specific matters, but they are rarely approved. Before your due dates, it is better to finish filing to avoid going through any penalties.What are the benefits of hiring compliance consultants?

Taking help from experts in handling compliance filings guarantees you will avoid penalties, manage your documents properly, meet all requirements and get support when needed.- Avoid penalties

- Proper document management

- Compliance with legal requirements

- Time-saving support

Is Form 8 mandatory for LLP?

Yes, every business is required to file their Form 8 every year. Form 8 helps LLPs state their financial status and if they are able to repay debts.Is ROC filing mandatory for LLP?

Yes, An LLP must submit their annual returns and accounts statements to the ROC no matter if they have made any revenue that year.What is the cost of an annual filing compliance package for LLP?

Costs may range from Rs. 1,000 to Rs. 5,000 or more depending on service providers but generally include government filing fees plus professional fees.What is the last date/ due date for LLP ROC annual filing and LLP Return?

Every LLP is required to file Annual Return in Form 8 and Form 11 within sixty days i.e. 30th May every year, following the end of the financial year on 31st March.What forms are required for LLP annual filing?

- Form 8 is used to submit the Statement of Account & Solvency

- Form 11 is used to submit Annual Return

What is the due date for filing Form 8 and Form 11?

Both forms must be filed by 30th May of the subsequent financial year.Can LLP returns be filed without DSC?

No, filing Form 8 and Form 11 requires the Digital Signature Certificate (DSC) of the designated partners.How to rectify errors in submitted forms?

In case a mistake is found, LLPs are allowed to rectify the submitted forms on the MCA website. Legalfidelity’s experts will help you through problems to ensure those errors do not happen again.What documents are attached to Form 11?

Form 11 does not require any attachments but must be digitally signed by designated partners.Who is responsible for filing the forms?

The designated partners of the LLP are responsible for timely filing. They can also appoint professionals for assistance.How to check if LLP filing is complete?

You can verify the filing status on the MCA portal using the LLP’s Unique Identification Number (UIN) or LLPIN.What is annual return?

All LLPs must prepare an annual return which includes details related to the partners and business activities the past year.Does LLP need to file an annual return?

Yes, every LLP must file in Form 11 Annual Return yearly.What is the purpose of Form 11 for LLP?

The purpose of Form 11 is to file updated the information related to partners, what they have invested and other useful details.How is Form 11 different from Form 8?

Form 11 is an Annual Return, while Form 8 contains the Statement of Account and Solvency.Can changes be made in LLP agreement during compliance filing?

Changes to the LLP agreement can be registered by filing Form 3 with the MCA but this is done independently from annual compliance filings.Is it mandatory for LLP to file ITR?

Yes, LLPs must file Income Tax Returns (ITR) annually, irrespective of turnover.What is the annual turnover limit or tax audit threshold limit for LLP?

If LLP’s turnover exceeds INR 2 crore in a financial year, tax audit under Section 44AB is mandatory.Is audit mandatory for all LLPs?

No, audit is not mandatory for every LLP. If turnover of any LLP exceeds the specified limit or if required by other regulatory provisions, audit becomes necessary.Can LLPs with zero turnover skip ITR filing?

No, It is obligatory compliance requirement for LLPs to file ITR even if there is zero turnover. Non filing of ITR may attract penalties and other legal issue.Is AGM mandatory for LLP?

No, LLPs are not required to hold Annual General Meetings (AGM). Unlike companies, LLPs has to follow different forms of compliance and are not required to hold AGM.Is DIR-3 KYC necessary every year?

No, Only Directors of companies are required to file DIR-3 KYC. It is not applicable on LLP designated partners to submit DIR-3 KYC.What if LLP has no transactions in the financial year?

Even if LLP has not carried out any transactions during the year, it is mandatory to file:- Form 8 declaring no business activity

- Form 11 to update and confirm the details of the LLP’s partners

Are late fees charged per form or per day?

Late fees are calculated on per day and per Form basis. You can avoid these penalties by filling on or before due date.

Get In Touch

Customer Reviews For LLP Annual Compliance Filing

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

KAVITA D

Highly professional and efficient. I am very satisfied.

Sunil A

Their expertise made all the difference. Great job!

Anjali K

Excellent service, very professional and responsive.

Tanya K

I was pleasantly surprised by their efficiency.

AMIT A

Handled my queries with patience and professionalism.

Shruti T

Their commitment to quality is commendable.