ITR 1 Sahaj Return Filing

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

ITR 1 Sahaj Return Filing Online - Process, Documents, Benefits, Cost

Filing income tax returns is a yearly duty for millions of salaried individuals across India. ITR 1 Sahaj Return Filing is the easiest and most straightforward way to file returns for people with simple income sources who work as employees . This form, also known as Sahaj, represents a simplified format of tax compliance for individual salaried taxpayers.

Here you'll get to know about all essential information and overview about ITR 1 Sahaj filing. It includes eligibility requirements, process, documentation, benefits, due dates and more.

ITR 1 Sahaj Return Filing in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get ITR 1 Filed

filed

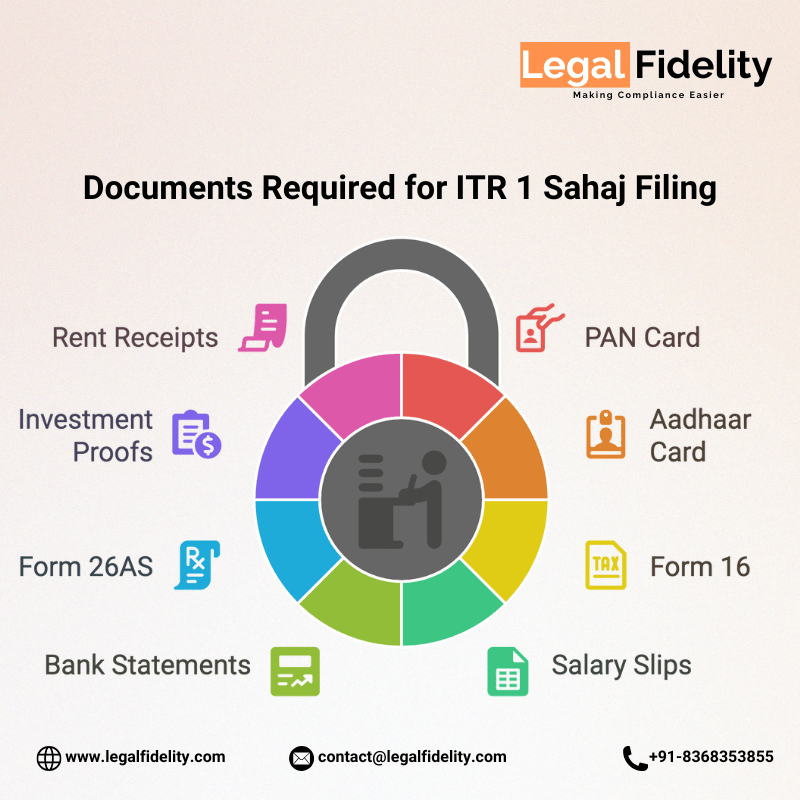

Documents Required for ITR 1 Sahaj Return Filing

PAN Card

Aadhaar Card

Form 16

Salary Slips

Bank Statements

Form 26AS

Investment Proofs

Rent Receipts / HRA Declaration

What You Get

Acknowledgement

What is ITR 1 Sahaj Return Filing?

Table of Contents

- Why is ITR 1 Sahaj Return Filing Important for Salaried Individuals?

- Eligibility Criteria for ITR 1 Sahaj Return Filing

- Essential Documents Required for ITR 1 Sahaj Return Filing

- Step-by-Step Process for ITR 1 Sahaj Return Filing

- Modes of Filing ITR 1 Sahaj

- Important Due Dates for ITR 1 Sahaj Return Filing in FY 2024- 25

- Benefits of Filing ITR 1 Sahaj Return on Time

- Consequences of Missing the ITR 1 Sahaj Return Filing Deadline

- Mistakes to Avoid While Filing ITR 1 Sahaj Return

- How to Verify Your ITR 1 Sahaj Return Filing

- Tracking Your ITR 1 Sahaj Refund Status

- Common Refund Delays and Solutions

- How to Revise ITR 1 Sahaj Return After Filing

- ITR 1 Sahaj Return Filing for Pensioners

- Tax Slabs Applicable under ITR 1 Sahaj Return Filing for FY 2024-25

- Filing ITR 1 Sahaj Return for Multiple Form 16s

- Conclusion

- File Early and Stay Compliant

Income Tax Department of India provides a simple income tax return form called ITR 1 Sahaj Return Filing Form. ITR 1 Sahaj is specifically made for resident individuals whose total income consists of:

