GST Registration in Bangalore

Free Consultation

Online Process

No Hidden Costs

Satisfaction Guaranteed

Get In Touch

Trusted by thousands and counting...

GST Registration in Bangalore Online - Process, Documents, Benefits, Cost

In India, on 1st July, 2017, the Goods and Services Tax Act or GST Registration in Bangalore was introduced. It is an important compliance requirement for companies in India to secure GST Registration in Bangalore.

Earlier, multiple indirect taxes were imposed on several goods and services, such as VAT, excise duty, service tax, etc. The government brought in a single tax regime to eliminate these various indirect taxes.

GST is a consumption-based tax that is levied on every transaction. Its main objective is to establish a harmonized tax structure, eliminating the double taxation effect and boosting ease of doing business.

Why Choose LegalFidelity for GST Registration in Bangalore?

LegalFidelity offers you seamless GST registration in Bangalore with the help of their team of experts. This way, you can focus on growing your business while we manage the legal work. Start your GST Registration in Bangalore process now!

- Professional Advice with Customized Support

- Fast Service and Clear Pricing

- Comprehensive Assistance from Start to Finish

- 100% Online and Paperless Application

- Dedicated Assistance with Direct Communication

- Successful History of Registrations

- Trusted by Businesses Nationwide

Gst Registration Certificate Sample

GST Registration in Bangalore in 3 Easy Steps

1. Fill the Form

to get started.

2. Call to discuss

connect with you for a detailed consultation.

3. Get GST

GST Application

Documents Required For GST Registration in Bangalore Online

ID Proof

Address Proof

Photo

Registered Office Proof

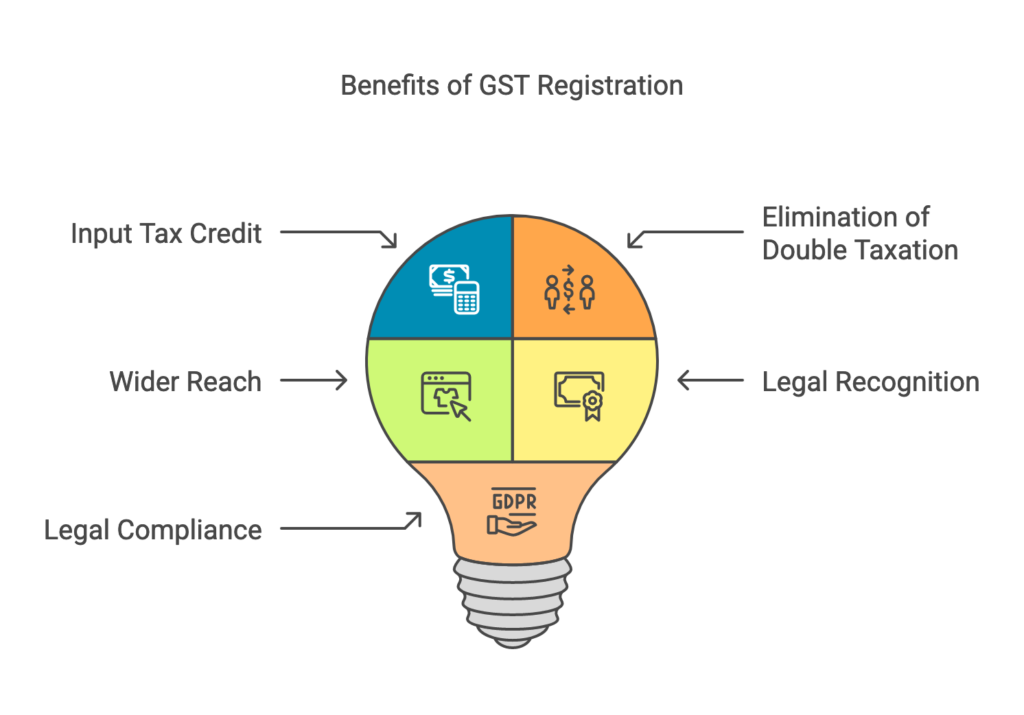

Benefits of GST Registration in Bangalore

Avail Input Tax Credit

Elimination of Double or Cascading effect of Taxation

Wider reach through Online Platforms

Legal Recognition to Business

Legal Compliance

What You Get

GST Acknowledgement

What is GST Registration in Bangalore?

