Sole Proprietorship Firm Registration in Pallavaram

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

Sole Proprietorship Firm Registration in Pallavaram Online - Process, Documents, Benefits, Cost

Starting your own business can be very exciting. In Pallavaram, it is very easy for small traders and entrepreneurs to Establish and go for Sole Proprietorship Firm Registration in Pallavaram. A Proprietorship Firm is a common and simple way to start your own business.

As a new business owner, you may be overwhelmed by the registration process. A single error in the registration process can cause legal issues and avoidable costs.

We, at LegalFidelity, are experts in simplifying the process. We handle everything from preparing your documents to ensuring full compliance, so that you can focus on growing your business only.

Why choose us?

- Expert Guidance for a seamless registration process.

- Affordable Services with Transparent Pricing

- Comprehensive Assistance

- Fast Turnaround Time

- Proven Reliability

- MSME Certificate

- GST Certificate

- Shop License

Sole Proprietorship Firm Registration in Pallavaram in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get Registered

registered

Documents Required for Sole Proprietorship Firm Registration in Pallavaram

Identity proof

Address Proof

Proof of Place of Business

Benefits of Sole Proprietorship Firm Registration in Pallavaram

Easy Formation

Complete Control of Proprietor

Lesser Compliances

Tax Benefits

What You Get

GST Acknowledgement

Proprietorship Certificate

Shop and Establishment Act Registration

*items vary based on the selected plan

Sole Proprietorship Firm Registration in Pallavaram

Single or Sole Proprietorship firm Registration in Pallavaram means a business unit in which ownership and management is controlled by One person. For Legal and Taxation purposes business and the owner are considered the same.

Table of Contents

- Important Features of Proprietorship firm Registration in Pallavaram

- Merits or Benefits of Sole Proprietorship firm Registration in Pallavaram

- Demerits or Disadvantages of Sole Proprietorship Firm Registration in Pallavaram

- Registration Process of Sole Proprietorship Firm in Pallavaram

- Documents required to Register the Sole Proprietorship Firm in Pallavaram

- Time Taken for Sole Trader Registration in Pallavaram

- Documents you will get after Sole Proprietorship Firm Registration in Pallavaram

- Cost of Registering a Sole Proprietorship Firm in Pallavaram

- Compliance Requirements for Sole Proprietorship Firm Registration in Pallavaram

- Conclusion

- Why choose LegalFidelity for Sole Proprietorship Firm Registration in Pallavaram

Important Features of Proprietorship firm Registration in Pallavaram

- Owned by One Person: Sole Proprietorship firm owned and managed by one person.

- No Separate Legal Entity: The Owner and business are considered the same for Legal and Taxation Purpose.

- Unlimited Liability: The owner is responsible for all the liabilities and Obligations of the firm..

- Less legal Requirements : Sole Proprietorship firm has less legal Requirements as compared to other business Entities.