- Salary or pension income

- Income from one house property

- Other sources like interest from savings accounts or fixed deposits

The word Sahaj itself means easy, and that’s what this form is all about. It is the most commonly used form because it is used by resident salaried people and it requires fewer documents and is easy to file.

Why is ITR 1 Sahaj Return Filing Important for Salaried Individuals?

People with regular jobs generally have a simple income. ITR 1 Sahaj is made just for them because:

- The income of employees who earn salaries runs consistently without unexpected changes.

- Salaried individuals benefit from ITR 1 Sahaj filing because it includes ready-to-use Form 16 data filling capabilities.

- The system performs time-saving functions by automatically populating data extracted from Form 16.

- It saves time by filling in some details automatically from your Form 16.

- You can file it online easily, but it is ideal to take guidance from expert like Legalfidelity to file return accurately.

- This form helps you to be compliant with tax rules and lets you claim benefits like 80C, 80D, and HRA.

- ITR 1 can be used as income proof for things like applying a visa, taking a loan, or planning your finances.

In short, if your income is simple, using ITR 1 Sahaj is not just easy—it’s also a smart choice.

Eligibility Criteria for ITR 1 Sahaj Return Filing

Who Can File ITR 1 Sahaj?

You are eligible to file ITR 1 Sahaj for FY 2024-25 when all the following conditions meets :

- If You are a resident individual not being HUF or non-resident.

- A total income not exceeding Rs. 50 lakhs makes you eligible to file ITR 1 Sahaj.

- Your income sources include: Salary or pension, One house property without including losses from earlier years, Other sources like interest, family pension

- You are not a director in a company or holding unlisted shares

That’s why ITR 1 is the top choice for salaried people, retired persons, and anyone with simple finances.

Who is Not Eligible for ITR 1 Sahaj Return Filing?

You cannot file ITR 1 Sahaj if:

- You have income above Rs. 50 lakhs.

- You have more than one house property.

- You are a director in a company.

- You hold unlisted equity shares.

- You have capital gains or income from business/profession.

- You are a non-resident or RNOR (Resident but Not Ordinarily Resident).

- You have foreign assets or foreign income.

If any of the above applies to you, you’ll need to use a different ITR form like ITR 2 or ITR 3.

Essential Documents Required for ITR 1 Sahaj Return Filing

It is important to preapre in advance before you begin filing your return, collect these essential documents to make the process smoother:

- PAN Card is mandatory for all taxpayers.

- Aadhaar Card is required for linking with PAN and for e-verification.

- Form 16 Issued by your employer contains salary details and TDS.

- Salary Slips is monthly breakdowns to cross-check with Form 16.

- Bank Statements is required to report interest income and other inflows.

- Form 26AS A consolidated tax statement showing TDS and advance tax.

- Investment proofs is required for claiming deductions under 80C, 80D, etc.

- Rent receipts or HRA declaration to claim the House Rent Allowance.

Keeping these documents handy ensures accurate and faster filing without errors or notices.

Step-by-Step Process for ITR 1 Sahaj Return Filing

Here is how you can file your ITR 1 Sahaj easily on the Income Tax website:

1. Logging into the Income Tax Portal

- Visit the income tax portal and login with user id and password or OTP for login.

2. Selecting the Correct Form

- Select the option “File Income Tax Return”.

- Choose the Assessment Year (2025-26) and select ITR Form for individuals with eligible income.

3. Filling Out the Details

- Most of the personal data such as your pre-filled information will appear like salary, TDS, etc.