GST registration in Bangalore refers to the process of getting registration. After registration, a unique Goods and Services Tax Identification Number (GSTIN) is issued to the business. Registration mandates the liability to collect and deposit GST to the government.

Table of Contents

- Legal Requirements of GST Registration in Bangalore

- Eligibility Requirement Under Goods and Services Tax (GST) Act

- Documents required for GST Registration in Bangalore

- Step-by-Step Process for GST Registration Online in Bangalore

- Checklist of Compliance after GST Registration in Bangalore

- Cost involved in GST Registration in Bangalore

- Time Required for GST Registration in Bangalore

- List of Documents you will get after completion of GST Registration in Bangalore

- Common mistakes to avoid during GST Registration in Bangalore

- Challenges faced during GST Registration in Bangalore

- One Stop Solution, LegalFidelity for GST Registration in Bangalore

- Get Expert Consultants & CA for GST Registration in Bangalore

- Why Choose a CA for GST Registration in Bangalore?

- Our Process – GST Registration by CA in Bangalore

It is necessary to get the GST registration in Bangalore for the businesses whose aggregate turnover exceeds the prescribed threshold limits: ₹40 lakh for goods (₹20 lakh for special category states) and ₹20 lakh for services (₹10 lakh for special category states).

Businesses such as interstate suppliers, e-commerce operators, and those involved in the supply of specific goods or services, must register for GST irrespective of turnover.

Legal Requirements of GST Registration in Bangalore

- Businesses must get registered themselves if their yearly turnover exceeds the prescribed threshold limits: ₹40 lakh for goods (₹20 lakh for special category states) and ₹20 lakh for services (₹10 lakh for special category states).

- Non-Compliance of GST Registration attracts Penalties : In case of Non compliance, businesses can attract penalties of 10% of the tax due or ₹10,000, whichever is higher.

- Business gets Legal Authorization : GST registration provides businesses legal acknowledgement as suppliers of goods and services, which increase their market recognition and Business trustworthiness.

Eligibility Requirement Under Goods and Services Tax (GST) Act

| Business Category | Type of Business | Turnover Limit for GST Registration |

|---|---|---|

| Normal Category States | Businesses supplying goods only | ₹40 lakh per year |

| Businesses engaged in services only | ₹20 lakh per year | |

| Special Category States | Businesses supplying goods only | ₹20 lakh per year |

| Businesses engaged in services only | ₹10 lakh per year |

Special Category States: Arunachal Pradesh, Assam, Meghalaya, Manipur, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, and Uttarakhand.

Documents required for GST Registration in Bangalore

Following documents are required for GST Registration in Bangalore:

| Business Type | Required Documents |

|---|---|

| Sole Proprietorship | ✅ Copy of Proprietor’s PAN card ✅ Copy of Proprietor’s Aadhar Card ✅ Cancelled Cheque or Bank Account Statement ✅ Address proof of business premises (Utility Bill, Rent Agreement, or Property Tax receipt) |

| Partnership Firm or LLP | ✅ Copy of Firm and all Partner’s PAN Card ✅ Notarized Partnership Deed of the LLP ✅ Proof of Bank account details ✅ Address proof of the principal place of business of Firm or LLP |

| Private Limited or Other Companies | ✅ PAN Card of the company ✅ Certificate of Incorporation/Registration of the company ✅ Memorandum and Articles of Association of the company ✅ Board resolution required to authorize a representative ✅ Copy of Bank account details and address proof |

Step-by-Step Process for GST Registration Online in Bangalore

- Provide your business information with us like Name of the Business and its Activity .

- Submit required scanned copies of documents.

- Our professionals will prepare and file your registration application.

- After that you will get the GST Identification Number (GSTIN) within the prescribed timeline.