Merits or Benefits of Sole Proprietorship firm Registration in Pallavaram

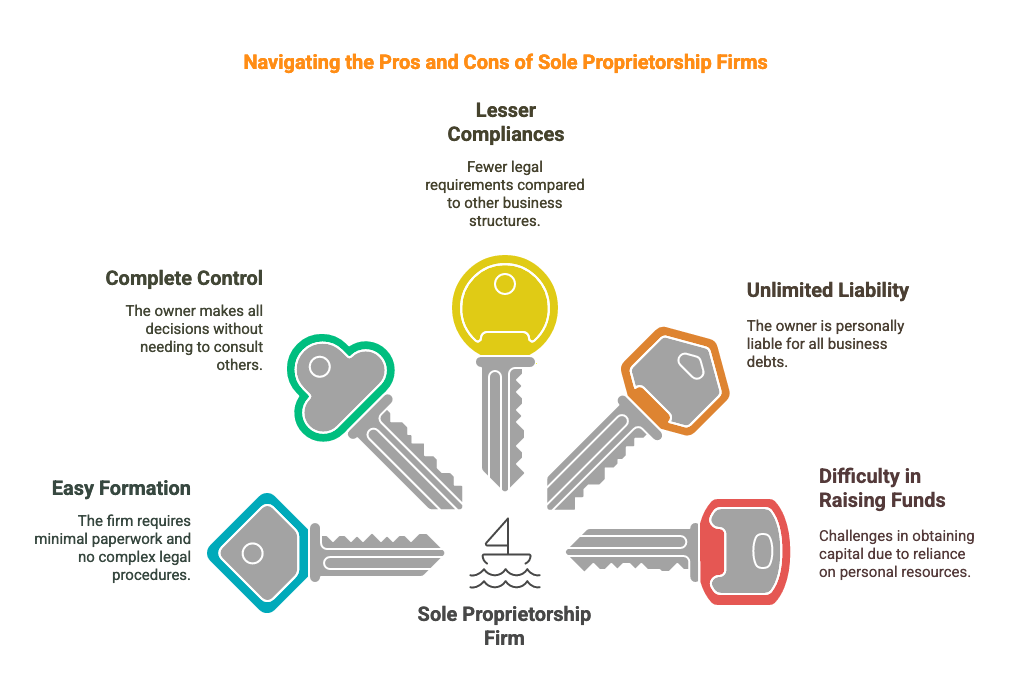

- Easy Formation : Most Important feature of a Sole Proprietorship firm Registration in Pallavaram is that it is very easy to set up the firm. There are no complex Legal Requirements. There is no need to register a Sole Proprietorship firm with the Ministry of Corporate Affairs. Your business can be Started with minimal paperwork.

- Complete Control of Proprietor: Complete control gives power to the owner to take all the decisions individually, So there is no need to consult with Partner or Shareholders .

- Lesser Compliances: Unlike Private Limited Companies, Sole Proprietorship firms have fewer Legal Requirements. Such as there is no requirement to File Annual Return with the Ministry of Corporate Affairs.

Demerits or Disadvantages of Sole Proprietorship Firm Registration in Pallavaram

- Unlimited Liability :

Major Disadvantage of Sole Proprietorship firm in Pallavaram is the Owner is personally liable for the debts of the firm. Business incurs debts, Therefore Owner will be personally liable for the debts of the business.

- Difficulty in Raising Funds for the business:

As you know, Sole Proprietorship firms depend on the owner’s resources, so it can be quite difficult to raise capital for the firm. Due to growth constraints of Sole Proprietorship firms, the Banks, Investors and other Financial Institutions show unwillingness to invest in the Business.

- Lack of Continuous Succession:

Due to lack of Perpetual Succession in Sole Proprietorship firms. The business ceases to exist if the business owner dies or retires or becomes incapable of doing the business.

Registration Process of Sole Proprietorship Firm in Pallavaram

- Apply for the Pan Card:

A Permanent Account Number (Pan Card) is the important document for all Financial Transactions and filing the Tax returns. If you do not already have the Pan Card , then firstly you have to apply for the Pan card through the Income Tax department. - Selection of Business Name:

Choose a distinctive and meaningful name for your business. There is no need to get registered the business name, however It is preferable that the name of the business should not be identical with other existing Business names in use, to avoid the legal challenges.

- Opening a Bank Account:

To separate the personal and business transaction it is advisable to open a separate current account in the name of the firm. Generally, the bank requires basic documents like Pan Card, Address proof, Business registration Certificate for Opening the Bank account.

- Obtaining Necessary Business Registration:

According to the nature of business, You may need the following Registrations:

- GST Registration: Mandatory if your turnover exceeds Rs. 20 lakhs (Rs. 10 lakhs for specific states).

- MSME Registration: To get benefits of government schemes and benefits.

- Shops and Establishment Act Registration: Necessary for businesses operating from a physical location like shops, offices etc.

Documents required to Register the Sole Proprietorship Firm in Pallavaram

- Identity proof

- Aadhar card

- Pan Card

- Address Proof

- Electricity Bill or Water Bill etc.