- Verify and edit any missing details like deductions, bank accounts, etc.

- Cross-check all data from Form 16, 26AS, and AIS (Annual Information Statement).

4. Verifying and Submitting the Return

- Last and important step after filling out all information is preview your return submit it .

- You have the option to e verify your return using different method like Aadhaar OTP, DSC, etc.

- Offline method to e verify return is to send the ITR-V to CPC Bangalore within 30 days.

In this way you can submit your ITR 1 Sahaj return.

Modes of Filing ITR 1 Sahaj

You can file and submit the your ITR through the following methods:

Through LegalFidelity (Recommended)

- At Legalfidelity, we offer you expert assisted ITR filing. Our professionals ensure accurate filing, help you claim all eligible deductions and exemptions like HRA and 80C, and reduce your tax liability legally.

- It is suggested to salaried individuals to hire experts at Legalfidelity, those having multiple deductions or confusion around HRA, 80C, etc.

- We ensure accurate and timely ITR 1 Sahaj filing.

Online Filing

- Quick and user-friendly method to file the ITR

- pre-filled information will appear like salary, TDS, etc.

- Suitable for easy filing with simple income structure.

Offline Filing

- Download the utility from the income tax portal, fill offline, and upload the JSON file.

- Ideal for users who prefer working on a desktop environment or have limited internet connectivity.

Important Due Dates for ITR 1 Sahaj Return Filing in FY 2024- 25

Make sure you mark these important date on your calendar to save time and stress free filing for FY 2024-25 (AY 2025-26):

Last Date for Salaried Individuals

The regular deadline is July 31, 2025 to file your ITR 1.

Other Important Deadlines

Belated Return: You can file the belated return by December 31, 2025, with a late fee, If you missed the July deadline.

Revised Return: You can file revised return by December 31, 2025 to correct any errors, If you have made a mistake in your original return.

Filing on time is always better idea, you may get your refund faster, avoid last minute hassle, and have sufficient time to fix any errors.

Benefits of Filing ITR 1 Sahaj Return on Time

Timely Filing of Income tax return before the deadline keep you legal compliant and also brings several other benefits:

Avoiding Penalties

Early filing of Income tax return, avoid the chances to pay any late fees.

Late filing may attract penalty between Rs. 1,000 and Rs.10,000 as a penalty under Section 234F.

Faster Refund Processing

Timely filling of ITR 1 Sahaj, ensures that you get your tax refund faster without any delays.

The Income Tax Department gives priority to returns filed within the due dates for quicker disbursements, so you get your money back sooner.

Loan and Visa Advantages

Various financial insitituation like Banks and embassies requires ITR returns as proof of income for applying for a loan or a visa. Filing ITR 1 Sahaj on time helps build your financial credibility and helps you when applying for loans, visas.

Consequences of Missing the ITR 1 Sahaj Return Filing Deadline

Missing the deadline for filing ITR 1 Sahaj can lead to serious problems. Here are the issues you may face:

Late Fees Under Section 234F

If you missed to file the return the due date, you will have to pay late fees under Section 234F of the Income Tax Act. The penalty amount depends on the delay:

- Up to ₹5,000 if filed before December 31st of the assessment year.

- Up to ₹10,000 if filed after December 31st of the assessment year.

The longer you delay in filing the return, the higher the penalty you have to pay, So it is best to file your return before the deadline.

Interest on Tax Due

If you do not pay tax and missed the last date, you will be charged 1% interest per month on the unpaid tax amount. As long as you delay in filing the return, the more interest you will have to pay on tax due until the payment of taxes.

Restrictions on Carry-Forward Losses

In case of belated returns, you cannot carry forward losses such as capital loss, or business losses to coming years except house property loss. This means that you lose the opportunity to set off these losses against coming years income.

Mistakes to Avoid While Filing ITR 1 Sahaj Return

Even small errors can cause a problem when filing ITR 1 Sahaj, Here are some general mistakes you should avoid:

Incorrect PAN or Aadhaar

Make sure that your PAN and Aadhaar numbers are correct and properly linked.