Checklist of Compliance after GST Registration in Bangalore

- Mention the GSTIN number on the invoice and display board of your business.

- Prominently display the Registration Certificate to your customers at your place of business.

- File return based on type of business:

- GSTR-1: Mention the details of all outward supplies of goods and services made.

- GSTR-3B: In this return monthly self-declaration to be filed, for giving summarized details of all outward supplies, input tax credit claimed, tax liability determined and taxes paid.

(Returns will be filled monthly (GSTR-1, GSTR-3B) or quarterly under the composite or QRMP scheme)

- GSTR-1: Mention the details of all outward supplies of goods and services made.

- In every tax period, you must verify the sales and input tax credit details with GSTR-1 and GSTR-2B before filing GSTR-3B.

- Keeping Detailed Records: Need to maintain detailed records of invoices, payments and returns for at least six years to comply with the compliance requirement and avoid query during audits.

- Non-Compliance due to delay in filing the returns attracts a penalty of ₹100 per day (up to ₹5,000). Incorrect filling of information leads to fine or legal action.

Cost involved in GST Registration in Bangalore

The cost involved in GST Registration including Professional/ Expert guidance fees may vary, depending on the business type and service provider and other factors.

Time Required for GST Registration in Bangalore

- Standard Completion Time without queries : Generally it will take 5-7 working days

- With Queries: Due to queries, it will take 7-10 additional working days for the completion of the registration process.

List of Documents you will get after completion of GST Registration in Bangalore

- A 15-digit unique GSTIN (GST Identification Number) number for your business.

- Proof of GST Certificate after successful registration.

- Login Details to the GST portal for filing GST returns and completing compliances.

Common mistakes to avoid during GST Registration in Bangalore

- Incorrect PAN Details & Other Information: Double check that PAN details and other information are correctly filled

- Choosing Incorrect Business Type: Must select the correct business type like Proprietorship, LLP and Company .

- Not checking all documents before submission: Must Check all the documents properly scanned and attached.

- Not tracking Application Status: Timely checking of application status, by using ARN enables us to address any issues quickly.

- Ignoring OTP verification: Do OTP verification on time to avoid delays in the registration process.

Challenges faced during GST Registration in Bangalore

Multiple challenges faced by many businesses during the registration process, such as:

- Sometimes businesses fail to understand the eligibility criteria and turnover threshold limits of registration.

- Documentation preparation and submission varies according to the business type, making the registration process difficult and complex.

- Lack of knowledge of legal aspects of business registration and mistakes in providing information can lead to delays or rejection of registration.

One Stop Solution, LegalFidelity for GST Registration in Bangalore

LegalFidelity provides you the easiest GST registration process in Bangalore through their professional expertise of many years along with expert guidance to handle your needs with ease:

- Our professionals will provide Step by Step Guidance in the registration process.

- Our Team will help you in better understanding to kickstart your own business stress-free.

- Dedicated Support and accuracy in documents preparation and filling activities decrease the possibility of rejection.

- Time Saving registration process and fast approval of GSTIN, with our efficient approach and simple registration process and complete compliance with no stress.

Get Expert Consultants & CA for GST Registration in Bangalore

Looking for a Expert Consultant or CA for GST registration in Bangalore?

LegalFidelity offers budget friendly and trustable GST registration services, specially designed for businesses, startups, and professionals in Bangalore.

Our qualified team of Chartered Accountants handles your complete GST registration process. Without any errors, timely approvals, and ongoing tax compliance.

Let us handle your documentation work while you focus on your business growth!

Why Choose a CA for GST Registration in Bangalore?

Registering under GST may look simple, but in reality even a minor mistake can lead to delay your business operations or result in extra costs.

Here is why smart and leading businesses in Bangalore prefer getting it done by a CA.

- Your application is prepared and filed by a qualified Chartered Accountant who understands GST law and your business requirement

- We ensure to double check all the documents and details before submission to prevent any mismatch and mistake that could delay your registration process

- CA authentication adds more trustworthiness and accuracy to your application. Faster the approval process.

- We also provide support after registration such GST return filing, amendments, compliance, and more. Whenever you need it.