- Rent agreement if required

- Proof of Place of Business

- Receipt of Property Tax

- Rent Agreement or Lease deed

Time Taken for Sole Trader Registration in Pallavaram

Generally it takes only 7-10 working days to get the Sole Proprietorship firm registration in Pallavaram

Documents you will get after Sole Proprietorship Firm Registration in Pallavaram

Depending upon the type of registration, you may get the following registrations:

- GST Certificate

- MSME Certificate

- Shops and Establishment Act Registration (if applicable)

Cost of Registering a Sole Proprietorship Firm in Pallavaram

The Cost depends on the type of registration required. At LegalFidelity, you can get Proprietorship Registration starting from 999 only.

Compliance Requirements for Sole Proprietorship Firm Registration in Pallavaram

- Filing of Income Tax return: Sole Proprietorship firms need to file Income Tax return as per the IT Act. Tax rates are the same as individual tax slabs.

- GST Returns: If your Business is registered under GST, then you must file GST Returns, monthly or Quarterly depending on the Turnover.

- TDS deduction and Filing: If you have employees or making payments that require TDS deduction, you will need to deduct and deposit the TDS deducted as per applicable laws.

Conclusion

Sole Proprietorship Firm Registration in Pallavaram is the most cost effective and simple way for small business owners looking to start their own business. Sole Proprietorship firm has its limitations. For Small Business owners, advantages are more than limitations as it allows them to start their own business.

If you are planning to register your business as Sole Proprietor, consult with the professional to ensure that you will meet all the legal compliance requirements

Why choose LegalFidelity for Sole Proprietorship Firm Registration in Pallavaram

LegalFidelity offers complete guide and services to help you to start your own Sole Proprietorship firm in Pallavaram easily. Our team ensures accurate documentation, quick registration and expert guidance during the registration process.

- Quick and Hassle free Registration process.

- Expert advice on Tax and Compliance Matters.

- Affordable prices with No Hidden Cost

Faqs about Sole Proprietorship Firm Registration in Pallavaram

What is the cost of registering a Sole Proprietorship Firm in Pallavaram?

The Cost varies and depends on the type of registration required. LegalFidelity offers starting from just ₹999.How much time does it take to register a sole proprietorship in Pallavaram?

Generally, it will take 7 to 10 working days only.Is it Necessary to register the business name for sole proprietorship?

It is not required to register the business name for sole proprietorship, but it is advisable to select a name that is not identical with the other business name already in use.Is GST registration mandatory for sole proprietorships firms?

No, GST registration is not mandatory, but it's advisable. However, GST Registration becomes mandatory once your business turnover exceeds Rs. 20 Lakhs ( Rs. 10 for special states).Can I convert a Sole Proprietorship firm into a Private limited company?

Yes you can convert a Sole Proprietorship firm into a Private limited company by complying with the conversion process provided by the Ministry of Corporate Affairs.What are the taxes do Sole Proprietors need to pay?

Sole Proprietorship firms need to pay Income Tax as per the IT Act. Tax rates are the same as individual tax slabs.Can a sole proprietorship hire employees?

Yes, a sole proprietorship can hire employees. However, the owner remains personally liable for all business liabilities.What is the liability of a sole proprietor?

A sole proprietor has unlimited liability, it means that the owner's personal assets can be utilised to settle business debts of the firm.Is it necessary to have a business license for a sole proprietorship?

A business license may be required depending on the nature of your business and local regulations.What happens to a sole proprietorship after the proprietor’s death?

A sole proprietorship ends upon the death of the owner, as there is no perpetual succession.

Get In Touch

Customer Reviews For Sole Proprietorship Firm Registration in Pallavaram

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Rahul R

The team is very knowledgeable and helpful.

BHAVYA R

Handled my queries with patience and professionalism.

Sandeep M

I was pleasantly surprised by their efficiency.

Riya R

They exceeded my expectations with their service.

Vikram A

They took care of everything so I didn’t have to worry.

MEENA M

Smooth process with no hidden charges.