Mismatch or Mistake in information can cause the e-filing system to reject your return, and your filing will be invalid. It is recommended to always double-check these details.

Mismatch in Income Details

Sometimes, common mistake while filing the return is not cross checking your salary or income details with Form 16 and Form 26AS.

Ensure the information match to avoid errors. If there is a mismatch in the details could result in tax notice from the Income Tax Department.

Not Reporting Exempt Income

Many taxpayers miss to mention the exempt income such as interest on savings account or dividends from stocks.

It is necessary to mention these details even though they are exempt from tax, to avoid penalties or questions from the tax department.

How to Verify Your ITR 1 Sahaj Return Filing

The last Step after filing your ITR 1 Sahaj is to verify the return. It is important to verify it to complete the filing process.

e-Verification Methods

Following are the instant methods through which you can e-verify your return using one of them:

- Aadhaar OTP: If your Aadhaar is linked with your PAN, this is the easiest way to verify your return.

- Net Banking: Log in to your net banking portal and e-verify your return.

- EVC (Electronic Verification Code): EVC code can be generated through your bank account or Demat account to verify your return.

Physical or Offline ITR-V Process

If you prefer offline or physical method to verification, you can download the ITR V form, sign it, and send it to the CPC Bangalore office. It is necessary that retun must reach within 120 days of filing to avoid it being treated as invalid

Tracking Your ITR 1 Sahaj Refund Status

After you have filed your ITR 1 Sahaj, and you are expecting a refund. Here is how to track it:

How to Check Refund Online

- Visit the Income Tax portal and login with your user id and password.

- Select the option “View Your Tax Credit” or “Refund Status”.

- Choose the Assessment Year to check the current status such as refund issued, Refund under process or no refund due.

Common Refund Delays and Solutions

Refund commonly comes within a few weeks, but it can take longer due to various reasons, including mismatches in bank details, incorrect processing, or detailed examination.

If your refund is delayed:

- Delayed return can be a reason, so check if you have filed your ITR on time.

- Ensure that the bank details like IFSC and Name in Bank provided are correct.

- Cross check your data with 26AS and Form 16, mismatch may result into delay in processing the refund.

- You can also contact the Income Tax Department for clarification.

It is recommended to take the help of professionals like Legalfidelity to file or revise the income tax return. With our expertise and experience we ensure your return is correctly filed and your refund is processed on time.

How to Revise ITR 1 Sahaj Return After Filing

Sometimes, after filing your ITR 1 Sahaj, you may realize that you made a mistake or forget to mention some information. Here is how to fix it:

When Revision is Allowed

You can revise your ITR 1 Sahaj under the following situations:

- If you entered any incorrect income details or forgot to claim deductions like under Section 80C, 80D, etc.

- If you entered incorrectly or missed to declare a source of income.

- You can revise the filed return within one year from the end of the relevant assessment year.

Step-by-Step Guide to Revising

- Login with your user id and password on Income Tax portal

- Select “Revised Return” and fill in the correct details.

- Submit the revised return with correct details and verify your return.

It is good idea to take the help from experts from Legalfidelity to file your revised income tax return. With our expert guided assistance, we ensure your return is correctly filed and deduction claimed legally. so that your refund is processed on time

ITR 1 Sahaj Return Filing for Pensioners

ITR 1 Sahaj Filing is not limited to salaried individuals, pensioners can also file under this form if they satisfy particular conditions. Here is how pensioners can file:

ITR 1 Sahaj can be used by Pensioners who receive income from a pension or family pension.

- You receive a pension or family pension income.

- Earn Interest Income, if the total income is less than Rs. 50 lakh

- You do not have income from other sources, such as business income, capital gains, or property income.

Pensioners are also eligible if they receive income from:

- Agricultural income up to Rs. 5,000

- Interest earned on savings accounts or fixed deposits.