LegalFidelity = Trusted CA Partner in Bangalore

Our Process – GST Registration by CA in Bangalore

Step 1: Free Consultation with a CA in Bangalore

Get expert advice in just one call about your business type, GST eligibility, whether regular or composition scheme is appropriate for you

Step 2: Document Collection & Verification

Get the services on your finger tips , Upload scanned documents via email or WhatsApp. Our well experienced team will carefully handle the application process without any mistake.

Step 3: Filing by CA on GST Portal

Your application is prepared and filed after digitally signed by a professional CA. This reduces chances of rejection and faster the approval process.

Step 4: Receive ARN & GSTIN

Once the application get submitted, you will receive the ARN. You will get real-time updates until your GSTIN is approved.

Faqs about GST Registration in Bangalore

What is GST registration in Bangalore, and why is it important to get registered?

GST is an Indirect Tax and levied on every value addition. Its main objective is to make a comprehensive tax structure, eliminating the double taxation effect of taxes. It promotes ease of doing business and facilitates in claiming input tax credits and legally collect GST from customers.Who must register itself for GST?

Businesses with an yearly turnover exceeding ₹20 lakhs (₹10 lakhs for special category states) or those engaged in inter-state supply, e-commerce, or specific taxable services must register.Can I Voluntarily Register for GST if my annual turnover is Below the Threshold?

Yes, you can take the GST registration voluntarily. This is beneficial if you want to claim refund of Input Tax Credit, Inter state taxable supplies. It also enhances trustworthiness among the clients.What Documents are necessary for GST Registration in Bangalore?

You will need a copy of PAN Card, Aadhar card, Proof of Business registration such as LLP Deed, Certificate of registration, Address proof of Place of business and Bank account details.How long does it take to complete the registration Process?

Generally, the process will take 5-7 working days, if everything is submitted correctly. Delay in registration may occur due to any discrepancy in the details or documents provided.What Happens if the Application is Rejected?

You’ll get a notice mentioning the reason for rejection. You can answer the queries and reapply. To avoid delay in response, ensure timely checking of application status, by using ARN.What Are the necessary Post-Registration Compliance?

Once you get registered, you’ll need to file GST returns monthly or quarterly, maintain proper records of transactions and invoices, and follow GST rules to avoid penalties.Do I need separate GST registration for different states?

Yes, If a business operates in different states then separate GST registration is required for each state.What are the benefits of hiring LegalFidelity for GST registration in Bangalore?

Our Professional experts ensure a timely and error-free filing for GST Registration in Bangalore. We provide step by step expert guidance for quick approval, and post-registration compliance support.Do I really need a CA for GST registration in Bangalore?

It is not mandatory, but getting it done by a CA ensures correct filing, avoids delays and rejections. CA handles all the compliance issues faced during registration.How much does it cost to get GST registered by a CA in Bangalore?

LegalFidelity offers budget friendly packages just starting at Rs 1499 and include complete CA support from start to finish.Can I get GST registration completely online with a CA in Bangalore?

Yes, LegalFidelity offers 100% online gst registration through qualified CAs without any stress. So no physical visit is required.

Get In Touch

Customer Reviews For GST Registration in Bangalore

Over 1 lakh customers. More than 7 lakh services completed. At LegalFidelity, these numbers aren't just milestones—they're a testament to the trust we've built. We don't just offer services; we deliver seamless experiences, simplifying the complexities of accounting, compliance, and financial processes. Whether you're a startup or an established enterprise, we ensure precision, reliability, and unwavering support at every step. Our commitment? Excellence. Our drive? Innovation. As we evolve, so do our solutions—always staying ahead, always keeping your business a step forward.

Anjali K

Excellent service, very professional and responsive.

AMIT A

Affordable pricing with top-notch service quality!

Shruti T

Highly professional and efficient. I am very satisfied.

SHARMILA S

The team is very knowledgeable and helpful.

Vikram S

Their expertise made all the difference. Great job!

BHAVYA R

Best service at the best price. 100% satisfied!