During the filing process of ITR 1 Sahaj for pensioners, one may consider the following:

- Pensioners can claim deductions under sections such as 80C for investments and 80D for insurance premiums.

- Pensioners having age above 60 years are also eligible for higher exemption limits under the senior citizen category.

- Family pension income is taxable, but a deduction under Section 57 is available for family pensioners, reducing the taxable amount.

- Before submitting the return must ensure that all deductions and exemptions are correctly filled to reduce the tax liability

Tax Slabs Applicable under ITR 1 Sahaj Return Filing for FY 2024-25

When you file ITR 1 Sahaj, you need to choose between two tax systems:

The Old Regime and the New Regime. Here is what they mean and how the tax rates differ.

Old Regime

In Old tax regime taxpayers can claim multiple deductions and exemptions, such as:

- 80C for investments made.

- 80D for health insurance paid .

- HRA (House Rent Allowance).

- Standard Deduction of Rs. 50,000.

New Tax Regime

This regime offers simplified tax structure and lower tax rates but removes most deductions. It is recommended to compare both regimes and choose the best one that suits your financial situation.

Old vs New Regime: Which Regime is Better for You?

Old Regime: Suitable for the Individuals those who have multiple deductions, like PPF, EPF, or HRA.

New Regime: Better suited for those individuals with simple income and lesser deductions, as this regime offers a simpler tax structure with lower rates.

| Income Slab (₹) | Old Regime Tax Rate | New Regime Tax Rate |

|---|---|---|

| Up to ₹2.5 lakh | Nil | Nil |

| ₹2.5 lakh – ₹5 lakh | 5% | 5% |

| ₹5 lakh – ₹10 lakh | 20% | 20% |

| Above ₹10 lakh | 30% | 30% |

At Legalfidelity, we offer expert guided assistance from choosing the most suitable regime depending upon your financial situation to filing your ITR Returns, ensuring maximum savings and compliance.

Filing ITR 1 Sahaj Return for Multiple Form 16s

Those individuals who have switched jobs during the year or had multiple sources of income may receive multiple Form 16s from different employers.

Here we will let you know about the filing of ITR 1 Sahaj with multiple Form 16s :

How to Combine Income

- Add all the salary details received from different employers as mentioned in all the Form 16s under the Salary Income section while filing.

- Ensure the gross salary including basic salary, allowances, bonuses, etc. from all employers is correctly reported.

- Also add any other income earned by way of interest, rental income, etc. to avoid errors.

TDS Reconciliation

- Make sure that TDS (Tax Deducted at Source) mentioned in the Form 16 matches with details mentioned in Form 26AS.

- Mismatch in details can cause delay in processing refund or lead to a tax notice.

Conclusion

ITR 1 Sahaj Return Filing is a simple and hassle free process for salaried individuals, pensioners, and those with simple sources of income like salary or interest from saving account or Fixed Deposits.

Here, Legalfidelity ensures that taxpayers get access to affordable and simplified tax preparation services without any hassle. We ensure that all required

information and documents are ready like Form 16, bank details, and investment proofs. Taxpayers can easily complete the filing process without stress.

File Early and Stay Compliant

Filing your ITR 1 Sahaj well before the due date helps you to avail various benefits, such as avoiding penalties, faster refund processing, and better financial standing and Creditability.

Do not wait for the last date, File early to stay stress free and make sure to stay compliant and enjoy the financial advantages it brings.

Faqs about ITR 1 Sahaj Return Filing

Who is eligible for ITR-1 filing?

ITR-1 Sahaj is used by individuals with income from salary, pension, or interest income, and who have total income up to Rs. 50 lakh. Those with income from one house property and excluding income from business or professional are eligible to file this return.

Can I file ITR 1 now?

Yes, you can file ITR-1 Sahaj for the current financial year if you meet the eligibility criteria and file return before the last date to avoid penalty.

How do I apply for ITR 1?

Through Income Tax e-filing portal, you can file your return selecting ITR 1 form. You need to provide your details like income, deductions etc, and submit and e-verify after submission.

However, it is recommended, to appoint experts from Legalfidelity to ensure your return is filed correctly and that you claim all eligible deductions such as HRA, Section 80C, 80D, and more.

How much income is tax-free and what is the limit of tax exemption?

The tax-free limit for individuals below the age of 60 years is Rs. 2.5 lakh.

The tax-free limit for senior citizens above the age of 60-80 years, is Rs. 3 lakh.

The tax-free limit for super senior citizens above age of 80 years, is Rs. 5 lakh.

What happens if I don't file ITR?

If you forget or delay filing your ITR, you may attract penalties, interest charges on outstanding taxes, and no carrying forward of losses. Late filing under Section 234F can also result in fines.

What is the minimum salary to pay income tax in India?

The minimum taxable income for individuals is Rs. 2.5 lakh for those individuals below the age of 60 years. Income exceeding this threshold is taxable, but exemptions and deductions can reduce taxable income.Is it mandatory to file an ITR?

Yes, if your total income exceeds the exemption limit Rs. 2.5 lakh for those under 60 years or if you meet other requirement, filing an ITR is mandatory.How much income tax should I pay?

The amount of income tax you need to pay depends on your total taxable income, which is calculated after adjusting the exemptions, deductions, and tax slabs applicable to your income.Is ITR 1 for salaried people?

Yes, ITR 1 is used by salaried individuals who meet the eligibility criteria and whose income is up to Rs. 50 lakh with income like pension, one house property or income from other sources.How can I file ITR-1 by myself?

To file ITR-1 yourself:- 1. Login Income Tax portal.

- 2. Select ITR-1 and fill in the required details.

- 3. File the return and e-verify through Aadhaar OTP or net banking.

What is the processing time for ITR-1?

ITR-1 is commonly processed within 1-2 months after submitting the return. Refunds, if applicable, are generally processed within 30-45 days.Why am I unable to file ITR-1?

Possible reasons for being unable to file ITR-1 include incorrect details in the form, income mismatch, or eligibility issues like if you have capital gains or business income.What is the limit for filing ITR 1?

ITR 1 is for individuals with income up to Rs. 50 lakh. Those Individuals whose annual income exceeds this, or with business income or capital gains, must file a form ITR 2 to submit their return.Can we file ITR 1 for rental income?

Yes, you can file ITR 1 if your rental income comes from only one house property . However ITR 2 will be filed if you have rental income from more than one property.

How to file ITR 1 offline?

You can file ITR 1 offline by downloading the form from the Income Tax portal, filling it offline, and submitting it as a physical form. However, e-filing is faster and more convenient.Can I file the previous year ITR now?

Yes, you can file ITR for the previous year within the time limit before December 31 of the assessment year. If you fail to file your return before the due date it may attract penalties.How do I check my ITR 1?

By logging into the Income Tax portal you can check the status of your ITR-1. The status will show whether your return has been accepted, rejected, or is under processing.Where to claim HRA in ITR 1?

You can claim House Rent Allowance under Section 10(13A) in ITR 1, in the income from salary section by providing details of the rent paid, employer, and your taxable income.Can I file an ITR for the last 4 years?

No, as per the current income tax provisions, you cannot file ITRs for the last 4 years. You can only file Updated Return (ITR-U). You can file for the last 2 assessment years if you missed or need to correct your return. However, it comes with additional tax and penalties.Can I file 2 ITR forms?

No, you cannot file two ITR forms for the same year. You need to select the appropriate form based on your income sources like ITR 1, 2, 3, or 4 and file that form only. If you have filed a wrong form then you have the option to revise the return.

Get In Touch

Customer Reviews For ITR 1 Sahaj Return Filing

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

NIDHI C

A stress-free experience from start to finish.

AKASH S

The team is very knowledgeable and helpful.

Akash A

Amazing service! Quick and hassle-free process.

Shruti T

Highly skilled team delivering quality service.

POOJA G

Smooth process with no hidden charges.

SAMEER I

Very professional and transparent in their dealings.